Financial Firms Chinlink and MCM’s Joint Venture Sets Sights on Xi’an

[Sponsored Article] As many high-flying overseas investment bankers are chasing deals in China’s glittering coastal metropolises and economic powerhouses, two seasoned foreign bankers are looking inward and setting their sights on Xi’an, an ancient city best known for its Terracotta Warriors.

[Sponsored Article]

As many high-flying overseas investment bankers are chasing deals in China’s glittering coastal metropolises and economic powerhouses, two seasoned foreign bankers are looking inward and setting their sights on Xi’an, an ancient city best known for its Terracotta Warriors.

For Rachid Bouzouba and Adrian Valenzuela, co-founders of MCM Partners, a Hong Kong-based financial service boutique providing high-end investment and merchant banking services, Xi’an is a land full of opportunities thanks to the massive Belt and Road Initiative of which the city is its eastern starting point.

The two veteran bankers, each with more than 20 years of experience in the securities and capital markets think they can grasp the opportunities there by playing a bridging role as Xi’an embarks on the ambitious drive to turn itself into an inland logistics center and a technology hub.

“Xi’an is now one of the fastest-growing cities in China and it is definitely at the forefront of the emerging cities in the country, which presents huge potential,” said Rachid Bouzouba, former Head of Global Equities at Nomura and Head of Equities, EMEA of Lehman Brothers. “We want to grasp the opportunities and Xi’an is a great place to be.”

In order to tap the opportunities, MCM last year partnered with Chinlink International Holdings Ltd, a Xi’an-based and Hong Kong-listed financial services firm, to set up a joint venture, pooling together the strength of the two firms.

Chinlink is a financial services provider holding multiple licenses both in Hong Kong and China, providing financing guarantee, finance lease, supply chain finance and money lending services and etc. Chinlink has established a strong foothold in Xi’an and the Shaanxi province, boosting extensive knowledge and insights of local economy and market, according to Li Weibin, chairman and managing director of Chinlink.

The joint-venture can “leverage Chinlink’s deep local knowledge and relationships along with MCM’s extensive global network and investment banking expertise to connect Xi’an and Shaanxi with global resources such as international capital and technology,” said Li. “It provides opportunities for both Chinlink and MCM to significantly expand their respective financial services offering and expertise.”

Xi’an registered a 7.7 percent growth in GDP in 2017, well above the national growth rate of 6.9% with economy size overtaking those of Hefei, Jinan and Shenyang.

Xi’an is not only a major aircraft and aviation industry center in China, it is now being contemplated by many industry giants as an emerging regional business operation center and technology hub. Internet conglomerate Alibaba has located its northwestern headquarters in the city, while E-commerce giant JD.com and airline-to-hotel behemoth HNA both designated Xi’an as the global headquarters for their logistics business.

Last month, Amazon Web Services (AWS), the cloud computing arm of US Internet giant Amazon, set up a joint innovation center in Xi’an, taking advantage of the large number of talent and universities in the city.

The challenge in exploring the business opportunity and expanding presence in Xi’an and the Shaanxi as a whole is to “build trust, local presence and gain local understanding and insight”, according to Adrian Valenzuela, also co-founder of MCM, who is former Head of Equity Liquid Markets Distribution, APAC of Barclays Capital and Co-Head of Global Equities Distribution at JPMorgan.

“Building local presence and hiring the right local talent are some of the challenges for us,” said Valenzuela. “Our international breadth and exposure would not have sufficed in this regard, but the partnership with Chinlink can fill that gap because they have the extensive connections and at the right levels with local governments, companies and financial institutions.”

The joint-venture is planning to set up a local office in Xi’an and the company has already started to look for talent, according to the two co-founders of MCM Partners. “We need to find local people, train them and nurture them to build a local platform,” said Bouzouba.

In addition to the local expertise, the joint-venture also brings together the necessary professional qualifications, experience and expertise to increase cross-selling opportunities, as Chinlink and MCM expand their footprint in both China and globally, said Li of the Chinlink, which is principally engaged in providing financing solutions in Shaanxi through financing guarantees, supply chain finance and finance leasing to local firms.

For example, thanks to the qualification and licenses that the joint-venture has, Chinlink, MCM and the joint-venture can now provide a full suite of corporate finance and advisory services that cover the whole lifespan of a company, such as from its birth to IPO and other growth stages, Li said.

“This is the synergy and cross-selling opportunities the joint-venture with MCM creates, which improves efficiency and helps the company we serve grow faster,” Li said.

