Stable consumer-led growth a must for China’s economic transformation

But three possible headwinds for the household sector in 2018 – correction in property prices, slowdown in consumer credit growth and easing of wage growth – could set back China’s plans

With the two-week long Spring Festival celebrations coming to an end, the Year of the Dog is now in full swing. For an economist, the Lunar New Year festivities offer important clues for gauging the pulse of the economy.

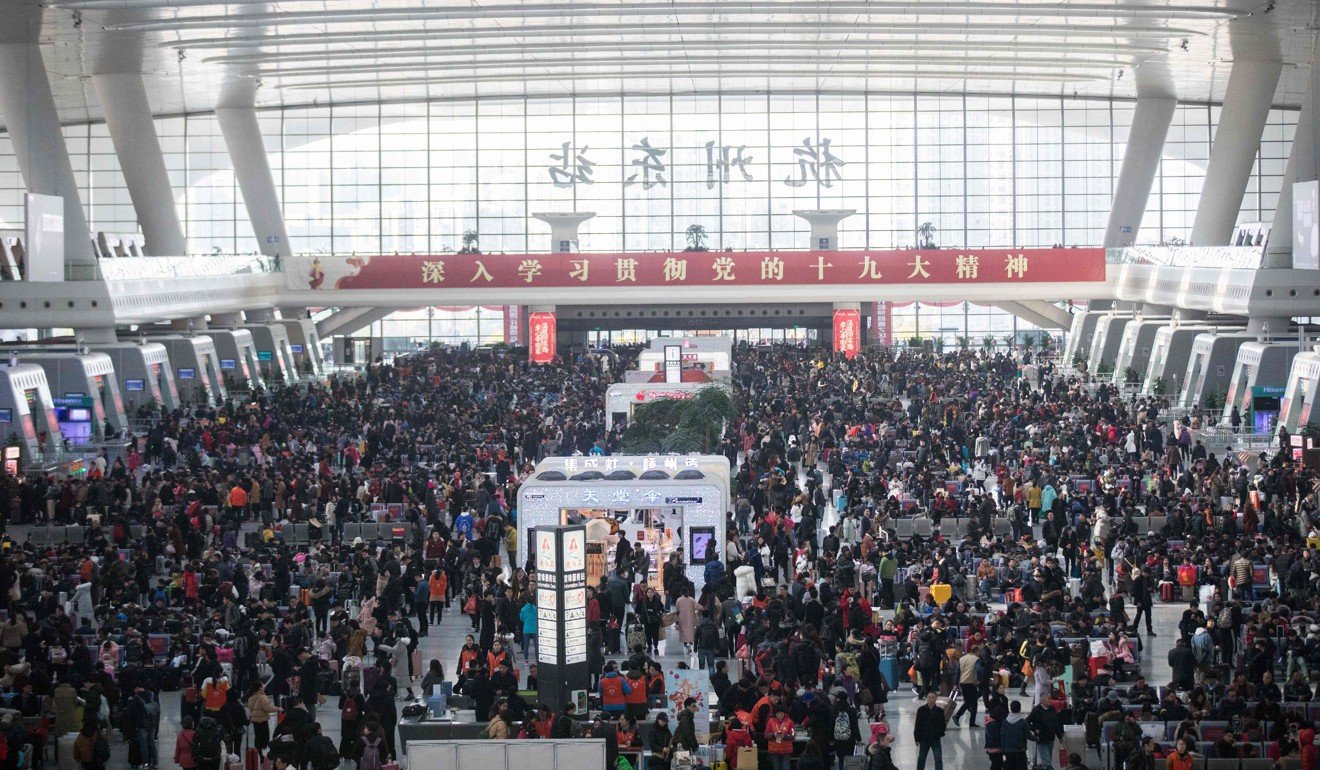

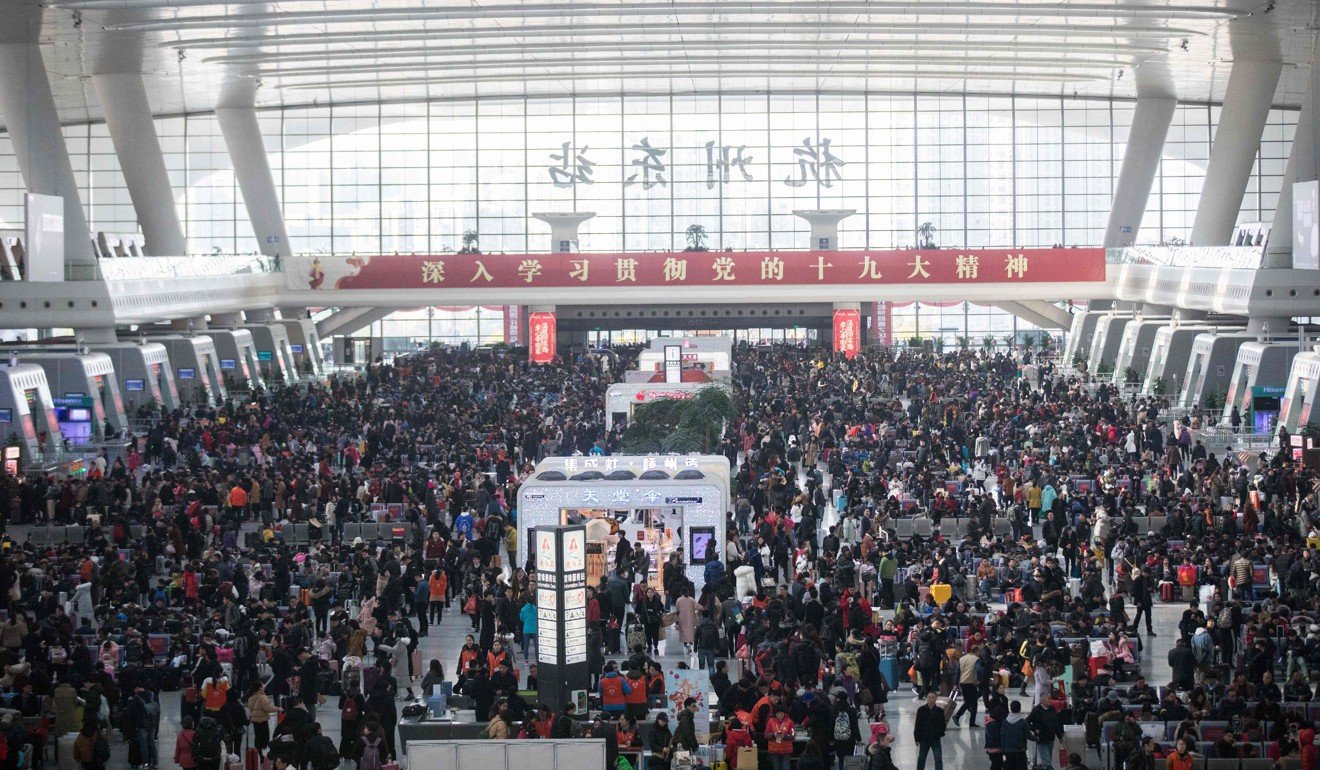

This is because the festival is often characterised by a bifurcation in the economy: the industrial sectors are in hibernation with millions of migrant workers returning home for holidays, while the consumer part of the economy is buoyed by strong festive-spending spree.

As China rebalances towards a consumption-driven economy, this therefore offers a critical window into the health of a very important part of the economy.

And the overall performance, in absolute terms, was not too shabby.

During the Golden Week, from February 15 to 21, total retail sales nationwide rose 10.2 per cent compared to the same period last year. Spending on leisure and entertainment services saw particularly fast growth, with box office receipts surging 43.5 per cent.

Tourism numbers also posted solid gains, up 12.1 per cent, while total spending increased by an even faster pace of 12.6 per cent. This is because of the rising share of overseas travels, which tend to have higher per-capita spending than domestic trips.

Last year’s yuan appreciation, along with easier visa and transport access, has encouraged more and more Chinese to take holidays overseas. This trend has created a contagious effect of China’s “consumption upgrade” – a phenomenon, we think, is set to continue in the years ahead.

The equity market reacted positively to these macro numbers, with all major indices finishing higher on the first day of trading. Analysts are generally optimistic, at the time of writing, that this recovery could be extended well into the National People’s Congress in early March.

From a macro perspective, a healthy consumer sector is important for ensuring a smooth transition of the Chinese economy. Without it, the economic rebalancing, towards consumption-driven growth, may lead to a more abrupt growth slowdown, potentially forcing the authorities to resort to short-term stimulus that risk reserving the structural gains of the last few years.

Stable consumption growth, in other words, can function as an important anchor, and a necessary condition for Beijing to continue the economic transformation.

