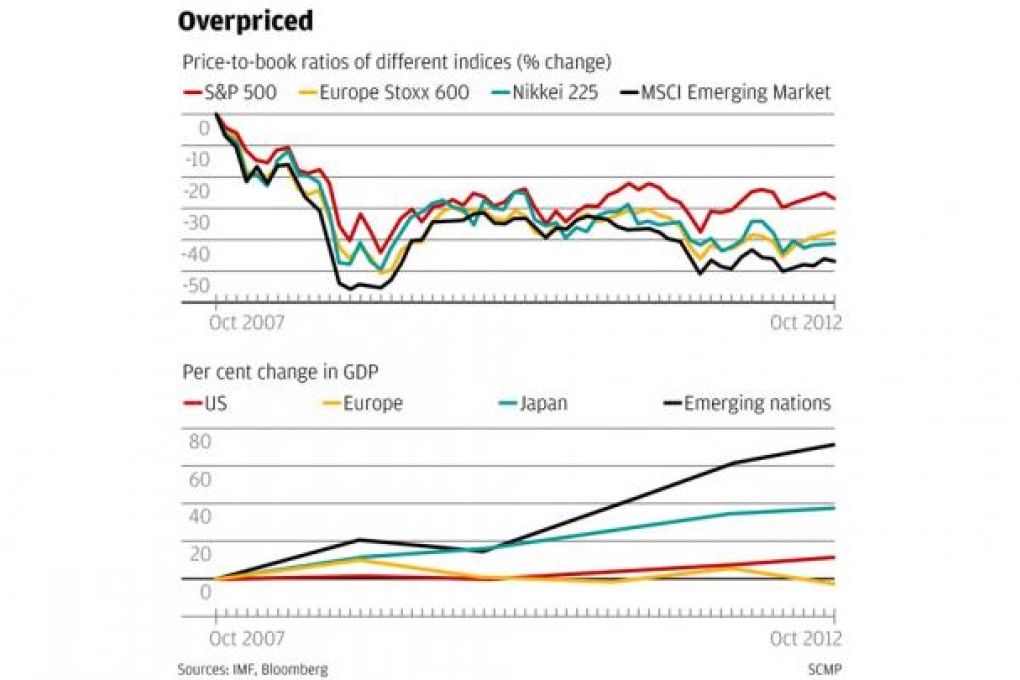

Five years after global equities peaked, valuations in developing countries have tumbled the most even as their economies expanded fastest.

The chart of the week shows the MSCI Emerging Market Index's price-to-book ratio has dropped 47 per cent since October 2007, compared with declines of 41 per cent for Japan's Nikkei 225 Stock Average, 38 per cent for the Stoxx Europe 600 Index and 27 per cent in the Standard & Poor's 500 Index.

The lower panel shows economic output has increased most in developing nations, according to the International Monetary Fund.

The decline in valuations has caught the attention of Jack Ablin, chief investment officer of BMO Private Bank, who said emerging-market stocks were too expensive a month before the MSCI gauge peaked on October 29, 2007.

Ablin, a Chicago-based investor, now advises holding more of the shares than are represented in benchmark indexes.