As trade tensions rise, Chinese investors move away from high-profile US properties to avoid Beijing’s wrath

Lesser known US assets that offer slow but steady returns – and are less likely to catch the eye of a vengeful Chinese government – are now more attractive to Chinese investors, analysts say

With Beijing clamping down on Chinese investment in the US amid threats of tit-for-tat trade sanctions, Chinese deal makers, once drawn to the glitziest real estate, have largely moved away from high-profile US properties.

Instead, they are turning to lesser-known assets that lack the glamour and possibility of fast profits, but offer slow and steady returns and are unlikely to draw Beijing’s attention.

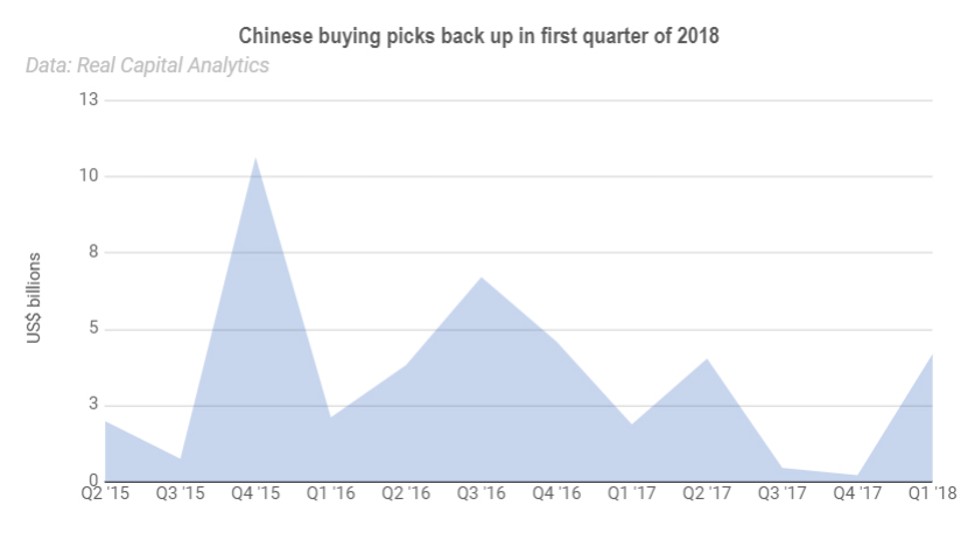

Deal volume in the most recent quarter jumped to the highest since the third quarter of 2016 after a lull. In the first three months of 2018, the amount of capital from China and Hong Kong deployed in the US commercial real estate rose to US$5.2 billion, nearly tripling the total amount in the entire year of 2017, according to Real Capital Analytics, a New York-based commercial real estate data provider.

Waldorf Astoria part of China's US property fire sale – but don't expect a bargain

“In contrast to the trophy assets Chinese investors tended to go for a few years ago, we now see Chinese buyers target deals that are much lower-profile,” said Richard Barkham, global chief economist at CBRE, a real estate service provider and investment firm based in Los Angeles.

“They are going for office buildings and multifamily properties that are less known.”

The largest deal in the quarter was the purchase of Global Logistic Properties (GLP), Asia’s largest warehouse operator, by a group of Chinese investors in January.

A consortium of investors including Hopu Investment, Bank of China, China’s largest real estate developer Vanke, SMG Eastern and Hillhouse Capital, paid about US$11.6 billion for GLP, which is based in Singapore but manages more than 170 million square feet of industrial real estate in the US.

HNA’s 2017 borrowing costs surge to record, topping all Asian companies

“The deal was not that sort of speculative development project that caused trouble for Anbang at the Waldorf Astoria in New York City,” said Jim Costello, senior vice-president at Real Capital Analytics.

Instead, it showcased how Chinese investors have grown more sophisticated and cautious in uncertain times.

Investors from Netherlands and Germany have been investing in this kind of US real estate for years. The assets they seek are the ones that generate steady returns. That’s different from Chinese investors who have primarily sought capital appreciation, said Costello.

A warehouse operator like GLP is a European-style investment that offers slow but stable income. It’s an area “investors globally are trying to get into these days, they are really focused on this income play,” said Costello.

Chinese companies have learned the hard way how eye-catching assets, such as the Waldorf Astoria – which Anbang bought in 2015 for US$1.9 billion – that might be good for asset appreciation can quickly draw attention from the Chinese government.

As Beijing looks to keep capital at home and curtail financial risks from mounting debt, some of the most acquisitive conglomerates, like Anbang and HNA Group, are being forced to sell their overseas assets.

Anbang’s ex-chief sentenced to 18 years for US$12 billion fraud, embezzlement

HNA is known to have overextended, funding its deals with huge amounts of debt, in making acquisitions like its US$6.5 billion purchase of a quarter-stake in the Hilton hotel group in 2016.

Anbang and its chairman, Wu Xiaohui, came under scrutiny by Chinese authorities for financial misdealings; the company has been run by regulatory agencies since February, and Wu was sentenced on Thursday to 18 years in prison for fraud.

The Chinese government may also apply more pressure on Chinese companies to cut their real estate holdings in the US if a trade war takes place.

“Everyone is waiting for clarity in terms of US and China policies and how new deals are getting approval,” said Peter Langerman, chairman and chief executive officer of Franklin Templeton’s Franklin Mutual Series of funds, on Wednesday.

Last year, Chinese acquisitions in real estate narrowed to a trickle. Chinese investors bought US$6.6 billion US commercial real estate for the year, a drop of 62 per cent from US$17.3 billion in 2016, Real Capital Analytics data show.

But industry participants don’t expect the lull to persist. The recent negotiations between China and the US have stirred hopes that a trade war can be avoided.

US lawmakers aim to force Confucius Institutes to register as foreign agents

To pressure China into making concessions is a “high risk strategy” for this administration, said Sonal Desai, director of research at Templeton Global Macro.

“But the end result might not be as catastrophic as it is being portrayed to be,” she said, indicating that common ground could be reached – provided the Trump administration figures out what exactly it wants from China.

Once that uncertainty passes, it will propel more mergers and acquisition transactions, analysts said. “I don’t see how Chinese capital can exit the US markets entirely. But we will likely see a different compilation of deals,” said Richard Hightower, analyst at Evercore ISI.