Jake's View | HKMA chief's household debt fears overblown

A clearer view of indebtedness reveals nothing to fret over, despite HKMA chief's alarmist talk

Soaring household debt and rampant consumer spending have put Hong Kong's economy at risk of overheating, the city's central bank boss said yesterday.

Let's look at some specifics here; for instance, that bit about rampant consumer spending, which so concerns Norman Chan Tak-lam, the chief executive of the Hong Kong Monetary Authority.

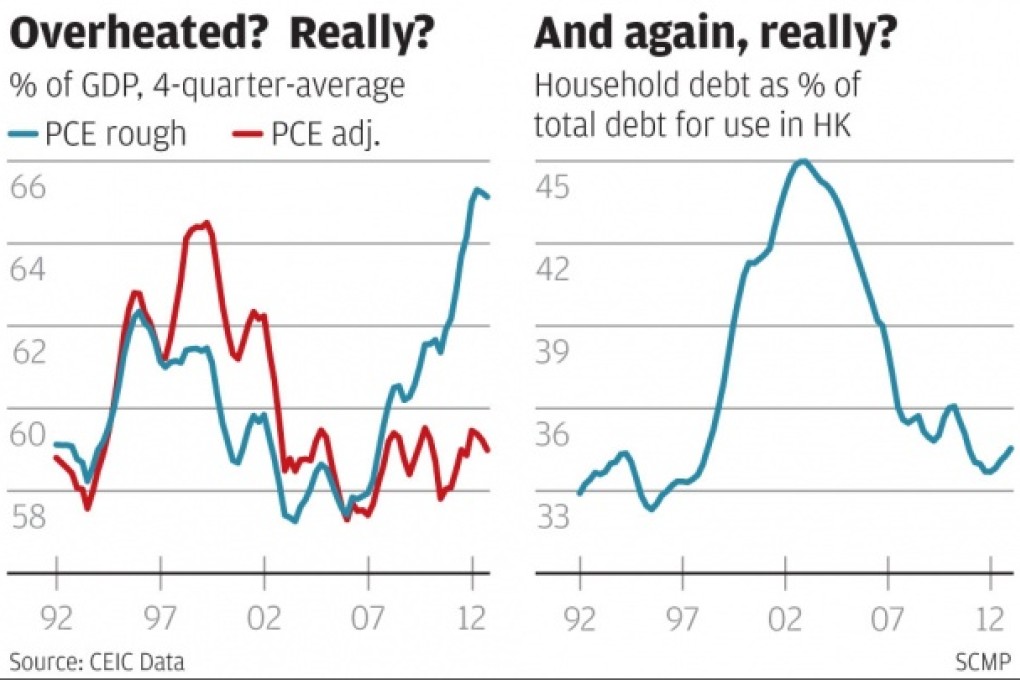

He appears to base his concerns here on a statistic that private consumption has grown faster than gross domestic product since 2005. Indeed it has when one looks at the figures superficially. As the blue line on the first chart shows, the ratio of private consumption expenditure to GDP has risen from about 57 per cent in 2005 to about 65 per cent at present.

But what our man forgets is that almost a fifth of consumer spending in our domestic market is now attributable to tourists. If they later run into trouble because they have overspent, well, that could be bad news for consumer credit in Zhejiang or Jiangsu provinces.

Thus when calculating GDP, established practice is to deduct this tourist spending from the local consumer figures but add back what Hong Kong residents spend abroad. It not only makes sense in GDP but it gives you a better picture of whether local consumer activity is restrained or overheated.