Xi Jinping’s dream city Xiongan may turn out to be China’s biggest public works project, ever

The ambitious project will count as the largest infrastructure project in the history of modern China, according to estimates.

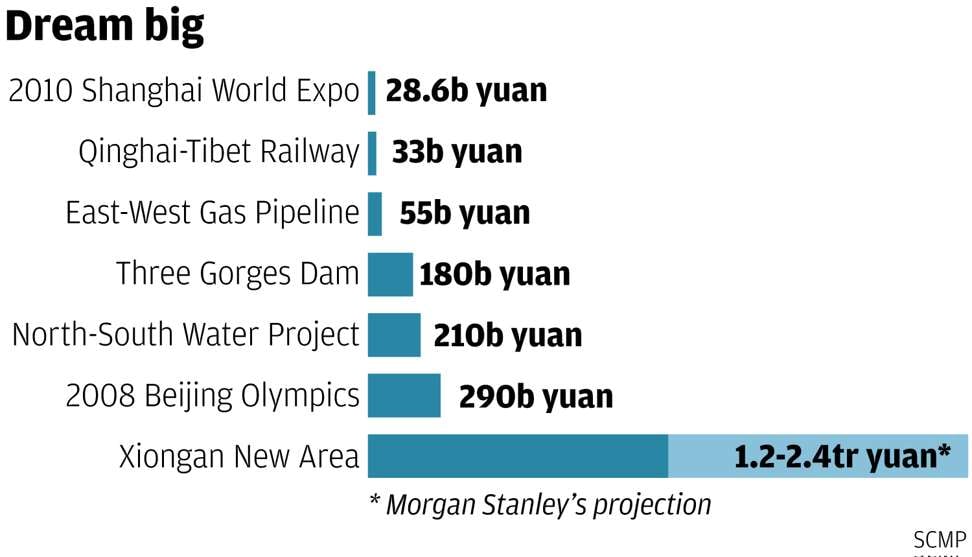

Xiongan New Area, the Chinese president’s ambitious plan to remake a backwater into a dream city, could lure as much as 2.4 trillion yuan (US$348 billion) of investments over the next decade, adding as much as 0.4 percentage point to China’s economic growth every year, according to a projection by Morgan Stanley.

The new city, designed as a salve to ease Beijing’s notorious overcrowding, air pollution and congested traffic, will redirect up to 6.7 million people to the 100 square kilometre area, eventually expanding the area’s size 20-fold over a decade.

That could potentially make it the largest ever infrastructure project in the history of modern China.

State-backed institutions and companies are likely to be the biggest winners out of the mega project, as they are in the best position to get the lion’s share of construction works and services, analysts said.

“Xiongan will be developed under the government’s plan by tapping the country’s own resources and strength,” said Zhang Zhiqian, deputy head of China Jianyin Investment’s research institute, in an interview with the South China Morning Post. “In terms of investment opportunities, it’s important to follow the government’s blueprint so as to comply with the policy directions.”

The Chinese central bank has already put its weight behind the project, as it organised a weekend seminar to direct the country’s financial institutions to extend credits toward projects associated with the project.

“There will be very few opportunities for speculators who hope to get rich overnight via investment in Xiongan,” said Jianyin’s Zhang. “After all, it’s a project on which the central government has a tight rein over it, and the development will be step by step.”

On April 1, the State Council announced its plan to build Xiongan (雄安新區) – a district that covers Anxin (安新), Rongcheng (容城) and Xiongxian (雄縣) counties in Hebei province - to absorb “non-capital” functions from Beijing.

The three counties, located about 100 kilometres south of Beijing, now have a total population of about 1 million. Population may ballon to 6.7 million over the next decade under the most optimistic scenario projected by Morgan Stanley, as new residents and a new workforce follow industries into the area.

State-owned enterprises, universities, hospitals, research institutions and less-important national organisations are expected to be relocated to the new area in the coming years.

Beijing touted the relocation project as a grand move on par with the developments of Shenzhen in 1980s and Shanghai’s Pudong New District in 1990s.

“It will be distinct from Shenzhen and Pudong which aimed at attracting foreign funds to support the development,” Zhang said. “Besides, it is unlikely to become a densely populated city because it is designed to be a “green” place for comfortable living.”

Jianyin Investment focuses on finance, manufacturing, culture, consumer and information technology sectors in tandem with the transition of China’s economy into a new pattern driven by consumer spending.

It said controlling financial risks amid high local governments’ debt levels, bond defaults and fraudulent online peer-to-peer lending practices should be given a priority this year.