Capital investment fails unless you build social capital as well

The Gulf states' petro-dollar-fuelled spending binge provides an example to China on the need to ensure all that infrastructure can be put to work

As a youngster, Monitor's columnist lived largely in the oil-exporting kingdoms, sultanates and emirates of the Persian Gulf.

At the time, money was flooding in, thanks to the tenfold real rise in the price of oil between 1970 and 1980.

But - the oil industry aside - the Gulf Arab countries remained at a fairly basic stage of economic development.

In the early 1970s, Riyadh, the capital of Saudi Arabia, was a city built largely of mudbrick.

The airport consisted of a single hangar, where on arrival you paid a customs official bearing an ancient silver-bound rifle to chalk a white cross on your suitcase. Paved roads were rare, and across much of the country Toyota pick-ups were only starting to replace camels as the main means of transport.

The in-rushing tide of petro-dollars soon changed all that. Cash-rich governments rapidly embarked on enormous programmes of infrastructure investment, building glittering multi-lane highways across the desert, and opening ever-bigger and fancier airports.

Yet despite these and hundreds of other lavishly funded investment projects, the impact on the non-oil economy was limited. Sure, the investments contributed to gross domestic product when they were made, but they boosted productivity much less than expected.

Put simply, the Gulf countries' ability to make investments far exceeded their capacity to use those investments productively. Even though they started out with minimal infrastructure, the result was deserted highways and empty airport terminals.

Granted, the example is an extreme one, but it helps to illustrate one of the main problems currently facing China's economy.

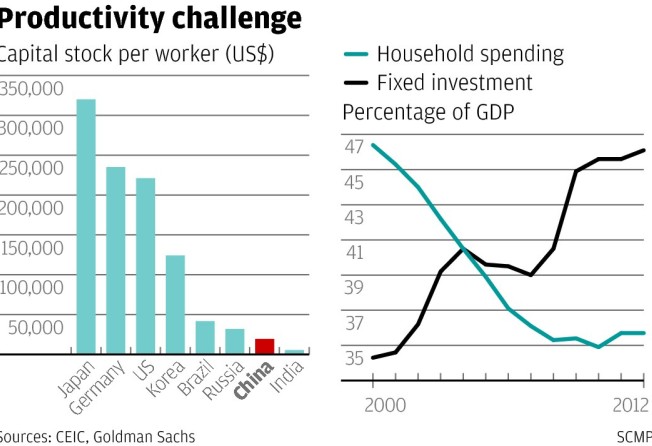

Investment bank analysts are fond of pointing out that China's capital stock - the accumulated value of investments in roads, railways, airports, factories and other fixed assets - per worker is a tiny fraction of that in developed economies.

Therefore, they conclude, China's unprecedented level of fixed asset investment, which reached 46 per cent of GDP last year, is not only justified, but economically advantageous.

Yet this argument takes no account of China's capacity to make productive use of all this new investment.

Michael Pettis, a professor of finance at Peking University, argues this capacity depends on a whole range of hard-to-quantify factors including quality of governance, bureaucratic even-handedness and efficiency, the strength of the legal system, the openness of the financial system to private entrepreneurs and levels of education, among others.

All these together, he calls social capital, arguing that for any level of social capital, there is an optimum level of investment in fixed capital.

Clearly, during the 1970s and 1980s, the Gulf Arab states massively over-invested in fixed capital given their limited levels of social capital.

Now Pettis warns that China, especially in the inland provinces, is investing beyond the capacity of its social capital to absorb and use those investments productively.

As a result, he argues that the benefits of additional fixed investment will be limited, unless policymakers concentrate on structural reforms to strengthen China's social capital, notably by improving local governance, reforming the financial system and lowering bureaucratic barriers to entry for private businesses.

Happily, given recent official pronouncements, there are signs that senior policymakers are aware of the limited utility of additional fixed investment, and that they are planning reforms to remove, or at least reduce, the structural constraints to further productivity growth.

Whether they can succeed or not remains to be seen. As the Gulf Arab countries found, building stuff is the easy part. Investing in social capital is far more difficult.