China may ease bad loan provision rules as banks struggle

Regulator ‘may differentiate among different banks on ratios’

Chinese authorities could loosen the regulatory requirements on bad loan coverage ratio to help the country’s banks struggling with their bottom lines in an economic slowdown.

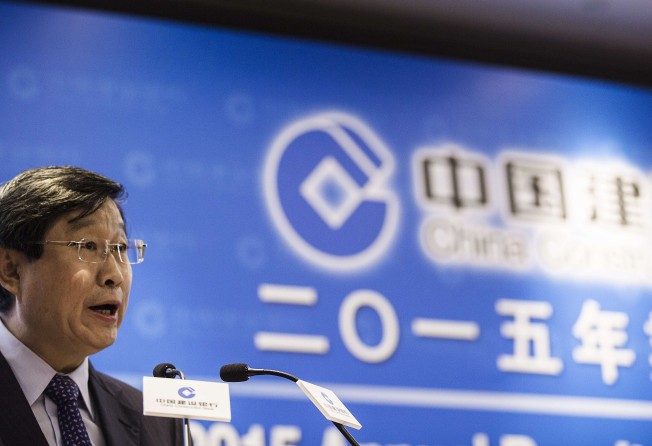

A statement by Wang Hongzhang, chairman of China Construction Bank (CCB), on Tuesday added to signs that Beijing is likely to lower the percentage of provision for bad loans even as more and more loans sour.

The boss of one of China’s ‘big four’ lenders told Bloomberg News that it would be “reasonable” and “possible” for the banking regulator to set the ratio at 120 to 130 per cent, down from the current 150 per cent.

A higher bad loan coverage ratio translates into a larger amount of capital the banks have to set aside to cover bad loans. The money can otherwise be added to the net profit figure.

Wang’s remarks are seen as a fresh sign that the China Banking Regulatory Commission (CBRC) is considering lowering the ratio since the largest state-owned lenders normally have the power to lobby the authorities for policy adjustments.

CCB’s provision was valued at 250.6 billion yuan as of the end of 2015 – 151 per cent of its total bad loans. It was 222 per cent the previous year.

The CBRC currently stipulates a minimum of 150 per cent bad-loan coverage ratio.

Analysts said worsening economic and corporate fundamentals have ratcheted up pressure on Chinese lenders.

“It’s a critical time for banks, whose performances are correlated to the economic conditions,” said Wu Kan, head of equity trading at investment firm Shanshan Finance. “They have reasons to lobby the regulator for a loosened requirement so as to report larger profits.”

Bad loans at China’s banks jumped 51 per cent to 1.27 trillion yuan as of the end of 2015 as economic slowdown and dwindling demand resulted in a rising number of defaults.

China’s economy grew 6.9 per cent last year, the slowest in 25 years. The central bank has cut the interest rates five times since November 2014, causing a narrower net interest margin for lenders.

The non-performing loan ratio for Chinese banks stood at 1.67 per cent at the end of last year, up 1.25 per cent from the previous year.

“It wouldn’t have a positive impact on banks’ fundamentals if the ratio is lowered,” said Haitong Securities analyst Zhang Qi. “Bosses of the top banks are just desperate to make their earnings reports look good.”

CCB posted only a 0.1 per cent net profit growth for last year.

Compared to their foreign counterparts, Chinese banks still enjoy a high net interest margin – the gap between the deposit and lending rates – as the biggest state lenders usually generate profits running into hundreds of billions of yuan a year.

Wang also told Bloomberg that the regulator would probably require different provision ratios for different banks.

The Chinese leadership is now making efforts to embark on a market-based interest rate mechanism, which is likely to deal another blow to state lenders, which can no longer enjoy a high net interest margin in future if the reform is carried out.