Weak yen builds pressure on firms to bring manufacturing back to Japan

- Tokyo to offer economic package to boost domestic manufacturing as firms reassess overseas operations due to global health crisis, Sino-US tensions

- Japanese firms may be looking reduce overseas costs, increase production at home but China still a ‘critically important growth market’, analyst notes

At a meeting of the Diet’s Budget Committee, he said a new economic package would include measures to financially support the construction of domestic production facilities for goods in key sectors including semiconductors, vaccines and large-capacity storage batteries.

JVC Kenwood Corp is relocating production of in-car navigation systems from China and Indonesia to Japan, dramatically ramping up capacity at its plant in Nagano prefecture. An official of Iris Ohyama Inc, which manufactures household goods and appliances, told Jiji Press that the Sendai-based firm shifted output of around 50 plastic components for its products back to Japan from China last month. The official linked the decision to soaring energy prices.

Clothing producer World Co is similarly manufacturing more in Japan, with output rising from 40 per cent of its products made in the country in the past to 90 per cent now, while Hitachi intends to double the proportion of appliances it makes in Japan and then exports to foreign markets to 10 per cent of its total output by the end of March next year.

With financial support available, more companies may also opt to consider manufacturing more at home, economists agree, although they have no intention of burning their bridges with the critically important Chinese market entirely.

“Companies were reconsidering their Chinese operations even before the disruptions caused by the pandemic because of worsening political tensions and the Japanese government at that time offered financial support to companies that wanted to relocate their China operations either back to Japan or to Southeast Asia,” said Martin Schulz, chief policy economist for Fujitsu’s Global Market Intelligence Unit.

“They were not giving up on China entirely because it was far too important as a market, but it did provide them with an alternative, a ‘China plus one’ strategy.”

“Before, decisions were taken based on economic factors; now, political considerations play a far larger role,” he said. “And there is concern about the outlook in China.”

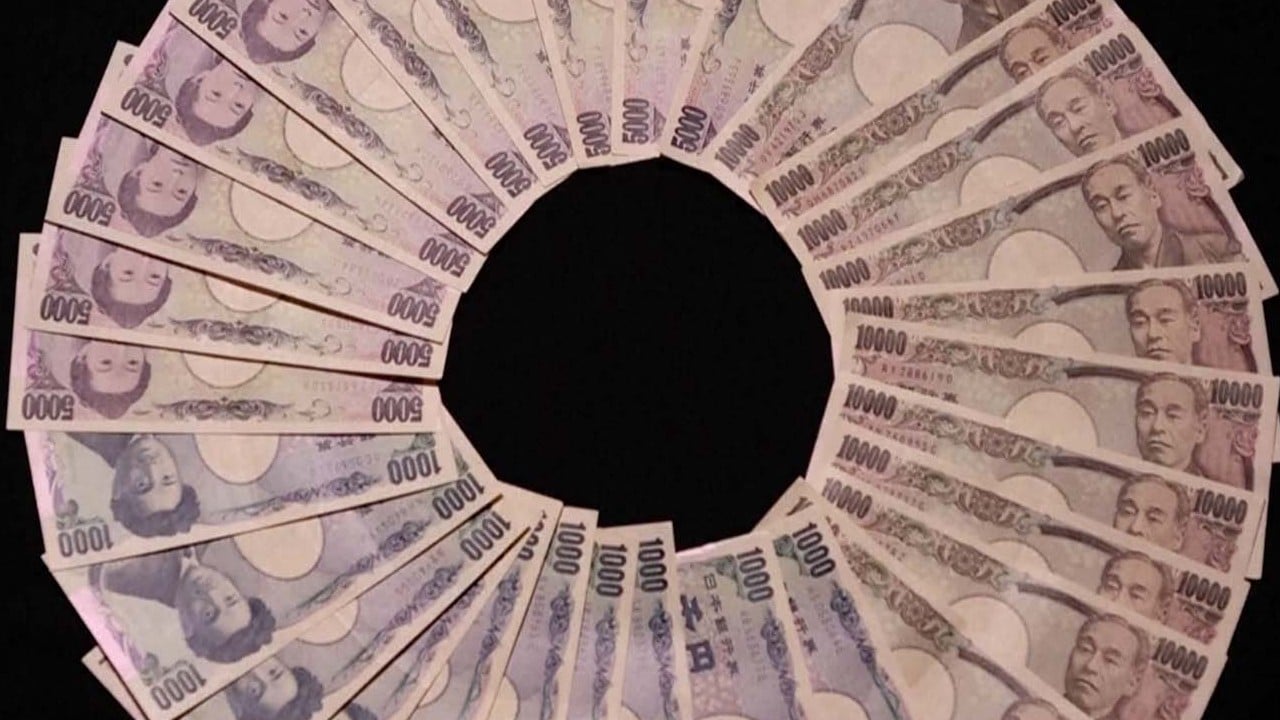

To encourage companies that might be wavering on a decision, Kishida has pointed out that the feeble yen is a significant plus. In real terms, the Japanese currency is at a 53-year low, making Japan one of the cheapest places to manufacture in Asia.

“There are many reasons for Japanese companies to come home at the moment – it’s safer, cheaper and there are better earnings when they can export – but we have to remember this is a rapidly ageing and shrinking market with severe constraints in, for example, labour and scale of production,” Schulz said.

“Japanese companies are trying to produce closer to their customers to reduce the challenges associated with extended supply chains, but they also realise that China will remain a critically important growth market for a long time to come,” he added.

Toshimitsu Shigemura, a professor of politics and international relations at Waseda University, believes Kishida’s call to Japanese firms is “only 50 per cent based on economic considerations”.

“The US government is pressuring the Japanese government and Japanese firms to come back to Japan, and that means this is primarily a political issue,” he said. “There are a lot of companies that have done very well out of being in China, but more and more they are concluding that the risk is just too big that they are at least exploring the possibility of coming back.”

Schulz agreed that Japanese corporations with sensitive technology were feeling the pressure to leave China and he believed that “globalisation is changing and will continue to change”.