How financial technology is driving Chinese consumer spending

With mobile payments and quick cash loans just a click away, mainland consumers are more willing to spend their money, say analysts

A boom in financial technology in the mainland is boosting consumer spending by making people more willing to part with their money, according to industry experts.

With technology making everything from mobile payments to quick cash loans and wealth management services available at the tap of a smartphone screen, Chinese shopping habits are changing rapidly, they said.

For James Zheng, 30, an IT engineer in Beijing, financial technology has fundamentally altered his approach to buying goods.

“I buy many things from consumer electronics, groceries to daily necessariness online. On average, I spend about 2,000 to 3,000 yuan a month,” he said.

The convenience of mobile payments has made online shopping much easier, while some new financial products such as “Jingdong white stripe” have also encouraged online purchases, Zheng said.

Jingdong white stripe is a service offered by e-commerce giant JD.com. It provides small amounts of credit to buyers who can enjoy an interest-free period. A similar product, named Huabei, that offers a deferred payment option is also available on Taobao.com and Tmall, the e-commerce platforms of Alibaba Group, which owns the South China Morning Post.

“I am actually more generous in my spending because of the convenience of financial products backed by big data and artificial intelligence technology. But of course, such a change is also because of salary increases I’ve had, and improvement in financial conditions,” he said.

“China’s financial technology in mobile payment has outstripped other countries, and that has changed my purchase habits alot. It’s so different from using just a credit card.”

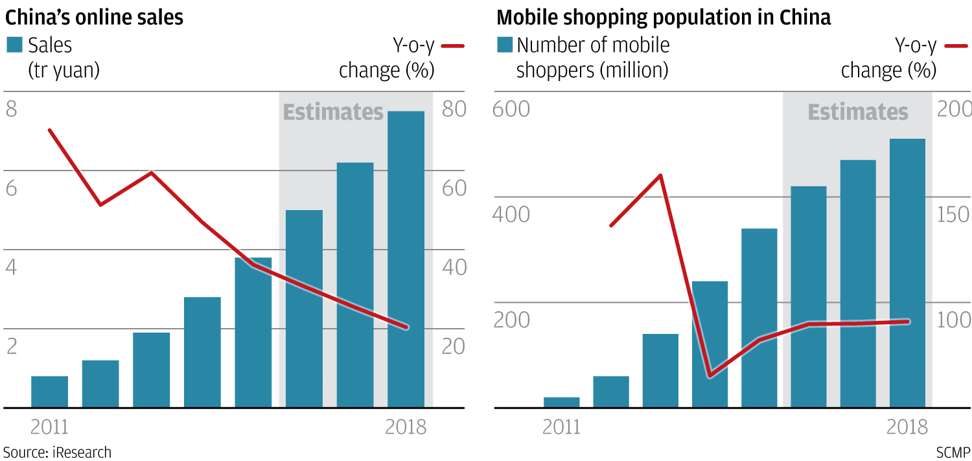

Last year, online retail sales in the mainland increased by 26.2 per cent to 5.16 trillion yuan (US$750.3 billion) from the previous year. That compares with a 10.4 per cent growth rate in total retail sales, which reached 33.2 trillion yuan.

“Advances in technology and the popularity of mobile devices have together cemented the foundation of internet finance. As big data and AI technologies are becoming more mature, the uses of financial technology can be widely expanded and are fast becoming a potent driving force of consumption,” Li said.

Increasingly sophisticated AI and big data technologies have also helped ease concerns over security in mobile payment and online credit. Li expects online spending to continue to expand, in particular among the younger generation.

However, the convenience of online spending will inevitably cause a certain level of overspending and irrational consumption, he said. “Althought overspending will likely be individuals cases, consumer education is needed to prevent the problem worsening.”

Data from Analysys showed that China’s mobile payment transactions in the first three quarter of last year more than doubled to 22.5 trillion yuan from 10.7 trillion yuan in the same period of 2015. While in the US, Forrester Research said mobile payment transactions for the full year reached US$112 billion, or about 770 billion yuan.

With the convenience in payment, consumers can make decisions much faster and are less hesitant to spend more

Technology firm Tencent Holdings’ WeChat Wallet, and Alipay, managed by Alibaba’s affiliate Ant Financial, are the two dominant mobile payment service providers in China.

The number of mobile users in China is also expanding. The latest study by the China Internet Network Information Centre, a state-backed agency, found some 469 million people paid with their smart devices in 2016, an increase of 31.2 per cent from a year ago.

For Zhou Jing, chief executive of digital lender Dumiao, these figures mean a huge market for the company, which uses financial technology to make lending easier and more efficient to consumers.

“Internet finance and fintech are undoubtedly spurring purchases. With the convenience in payment, consumers can make decisions much faster and are less hesitant to spend more,” Zhou said.

By leveraging big data, Dumiao is able to approve or decline loans for consumers in real-time at the point-of-sale. Once they’ve provide basic information and gone through a simple procedure on their mobile device, they can receive an approval within about 10 seconds.

The company, founded in 2015, has information on 20 million prospective borrowers in 300 cities, and processes about a million applications every month.

Zhou said Dumiao will continue to seek closer cooperation with retailers and other companies.

“With an option to obtain quick cash loans during online shopping, it’s easier for consumers to buy more expensive goods, which drives consumption,” she said.

As the applications of fintech continue to expand, it has become an area that companies ignore at their peril.

Yirendai, a New York-listed Chinese online lender, sees huge potential as the scope of fintech offerings expands.

“Yirendai is making use of fintech in providing consumer lending to individuals, while we are using the technology in robo-advisor services in wealth management,” said Tang Ning, who founded the company, as well as its parent firm CreditEase, an online lender and wealth manager.

“Consumers are in need of convenient and advanced ways to get unsecured loans. Not too much - maybe just tens of thousands of yuan - to satisfy their demands in daily life. But this market is largely untapped,” Tang said.

Yirendai’s strategy is similar to Dumiao in that it is looking to work with more retailers and companies, tapping the need of their customers who want quick cash loans via a mobile app or online.