US air campaign in Middle East proving windfall for arms industry

Military contractors had braced for leaner times until battle against Islamist fighters flared up

US military companies appear to be benefiting from the new war against Islamic militants in Iraq and Syria.

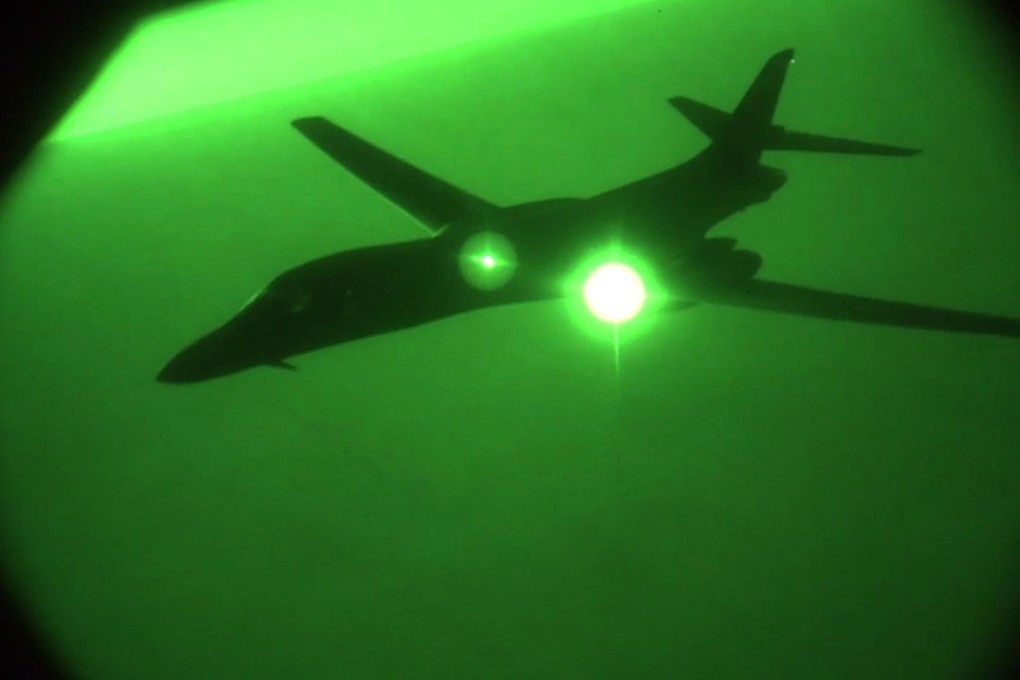

The daily pounding by US bombers, fighters and drones and the resupply of European and Arab allies that have joined the effort have cost nearly US$1 billion so far, analysts say, and will cost billions more later.

Shares of major military contractors - Raytheon, Lockheed Martin, Northrop Grumman and General Dynamics - have already been trading near all-time highs, outpacing the Standard & Poor's 500 index of large companies' stocks.

Investors anticipate rising sales for precision-guided missiles and bombs, and other high-priced weapons, as well as surveillance and reconnaissance equipment, as the Pentagon gears up for a conflict that commanders say is likely to last years.

Three days after US warships fired 47 cruise missiles at Sunni militant targets in northern Syria last week, the Pentagon signed a US$251 million deal to buy more Tomahawks from Raytheon, a windfall for the military giant and its many subcontractors.

As US combat operations ended in Iraq and Afghanistan, the defence industry braced for protracted budget cuts at the Pentagon. Major contractors have laid off workers, merged with one another and slowed production lines.