Taiwan banks put clamps on loans to mainland China firms

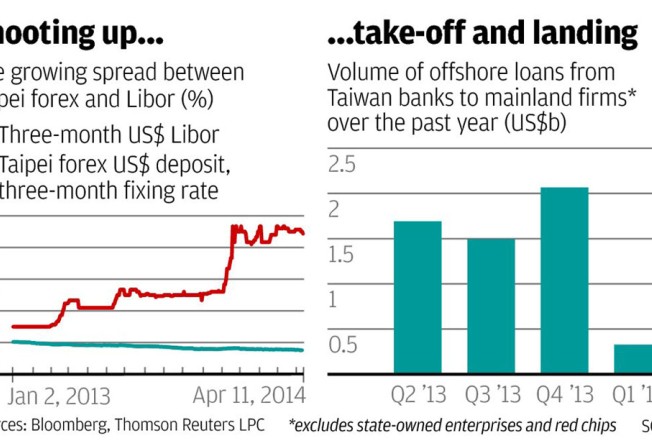

Taiwanese banks are shutting off lending to mainland firms. Offshore loans to mainland firms in the first quarter was just 15 per cent of the sums lent in the previous quarter, according to Thomson Reuters Loan Pricing Corp.

The banks' sudden departure from the market is pushing up mainland firms' offshore borrowing costs, by about 50 basis points to 1 per cent per year, said Stephen Chan, the Taipei-based head of corporate finance for Fubon.

Taiwanese institutions are a major supplier of foreign currency loans to mainland firms. By one estimate, they provide up to three-quarters of offshore loan capital to the mainland's small to medium-sized enterprises.

The island's banks are flush with US dollars, which they get from exporting firms that need to swap their sales proceeds into local dollars.

The banks are familiar with mainland China enterprises and are comfortable lending to them - there are about 40 banks in Taiwan active in the syndicated loan market for mainland firms.

"We share similar cultures. The Taiwan banks understand the China enterprises … the relationship is close," said Phoebe Li, the Taipei-based head of corporate finance for Chinatrust Commercial Bank.

So, why have Taiwanese institutions pulled out of this market?

The first fact people point to is the spike in the Taifx rate, which tracks the rate at which Taiwanese banks will lend US dollars to each other.

The rate spiked 57 basis points in December, or a one-month increase of 73 per cent. The international banks get their funding at the London interbank offered rate, but the Taifx's widening spread over Libor has priced the Taiwanese banks out of the international market for US dollar loans generally.

The reason for the Taifx spike is harder to explain. Some speculate Taiwan's central bank is intervening, to drive up US dollar rates relative to the New Taiwan dollar, keeping exporters' local costs down, thus making them competitive.

Others point to yuan liberalisations recently implemented in Taiwan.

In December 2012 the Bank of China started acting as a clearing bank for yuan transactions, and individuals are now able to convert up to 20,000 yuan (HK$25,290) a day.

Similar to what Hong Kong saw when it went through its own yuan liberalisations, Taiwan is generating masses of yuan reserves, with 240 billion yuan on deposit.

Taiwan banks can invest their yuan capital, fund the mainland's thriving trade finance market, or place it on deposit with the Bank of China - in all cases they will earn better returns than on US dollar assets of equal risk.

This is creating an interest among banks to hold yuan instead of US dollars, driving down reserves for US dollars, translating into relative scarcity and higher Taifx rates.

"Libor is 30 basis points, whereas in yuan you can easily get 3 per cent returns or above. You just place the deposit with Bank of China. With trade finance the returns may be 2 to 4 per cent [in yuan]," Chan said.

But perhaps the best explanation for Taiwanese banks' drop in lending to mainland firms is the simplest - banks are at their regulated quotas.

Authorities cap each Taiwanese bank's loan exposure to mainland firms at the net worth of the institution. This is to ensure that the loans do not threaten the solvency of each bank.

"We hit our China limits so quickly," Li said.