The Hongcouver | In Vancouver, Quebec millionaire migration has gone from real estate ‘conspiracy theory’ to premier-level concern

Should new millionaire migrants forfeit their C$800,000 ‘investment’ if they do not submit Canadian tax returns, and show they live in Quebec?

British Columbia’s provincial government on Tuesday imposed its bombshell 15 per cent tax on foreign buyers in Vancouver, and the real estate industry is in a state of apoplexy.

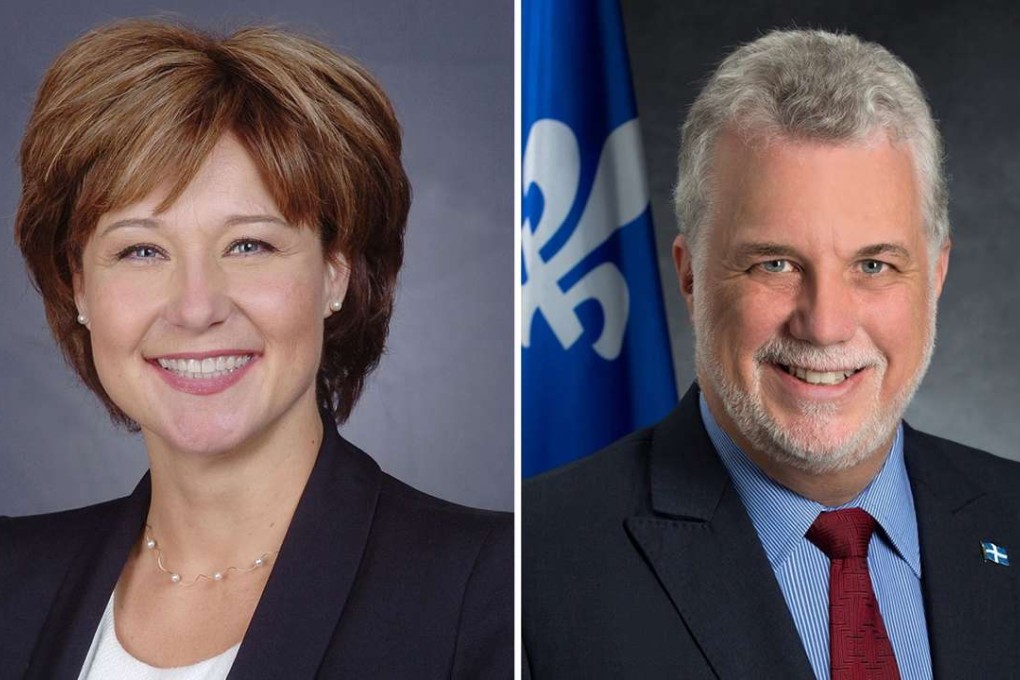

In the nine days since Premier Christy Clark turned the affordability debate on its head by announcing the tax, it has been dissected, analysed, critiqued and praised. It will apply to all residential Metro Vancouver real estate purchases by people who are neither permanent residents nor Canadian citizens.

But buried in the rubble of the tax’s blast crater was a small and barely reported nugget.

The Hongcouver blog has been banging on about the egregious failings of the QIIP for a couple years; most recently by making its elimination the basis of the only-slightly-grandiose One-Point Plan to solve Vancouver’s housing affordability disaster.