However, this resilience in consumption is not undisruptable. We see three headwinds developing for the household sector in 2018.

Stable consumption growth, in other words, can function as an important anchor, and a necessary condition for Beijing to continue the economic transformation

First, the wealth effect from house price appreciation is set to dwindle, as continued policy tightening cools the housing market. This will hit the pockets of those in low-tier cities, as last year’s strong price rally turns into a mild correction.

Second, the pace of consumer credit growth may slow, as the authorities rein in household leverage increase. While still low compared to most major economies, the speed of increase in China’s household debt is disconcerting. Zhou Xiaochuan, Governor of the People’s Bank of China, has alerted the regulators and banks to take note of rising financial risks, which we think will translate to tighter credit controls in 2018.

Finally, a general slowdown in the economy, which we expect to grow at 6.5 per cent this year, will pressure wage growth, and in turn, curb consumer spending. Even though this slowdown will not be as large as what we expect of investment, it will be enough to let the authorities to tread the line carefully between structural reforms and maintaining near-term growth stability.

Beyond the immediate implications, the longer-term transition towards a consumption-driven economy will continue. For investors, who share our constructive view on this transformation (see our column dated 17-January), we believe the economic rebalancing will create plenty of investment opportunities.

Sectors related to China’s consumption-upgrade have in fact already taken off, with stocks of Tencent, Alibaba and Kweichow Moutai significantly outperforming the market in recent years. We think there will be plenty of hidden gems in this space, as such a profound shift in the economy cannot all be captured by a few companies.

And the opportunities are not limited to Chinese assets too. The global spillovers, be it via tourism, foreign education or luxury goods spending, will spread the gains to those who are able to supply the right products to China’s emerging rich and middle class. This will contrast to the past decade when China’s influence was manifested mainly through its demand for energy and raw materials.

Appropriately rebalancing one’s portfolio will therefore be critical for capturing the new trends that China imparts on the world.

Aidan Yao is senior emerging Asia economist at AXA Investment Managers