National security law: could Japan or South Korea take Hong Kong’s finance crown?

- Japan and South Korea want to tempt businesses considering an exit strategy in the wake of Beijing’s national security law for Hong Kong

- But Tokyo’s high tax levels and South Korea’s complex regulations are hard to overlook, especially when compared to competitors such as Singapore

The Standing Committee of the National People’s Congress is expected to meet on Sunday to further discuss the law – which targets secession, subversion, terrorism and collusion with foreign and external forces endangering national security.

Details of the law, and the offences that constitute crimes, are still unclear. and this has raised fears that Hong Kong’s autonomy and freedoms, which have been crucial to its success as a financial hub, will be undermined. Beijing, however, maintains the new law will restore stability to a city wracked by a year of anti-government protests that on several occasions descended into violence.

Foreign firms have been looking into possible exit strategies in the event the law ends up restricting the free flow of information in the city or affects their ability to woo talent.

01:08

US Senate passes bill that could punish China for Hong Kong national security law

But businesspeople and analysts say even new proposals for fast-tracked visas, business licences, free tax advice, temporarily free office space and grants to equip permanent offices are unlikely to be enough to lure companies and high-flyers to Japan.

Similarly, South Korea’s financial regulator, the Financial Services Commission, last month announced yet another new plan for building financial hubs. The country has long had plans to turn itself into a Northeast Asia financial hub that could rival Hong Kong, Singapore and Tokyo but the campaign was put on the back burner after the 2007-2008 financial crisis.

Its latest proposal calls for regulatory reforms to promote private sector innovation, infrastructure “on a par with global standards” and administrative support for fledgling financial hubs in Seoul’s Yeoido district and Busan’s Moonhyun district.

Im Gug-hyun, a senior official of the Seoul city government, said the city was providing incentives including subsidies of up to one billion won (US$830,000) for facilities, wage assistance and training support in case incoming foreign companies hired more than 10 workers, as well as interpreter and counselling services.

But Seoul is unable to offer tax favours for foreign investors under a central government policy of preventing a spike in population growth in the already-crowded metropolitan area.

In contrast, Busan, located in the southeastern corner of South Korea, has told firms entering its Moonhyun financial hub that they do not have to pay corporate tax for three years after becoming profitable, and can benefit from a 50 per cent cut in corporate tax for the next two years.

TOKYO’S BIG PROJECT

Tokyo’s ambitious governor Yuriko Koike, who is standing for re-election next month, launched the Global Financial City: Tokyo project in 2017, featuring business support centres, streamlined business licence applications and acceptance of documents in English, with the aim of attracting 40-50 foreign financial companies to Tokyo by this year. As of last year, it had pulled in at least 33 such companies, most of them SMEs.

However, few see Tokyo as the likely major beneficiary of any potential exodus from Hong Kong.

“The simple answer is no. There would have to be a massive shift in tax rates and regulatory policy to make Japan more attractive,” said Tony Moore, president of Tokyo executive recruiter BMES, a subsidiary of Japanese staffing giant TechnoPro.

“And the FSA is a bit of a minefield, quite a few companies have been hauled over the coals by it,” added Moore.

But Tokyo does have some advantages, at least in the short term.

“I was talking to someone senior in one of the big four accountancy firms, who said deal flow in the region is only going to be in Japan for the next few months. Singapore is still under some restrictions due to the pandemic and Hong Kong is seen as unstable, while Japan has done quite well handling the virus,” said Moore.

But in the longer term, Singapore and Hong Kong look set to continue their rivalry to be Asia’s financial hub.

David Rosa, co-founder and CEO of Hong Kong-based fintech firm Neat, thought a significant withdrawal from Hong Kong was unlikely and, if it did happen, Singapore would be the biggest winner.

“The question is: do you want to do business with China? If so, why would you not be in Hong Kong? At least here, you’ll get a contract in English,” said Rosa.

Rosa sees a split between start-ups, which his company mainly works with and are less inclined to relocate, and larger, more established firms, which he thinks are more likely to move at least some operations out of Hong Kong.

