Claims China is world's No 1 trading economy are nonsense

The high import and export numbers are distorted by domestic firms fiddling taxes and the country's heavy involvement in processing trade

If you believe the media reports, China passed another milestone last year, overtaking the United States to become the world's biggest trading economy.

According to data from Beijing's customs officers, China's total imports and exports of goods reached US$3.87 trillion in 2012.

In contrast, figures from the US Commerce Department show that America's international goods trade was worth just US$3.82 trillion.

Hooray! China beats the US by US$50 billion.

Except there's a problem: the figures are nonsense.

The most obvious way they are wrong is because China's import and export numbers are heavily distorted by domestic companies fiddling their taxes.

Under mainland regulations, exporters of electronic gadgets and other widgetry can claim a value-added tax rebate worth 17 per cent of the goods' value.

What's more, under the Closer Economic Partnership Arrangement, no tariffs are charged on goods imported into the mainland from Hong Kong, provided the importer claims a relatively small component of value was added in the city.

As a result, mainland companies ship huge quantities of goods to Hong Kong, where their value is marked up by around 20 per cent before they are re-imported back into the mainland.

With this dodge, the scammers not only get their tax rebate when they export. By over-invoicing the re-imports, they get to circumvent the mainland's capital controls and ship money offshore, either to invest in international markets (or Hong Kong's properties) or to round-trip back into the mainland as foreign direct investment, which qualifies them for yet more tax breaks.

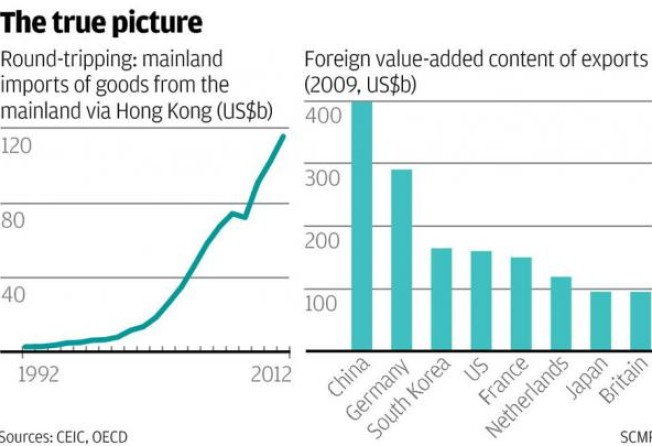

Figures from the Hong Kong government show the city was responsible for re-exporting some US$116 billion worth of stuff from the mainland back to the mainland last year, a 13 per cent increase over the year before (see the first chart).

If we assume the mainland importers claimed that 17 per cent of the value of their purchases was added in Hong Kong, which is in line with the Trade Development Council's figures, then we can estimate that the value of the mainland's total goods trade - both exports and imports - last year was exaggerated by some US$212 billion.

As a result, it looks very much as if China still lags some US$160 billion behind the US in terms of its international trade in goods, with just US$3.66 trillion of combined imports and exports in 2012, compared with America's US$3.82 trillion.

But even those figures are dubious. That's because much of China's international commerce consists of processing trade. High-value components from developed economies get imported, bolted together by low-paid workers in China's factories, and then re-exported to their final markets.

As a result, China's contribution to the total value of the goods it exports is low by international standards.

Infamously, one 2011 study estimated that China's share of the value added in a made-in-Shenzhen iPad with a US retail price of US$499 was just US$8.

Overall, according to the trade in value added database compiled by the Organisation for Economic Co-operation and Development, the foreign value-added share of China's exports amounted to 26 per cent of their face value in 2009. For US exports, the proportion was 11 per cent.

That makes a huge difference to the raw trade numbers. In 2009, the foreign value-added content of China's exports was worth almost US$400 billion, compared with US$160 billion for US exports (see the second chart).

Adjust the gross trade numbers to allow for this difference, and it soon becomes apparent that China is still a long way from becoming the world's largest trading economy in any meaningful sense, despite what last week's headlines may have claimed.