‘Actually, we’re okay for now’: LeEco raises US$600m in abrupt U-turn from cash shortage

The Chinese internet company unveils new chief executive for Asia-Pacific, along with strategy pivot to ‘focus on rapid cash flow growth’

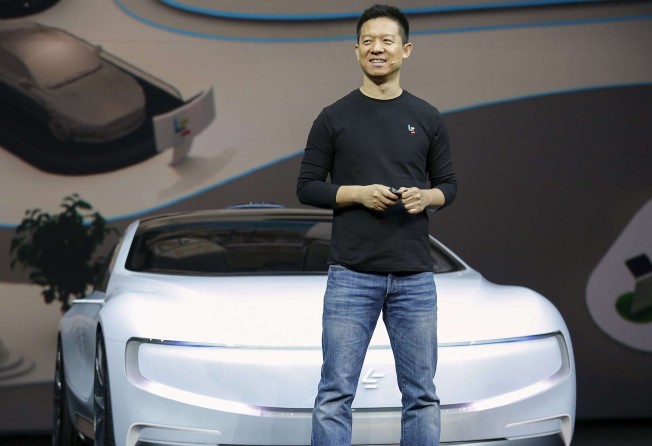

Chinese internet conglomerate LeEco, often referred to as the “Netflix of China”, has raised US$600 million in funds just two weeks after chief executive Jia Yueting said that the company was facing an impending cash crunch.

The company also said in an internal memo to employees on Tuesday that it would hold off on further expansion in Asia-Pacific, and has appointed a new chief executive to head its APAC operations as LeEco shifts its priorities to focus on its existing markets and improving cash flow.

On Tuesday, LeEco said that it had raised US$600 million in funds from investors including Jia’s classmates from the Cheung Kong Graduate School of Business in Beijing and Chinese corporations such as Chengxin Green Integration and China Heilan Group. The funding comes just a week after Jia had said that LeEco had weak fundraising abilities and was working on strengthening its capital structure.

The new funds will go primarily to the company’s car business, the LeEco See Plan, as well as LeEco Global Holdings, the company said. Jia had previously said that the company’s cash flow problems was largely due to expensive ventures such as the car division, which has already received over 10 billion yuan from company funds in early development.

In Tuesday’s internal memo to LeEco employees, the company also said that it would “temporarily hold horizontal expansion in the Asia-Pacific market”, as LeEco shifts priorities to “focus on rapid cash flow growth” and increasing the quantity and quality of its user base globally.

In the memo seen by the Post, the company also announced that Anthony Gao Jun will replace Mok Chui-tin as chief executive and president for LeEco’s Asia-Pacific operations, effective immediately.

“We are confident that Mr Gao will help ... drive sustainable growth in APAC businesses,” said a LeEco spokesperson. “It also shows the strategic importance of the APAC market to LeEco and its commitment here.”

The new personnel appointment is part of LeEco’s strategy update, as it seeks to focus on succeeding in existing markets like India, Hong Kong, China and the US. Previously, LeEco had hinted at expanding into other markets such as Southeast Asia and Europe.

The restructuring and shifting strategies also come almost a month after LeEco held a lavish launch in San Francisco in October, professing its ambitions of becoming Apple, Netflix, Amazon and Tesla, all rolled into one company. At the launch, it showed off its smart TVs, smartphones, a smart bicycle as well as its content and subscription services.

LeEco has been expanding rapidly into multiple industries since the beginning of 2015, including TV and film production. It also planned to produce its own autonomous electric vehicle, the LeSee Pro - a production model of which LeEco hinted could be unveiled in 2017.

LeEco’s troubles have spooked investors, as its Shenzhen-listed video streaming business, Leshi Internet Information & Technology Corp Beijing, saw its stock price take a beating.

When rumours of an impending cash crunch started swirling at the start of November, Leshi’s stock fell 14 per cent over the course of a week. At market close on Tuesday, Leshi’s stock closed at 39.10 yuan, up 0.1 per cent, although stock price has fallen over 30 per cent since last December.