02:22

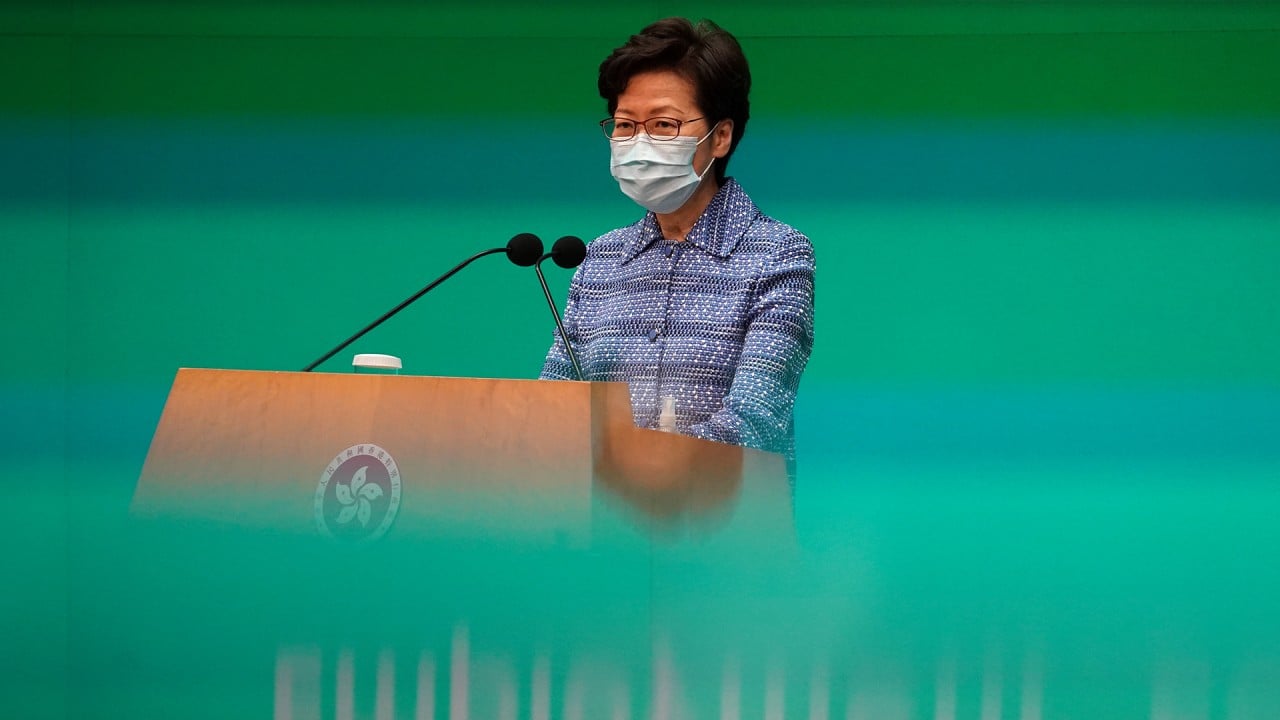

Hong Kong freedoms will not be eroded by Beijing’s national security law, Carrie Lam says

“Tokyo is just not as well connected with the region. It’s a long way from Narita [airport] into the city. Japan is a big market, but is its own planet,” said Rosa.

“Singapore is much more efficient in terms of red tape and the commute from the airport is much faster. And the official language is English, which is even better than in Hong Kong.”

A trader at a global investment bank in Tokyo, who was not authorised to talk publicly on the issue, also said Singapore would be the first choice for any big financial firm relocating out of Hong Kong.

“There’s already been some shift of trading operations to Singapore. They say it’s because there are a lot of hedge funds there, but that’s just an excuse. The real reason is low taxes,” said the trader.

Without a significant cut in Japan’s tax rates, which is not included in the government’s new proposals, Tokyo looks set to struggle to attract a significant slice of any departures from Hong Kong.

“Japan has decent press freedom, protection under the constitution – which we saw with the light restrictions during the pandemic, and is a fully-functioning democracy. But none of that is much of a concern to people in this industry,” the trader said.

HURDLES FOR SOUTH KOREA

South Korea’s efforts, including campaigns to woo foreign investors since 2009, have not sparked a rise in foreign financial firms doing business there, with about 165 registered currently and almost all of them in Seoul.

