HKEX profit drops 38pc on lower turnover, chairman warns of challenging outlook

Hong Kong-Shenzhen Stock Connect scheme will help boost turnover, analysts say

Hong Kong Exchanges and Clearing, the operator of the stock and futures markets in Hong Kong, has reported a better-than-expected decline in profit for the second quarter, as stricter cost controls helped offset the negative impact of the declining stock market.

The HKEX, which also owns the London Metal Exchange (LME), said its net profit fell 38 per cent to HK$1.56 billion in the quarter from April to June.

The exchange did not provide the second quarter result in its first half statement. The figure is deducted from the first quarter profit from the first half figure.

Analysts polled by Thomson Reuters were expecting net income of HK$1.35 billion in the second quarter, down 46 per cent on HK$2.52 billion in the same quarter a year earlier.

HKEX said in May it would slow down “less critical projects” and hire fewer staff after reporting a net profit decline of 9 per cent in the first quarter to a net profit at HK$1.43 billion.

In the first half year, the HKEX reported net profit at HK$2.99 billion, down 27 per cent from HK$4.095 billion a year earlier. Earning per share is HK$2.47, down 29 per cent from HK$3.49 a year earlier.

HKEX plans to pay an interim dividend of HK$2.21 per share, down 28 per cent from HK$3.08 a year earlier.

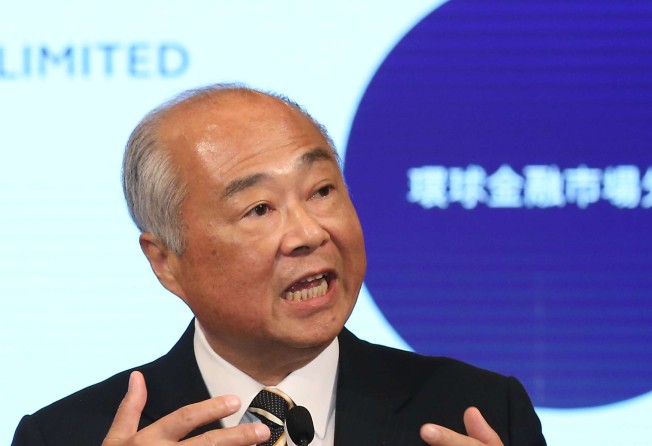

HKEX chairman Chow Chung-kong warned further challenges lie ahead.

“Considerable uncertainty surrounding the UK’s EU referendum (Brexit) also intensified market volatility and dampened market activity,” Chow said in a statement.

“The group will remain cautious and is committed to robust and prudent risk management for the maintenance of orderly markets in Hong Kong and London while enhancing our competitive advantages.”

HKEX’s earning have been hard hit by a lower market turnover and fewer new listings.

In the first six months of the year, the stock market average daily turnover was HK$67.5 billion, down 46 per cent from HK$125.3 billion from a year earlier.

Revenue and other income in the period dropped 18 per cent to HK$5.63 billion, down from HK$6.85 billion in the first half of last year.

Turnover at the LME, meanwhile, sold to Hong Kong Exchanges and Clearing for £1.4 billion in July 2012, was also affected by an 11 per cent cut in trading fees in the first half. Total revenue at the LME in the half dropped by 9 per cent to HK$805 million, down from HK$886 million a year earlier.

The stock market rally in April last year was triggered by a rule change to allow mainland mutual funds to invest in Hong Kong stocks via the Hong Kong-Shanghai Stock Connect scheme, which boosted average daily turnover in April last year to a record high of HK$200 billion per day.

In the first half of this year, however, market uncertainty returned, based on China’s economy slowdown and the turmoil triggered by the Brexit referendum.

There were 40 new listing in the first half of this year, a decrease of 22 per cent compared with 51 in the same period of time a year earlier.

The profit decline was better than the market expected, thanks stricter cost controls with staff costs down by 2 per cent year on year to HK$1.02 billion due to lower variable pay accruals.

HSBC has reduced its stock market average daily turnover assumption from HK$100 billion to HK$ 75 billion in 2016 to reflect the weaker-than-expected turnover momentum in the year to date.

HSBC analyst York Pun said in a research note before the HKEX results announcement that he expected the launch of the Hong Kong – Shenzhen Stock Connect in coming months, which will allow investors to conduct cross border trading between stock markets of Hong Kong and Shenzhen, to boost turnover.

HKEX’s shares dropped 0.98 per cent to HK$192.1 on Wednesday close after the announcement at lunch break, Its share price has risen 19 per cent in the past six months.