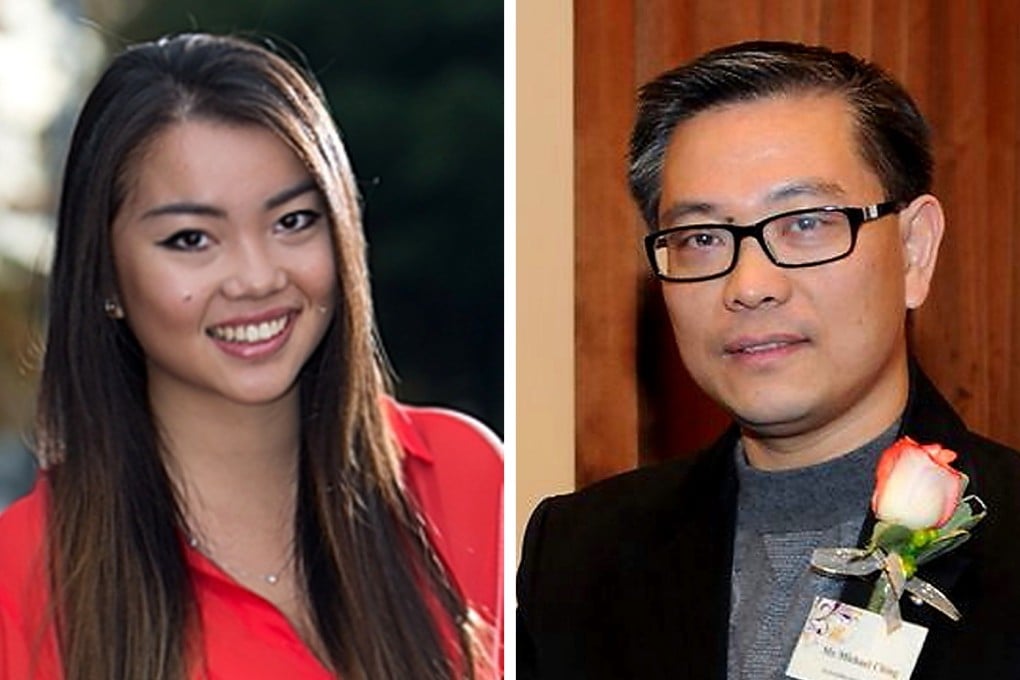

Linda Ching, daughter of Chinese corruption suspect Michael Ching, is replaced as investor in Titanic firm’s merger

UPDATE: Michael Ching Mo Yeung has commenced legal proceedings against South China Morning Post in the Supreme Court of British Columbia. Mr Ching alleges in his lawsuit that this article contains false and defamatory statements, and that the conduct of South China Morning Post and its reporter was malicious, reprehensible, high-handed, and blameworthy.

The Nasdaq-listed firm which received a US$1million (HK$7.75 million) investment in its upcoming merger from the teenage daughter of Chinese corruption suspect Michael Ching Mo Yeung says she no longer has a stake in the deal and has been replaced by another investor.

However, Premier Exhibitions - the cash-strapped owner of salvage rights to the Titanic shipwreck - did not respond when asked who had taken ownership of the stock-convertible debentures that were issued on April 2 to 1030443 BC Ltd, a Canadian firm of which student Linda Ching is the sole director.

Linda Ching’s investment was part of a crucial US$13.5 million financing deal for Premier that was organised by Dinoking Tech, as part of Dinoking’s planned merger with Premier. Dinoking’s majority owner, Bao Daoping, will take over as executive chairman and CEO of the combined firms, if Premier shareholders agree to the merger next month.

“Premier has been informed by Dinoking that, on or about July 6, 2015, the investment in the [funding] Note by 1030443 BC Ltd, was replaced by another investor and 1030443 BC Ltd had no further interest in the Note or, to the knowledge of Dinoking, any other ownership interest in any other securities of Premier,” Premier said in a news release issued on Wednesday.