Danger China is repeating America's pre-crisis errors

Mainland credit boom risks spiralling out of control, with the huge loans handed out by state banks needing to be serviced with ever more credit

In 2001, policymakers in the United States made an enormous blunder. Now China may be repeating the same mistake.

Freaked out by the collapse of the dotcom bubble in March 2000, and afraid of a powerful economic downdraft following the terrorist attacks on New York and Washington in September 2001, the Federal Reserve slashed interest rates.

Between the end of 2000 and mid-2003, the Fed cut its target rate 13 times, from 6.5 per cent to just 1 per cent.

Credit creation ballooned. At the same time, investors' demand for returns in the low-yield environment triggered an explosion in financial engineering.

The result, five years later, was America's biggest financial crisis since the Wall Street crash of 1929 and its deepest economic slump since the 1930s.

When that crisis struck, the response Beijing came up with read straight from the Fed's playbook.

Spooked by the evaporation of export orders, and afraid mounting job losses could spark social unrest, the Chinese government pinned its hopes on a massive round of monetary easing to support growth.

The central bank quickly cut lending rates by more than 2 percentage points.

But lending rates have never been that important in China, where the state banks tend to allocate credit to state-owned companies regardless of price.

So to guarantee maximum impact, the authorities simply ordered the banking system to ramp up lending to corporate and government borrowers.

In 2009, credit shot up by more than 30 per cent of gross domestic product, fuelling an orgy of investment by cashed-up state companies and local governments.

Sure enough, while much of the world slid into recession in 2009, China's economy duly recorded an impressive 9.2 per cent growth rate.

And the credit expansion continued ever since. Increasingly, however, analysts are asking whether the price was worth paying.

"Too much credit has been created too quickly," warn Edward Chancellor and Mike Monnelly in a recent report for asset manager GMO.

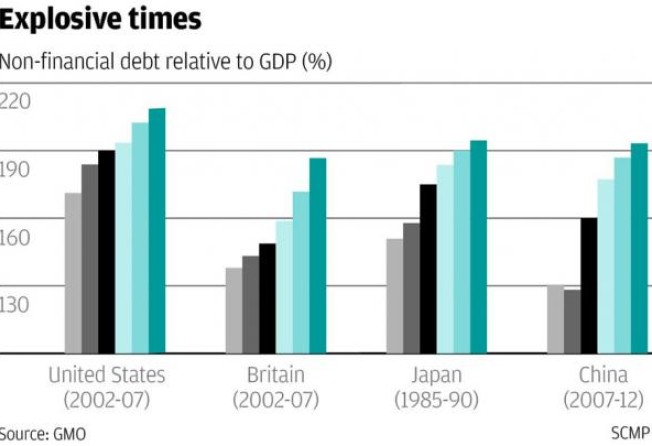

They point out that the rapid expansion in credit relative to China's gross domestic product over the past few years is uncomfortably reminiscent of the credit booms that preceded the 2008 financial crisis in both the US and Britain, as well as of the explosion in credit immediately before the collapse of Japan's bubble economy in 1990 (see the charts).

Worse, they fret that in China too much borrowed money has been ploughed into trophy projects that will never generate sufficient returns to service the debt that funded them.

As a result, the economy needs ever-expanding injections of credit to ensure it can meet Beijing's growth targets. "China's economy has become a credit junkie," Chancellor and Monnelly conclude.

That's not all. GMO's analysts note other similarities with America's pre-crisis credit binge.

With deposit rates negative in real terms, China's financial system has become ever more inventive at packaging risky loans as structured investment products which it can sell to yield-hungry investors.

Worse, many of these off-balance sheet loans have been extended primarily on the basis of the borrowers' collateral, rather than their cash flow.

That's fine when asset prices are going up, but it creates the danger of a devastating positive feedback loop should they fall.

And to cap it all, many loans have been guaranteed by undercapitalised credit guarantee companies, in much the same way as poorly capitalised US institutions sold credit default insurance.

As a result, Chancellor and Monnelly warn that China may be heading for a US-style credit crunch so severe that it could pose "an existential threat" to the economic model that has powered China's growth for so long.