Experts say the attributes of financial hubs include currency convertibility, low taxes, supportive government policies and the feel of a global city to attract talent.

In this regard, South Korea, despite being able to offer modern business infrastructure in its capital Seoul, has a few hurdles to overcome. These include red tape and a lack of transparency in regulation, a shortage of English-speaking financial experts and a relatively inflexible labour market that makes it difficult to hire and fire.

Hank Morris, a long-time securities and asset management professional who served as a chief manager for British brokerages and merchant banks, said he could not see any notable policies or incentives such as tax breaks that could lure foreign financial firms to South Korea.

“Probably the most important thing from the perspective of foreign financial companies would be a decision by the Korean government to make the won fully convertible,” said Morris who serves as a director on the board of the Seoul Financial Forum, a non-government body working to develop the Korean financial sector.

The other major problem in South Korea, he said, was that the regulatory reporting requirements were “very extensive and costly to comply with”.

“A foreign asset management executive once told me that in Korea, his company had funds under management of around US$4 billion and were required to submit about 4,000 reports annually. But in Japan his company managed about US$40 billion and he had to submit only 1,000 reports to Japanese officials”.

“In my opinion, rather than moving into Korea, foreign financial companies would in some cases prefer to sell their businesses in Korea and leave the market,” he said. The US life insurance company, Prudential Life Insurance Korea, had sold its business to a Korean company, he noted.

“Given the expense and relative difficulty of operating in Korea, I think that it is very unlikely that foreign financial companies in Hong Kong will target Korea as a place to establish their operations if they decide to withdraw from Hong Kong,” he said.

With regard to international schools, he said the Korean government had allowed several foreign schools to be established for foreign primary and secondary students. While they could handle additional international students, the existence of such schools alone would not be a huge incentive for foreign financial firms, he said.

A veteran Hong Kong-based fund manager well acquainted with regional markets was sceptical about South Korea’s attraction for foreign financiers.

“There have been a series of announcements from South Korea to develop financial hubs over the past 17 years but to put it bluntly, it’s like building castles in the air,” said the fund manager, who declined to give his name, citing privacy reasons.

The top three factors for businesses to relocate to a country were: profitability, regulations and tax, he said.

“On any of these factors, South Korea has no merits,” he said, adding that setting up a company in Singapore and Hong Kong was “easy and fast”, with experienced officials willing and ready to assist in the process.

00:59

EU leaders warn Xi of ‘negative consequences’ if China imposes national security law in Hong Kong

While South Korea had a solid manufacturing industry, including Samsung Electronics, its stocks, bonds, and merger and acquisition markets had made little progress over the past decade, he said.

Because of the won’s limited convertibility and infeasible offshore trading, free flows of capital into and out of South Korea were quite restricted, a formidable obstacle for traders, he said.

High corporate tax of 25 per cent was also a turn-off. “It is necessary for the government to provide low or zero tax rates,” he said.

Kwon Young-soo, head of the Financial Services Commission’s financial hub support team, acknowledged that South Korea had more regulations than other financial hubs.

“But I’ve found many foreign investors and financiers have quite overblown concerns over regulations in this country,” said Kwon, who worked in the Financial Services Commission’s Hong Kong office for three years.

“We’re also pushing for easing regulations and lower corporate and income taxes but we have to do them all through written laws and it’s not easy for us to catch up with the flexible regulatory systems of Hong Kong and Singapore,” he said.

“We can’t just let go of regulations on foreign exchange flows only for building financial hubs. This is because we have greater foreign exchange risks, different from Singapore or Hong Kong whose currencies are virtually pegged to the dollar,” he said.

South Korea had a traumatic experience during the 1997-1998 Asian financial crisis, when the won lost much of its value, being mauled by short-term investors.

It had to turn to the International Monetary Fund for a US$58 billion bailout package even though its exports were strong and manufacturing sector solid.

“Smart investors come wherever there is money, no matter how. China is a huge market and it is still growing. In contrast, South Korea is a small market and its growth is in stalemate. This is why the government’s efforts to develop the financial sector have not made tangible progress so far,” he said. ■