Shanghai office glut grows with new skyscraper

Rents may fall 17 per cent in the next three years as the record-breaking tower adds to supply

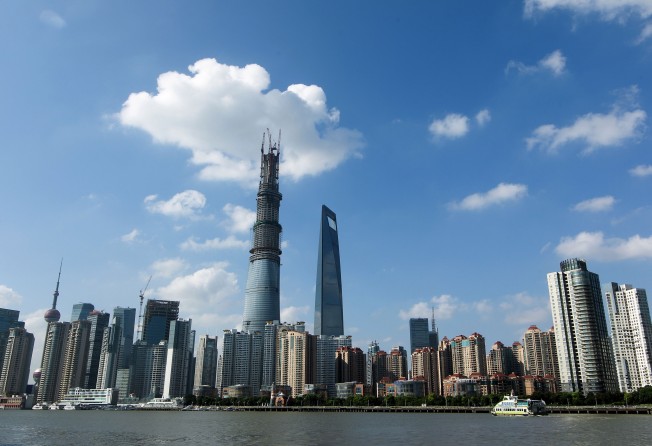

When completed in 2015, the Shanghai Tower will be the mainland's tallest building. The 632-metre skyscraper will also deepen a glut of office space in the city, putting pressure on rents.

The mainland's resolve to turn Shanghai into a global economic, financial and shipping hub by 2020 has led to an office building boom. Rents in the city might fall as much as 17 per cent in the next three years as space was added and the world's second-largest economy strove to maintain growth, CBRE said.

"Such a big supply will pressure office rents in prime locations," said Alex Chen, Shanghai-based senior associate director at RET Property. "The numbers are showing that vacancy rates and rents are definitely heading in a negative direction citywide."

Office rents in Shanghai declined 0.3 per cent to 8.41 yuan (HK$10.66) per square metre a day in the third quarter of this year, the first quarterly drop since 2010, Savills said.

Once finished, the Shanghai Tower will rank as the world's second-tallest building after the 828-metre Burj Khalifa in Dubai. The mainland's current record holder, the 492-metre Shanghai World Financial Centre, is diagonally across Dongtai Road and houses the local offices of Google and Ernst & Young.

Most offices being built over the next two years will be outside prime areas, where land is becoming scarce. About 70 per cent of the new office space expected by 2015 would be in non-prime locations including those near Shanghai's smaller airport in the city's west and the area where the World Expo was held in 2010, Savills said.

The vacancy rate in Lujiazui was 3 per cent and would double to about 6 per cent by the end of next year, CBRE said. The grade A office vacancy rate outside the central business district rose 0.3 percentage point to 24 per cent in the third quarter from the second quarter, a report by Jones Lang LaSalle in October said. For the entire city, the rate stood at 7.5 per cent, the broker said.

Office rents in Lujiazui were 10 yuan per square metre a day in the third quarter, 53 per cent more than four years ago, said Jones Lang LaSalle. The firm forecast rents would rise 5 per cent in the next two years because of the extra space the Shanghai Tower would add to the market. Rents grew 14 per cent in the two years that ended in the third quarter.

Among developers joining the construction spree are Shui On Land, which is building Hongqiao Tiandi, an office and restaurant precinct near the airport, and Soho China, the biggest developer in Beijing's central business district, which is building an 86,000 square metre mixed-used project called Sky Soho in the same area.

"The sheer volume of supply will place pressure on the city's overall market," said James Macdonald, head of China research for Savills. "Landlords have become increasingly aware of the impending glut of supply and taken steps to ensure they can maintain satisfactory occupancy levels" by cutting rents.

The China Banking Regulatory Commission's Shanghai branch has asked banks to pay "high attention" to financing risks of the city's commercial real estate, China Business News reported on December 5. It quoted the regulator as saying the city's commercial real estate was "oversupplied" and the market was "nearly saturated".