BlackBerry has stopped making phones, finally surrendering to Apple and Samsung

‘The market has spoken and I’m just listening’: BlackBerry CEO John Chen

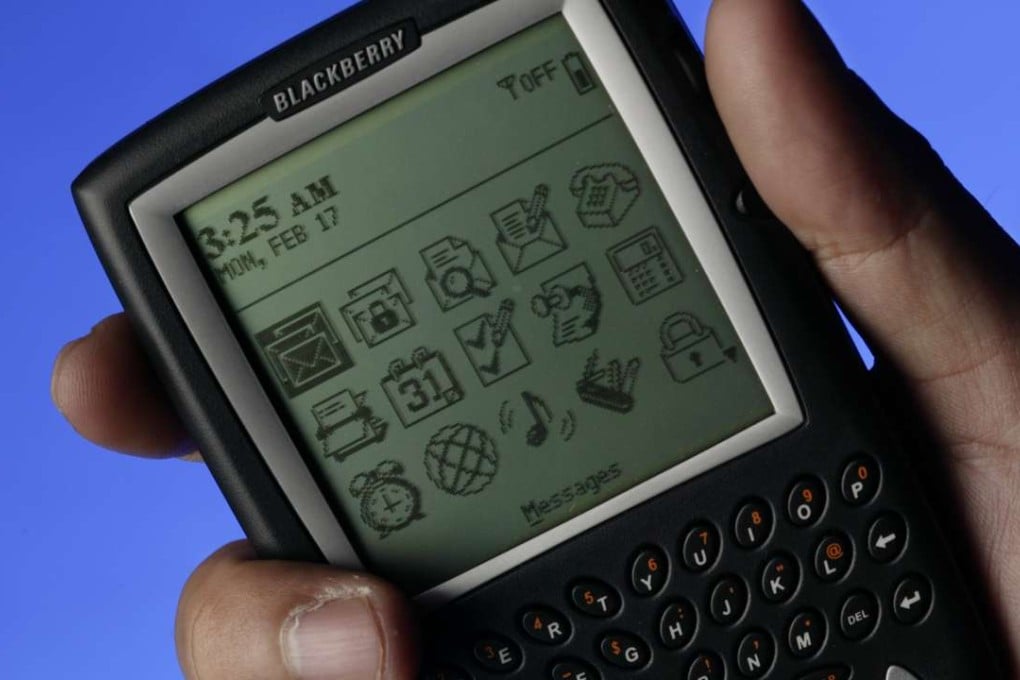

It’s official. BlackBerry Ltd, the Canadian company that invented the smartphone and hooked legions of road warriors on devices so addictive they were known as “CrackBerry”, has stopped making handsets.

Finally conceding defeat in a battle lost long ago to Apple and Samsung, BlackBerry is handing over production of the phones to overseas partners and turning its full attention to the more profitable and growing software business. It’s the formalisation of a move in the making since Chief Executive Officer John Chen took over nearly three years ago and outsourced some manufacturing to Foxconn Technology Group. Getting the money-losing smartphone business off BlackBerry’s books will also make it easier for the company to consistently hit profitability.

“This is the completion of their exit,” said Colin Gillis, an analyst at BGC Partners. “Chen is a software CEO historically. He’s getting back to what he knows best: higher margins and recurring revenue.”