No 'taper tantrum' this time, but Hong Kong can't be complacent

While interest rates in the city are unlikely to rise soon, falls in property market look set to broaden as bond yields climb amid stable rents

The contrast with June's "taper tantrum" could hardly be more stark.

Six months ago, concerns that the United States Federal Reserve might soon begin winding down its programme of quantitative easing were enough to send financial markets into spasms.

Bond markets went into a tailspin on fears that the Fed would no longer be supporting prices with its asset purchases. As prices fell, yields shot up.

In Asia, stock and currency markets took a beating as international investors began pulling money out of the region. In Hong Kong, the benchmark Hang Seng Index fell 16 per cent in just four weeks.

The sell-off proved short-lived. When it became clear that tapering was not imminent, the panic blew over and markets settled down again.

And by the time the Fed finally got around to announcing yesterday that it would start scaling back its asset purchases next month, investors scarcely batted an eyelid.

Most East Asian markets rose on the news. And although Hong Kong-listed stocks dropped, the fall reflected fears of a year-end liquidity squeeze in mainland money markets rather than nerves over tapering.

Investors are so sanguine partly because their expectations of the Fed's move have long been priced into the market and partly because the direct near-term effects of tapering are likely to be small.

After all, the Fed will not be tightening monetary conditions. Rather, by cutting its asset purchases from US$85 billion a month to US$75 billion, it will still be easing, just a little less aggressively than before.

In the short term, that's unlikely to make much of an impact, given that most of the newly printed cash created by the Fed's asset purchases simply remains on deposit at the Fed in the form of excess bank reserves. What's more, the Fed will wind in its easing measures only gradually and be highly cautious about eventually moving to a tightening stance.

In yesterday's statement, the Fed stressed it would keep benchmark short-term interest rates effectively at zero as long as inflation remained subdued and the US unemployment rate exceeded 6.5 per cent.

At the current rate of decline, that suggests it will not raise interest rates until at least the end of next year.

Factor those in, and the proportion of the US working-age population not in employment remains at its lowest level since the late 1970s.

That will make the Fed's chiefs reluctant to increase interest rates for a while yet.

Even so, Hong Kong should not feel complacent.

Because of our currency peg to the US dollar, the Fed's quantitative easing has had an enormous impact on local monetary conditions. Since the US credit crisis first began, Hong Kong's monetary base has ballooned fourfold from HK$300 billion to more than HK$1.2 trillion today.

As the Fed begins to wind down its easing, it would not be surprising to see some of that liquidity draining away again.

The effect will be felt most keenly in Hong Kong's property market. Since the Fed began its first round of quantitative easing in 2008, local home prices have shot up 100 per cent.

Now, with tapering, they are likely to come under pressure, even though mortgage rates are set to stay low for at least another year. The reason is that Hong Kong properties will begin to look less attractive to investors in relative terms.

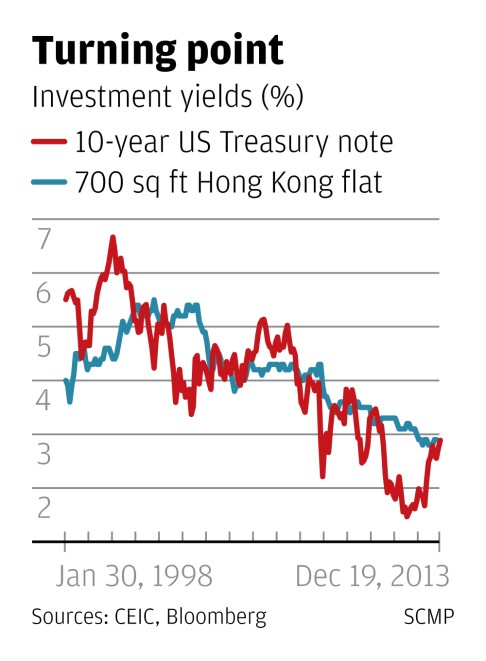

As the chart shows, for almost the entire period since 2008, the rental yield on a 700-square-foot Hong Kong flat has comfortably exceeded the yield on 10-year US Treasury notes, making local property relatively attractive as an investment.

However, since last summer's taper tantrum, the yield gap has closed, with little now to choose between the two assets.

With tapering, bond yields are only likely to climb further. For Hong Kong properties to remain an attractive investment, yields on local flats will have to rise, too. With rents relatively sticky, that means prices will have to fall.

It's already happening in the primary market. With tapering, expect to see prices in the broader market coming under pressure, too, next year.