Mainland millionaires turning backs on Canada and looking to the US and Europe, say migration agencies

Millionaires are looking elsewhere after axing of investor visa scheme, with the US and Europe the prime alternatives, migration agencies say

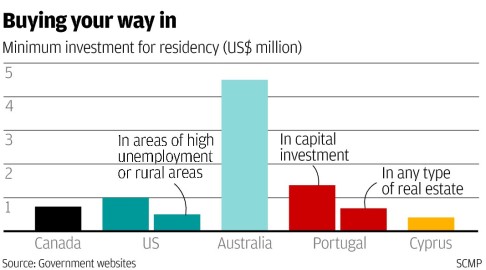

A rising number of wealthy Chinese are moving to the US and Europe because their once-favourite destination, Canada, has been scaling back entry, migration agents say.

Hong Kong-based immigration consultants are also trying to provide would-be migrants with alternative programmes after the scrapping of Canada's investor visa scheme.

Wang Pin, a Chinese-born Canadian, said he had to close his immigration consultancies in Toronto, Canada's largest city, and Shandong province last year when business shrank.

"My firm has done badly over the past two years after applications to the Immigrant Investor Programme were frozen in 2012," said Wang. "For Canada, the advantage of attracting migrants is being lost as most Chinese want to move to other countries. They have to wait for an uncertain time if they choose Canada."

The Canadian government on Tuesday officially terminated the controversial investor visa scheme, which has allowed Chinese millionaires to emigrate since 1986. About 45,000 mainland applications in the waiting list for visas will no longer be processed and applicants will have their fees refunded.