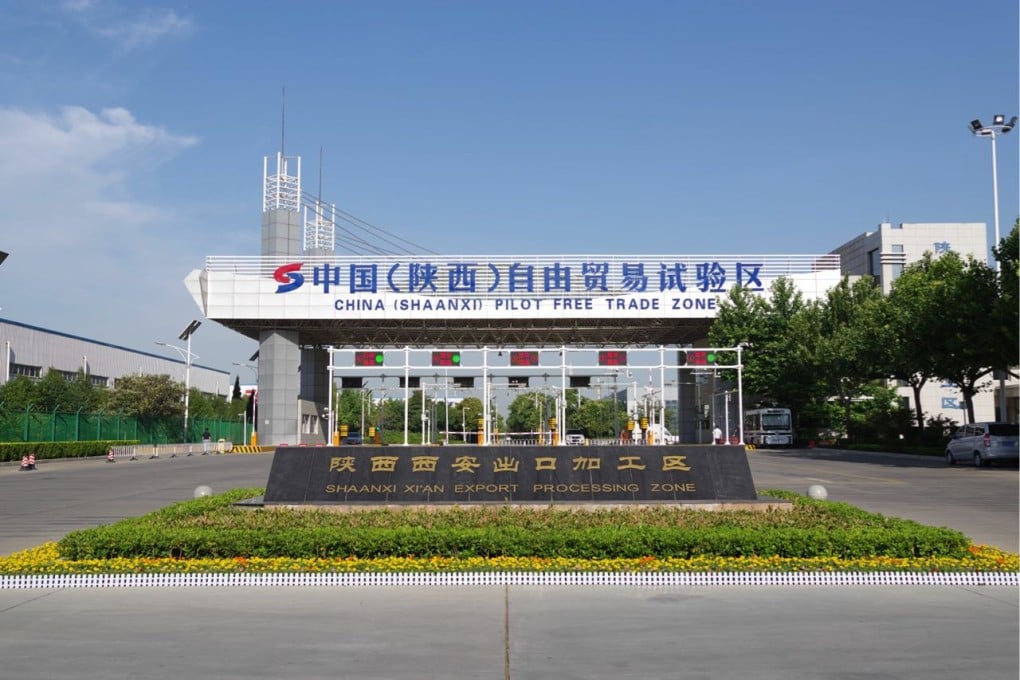

The joint-venture, positioned as a cross-border financial player with local presence in Xi’an and a fully integrated platform with access to international capital markets, is also committed to combining its local insight and international capital and financial market expertise to help develop financial services market in Shaanxi and foster the cross-border finance ecosystem in the free trade zone, Li said.

Aside from boosting local presence, the joint venture, which is also positioned itself as a key participant in the Belt and Road Initiative for international investors to invest in related enterprises in Shaanxi and for local firms to access global resources, has already taken initiatives overseas to raise the profile of the city and the province as a whole.

As part of those efforts, MCM, which is focused on bridging opportunities and connecting the Asia region and particularly China with global investment opportunities and capital, opened a London office last year and has participated in several investment workshops in London and Hong Kong that are related to Shaanxi to raise its profile among international investors, according to Valenzuela.

Apart from educating local enterprises about how to connect with international capital markets and helping them access global capital and resources, the joint-venture is also bringing resources and expertise to Xi’an, according to Valenzuela.

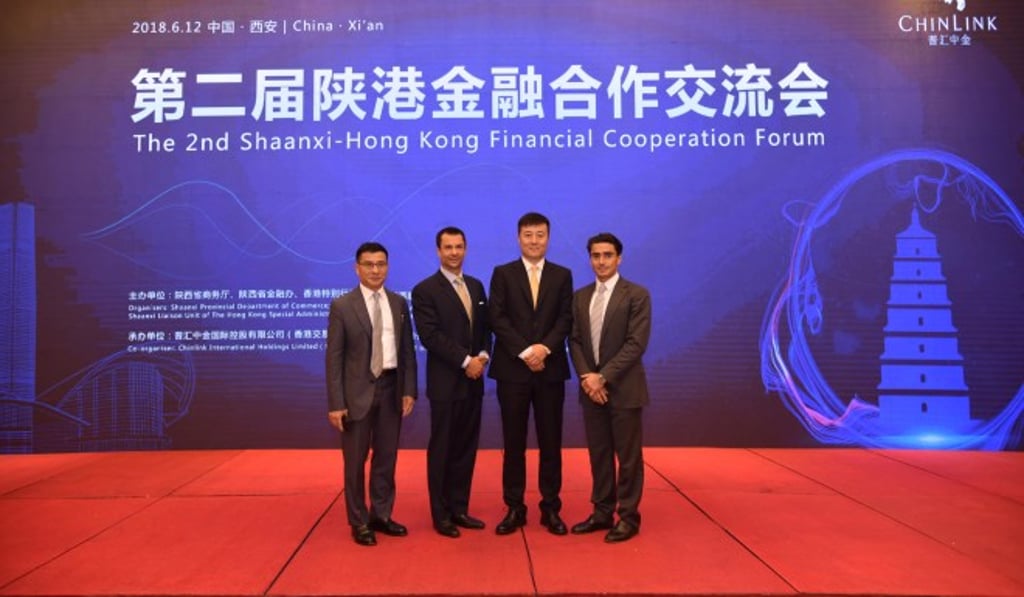

One of such programs is the Shaanxi-Hong Kong Financial Cooperation Forum, a platform where government officials, representatives from Hong Kong and overseas financial institutions, accounting and law firms, local entrepreneurs are brought together to explore business opportunities. Launched in 2017, the annual forum was well received by the local government and business community.

And thanks to the connections and expertise MCM boosts, the event had invited many seasoned bankers and experts to share their expertise and viewpoints. Christian Dargnat, former Chief Executive Officer at BNP Paribas Asset Management, was present at the second forum, which was held on June 12 in Xi’an.

“Raise the awareness of international investors about the important role Xi’an is playing in the Belt and Road Initiative and about its technology development is equally important,” said Valenzuela.

The joint-venture is already organizing foreign investors and renowned educational and research institutions from U.S and Europe to Xi’an to establish contacts, presence and seek collaborations here in Xi’an, Valenzuela said, adding they are planning more such initiatives in the future.

The Belt and Road Initiative, the establishment of the free trade zone in Shaanxi and Xi’an’s drive to turn itself into a major economic powerhouse in the west China, will generate immense opportunities and financing needs where the joint-venture can tap into, Li said.

The number of newly registered business entities in Xi’an amounted to 283,200 in 2017, almost double the figure in 2016, injecting vitality into the local economy and pointing to a huge growth potential ahead.

Therein lies the tremendous opportunities for a financial services platform such as our joint-venture, which in turn will help both Chinlink and MCM to capitalize on the next stage of development and growth in the Xi’an and Shaanxi region, Li, the chairman of Chinlink, said.