China clampdown to spur rare earths projects abroad

Tighter controls amid pollution clean-up and higher prices boost prospects for rare earths

The toxic time bomb set by China's rare earths mining boom is set to boost the prospects for some of the US$12 billion of projects being developed outside the world's biggest supplier.

As part of its pollution clean-up, China, which controls 90 per cent of the global market, is studying the introduction of new taxes and regulations for rare earths in the June half that are forecast to drive prices higher.

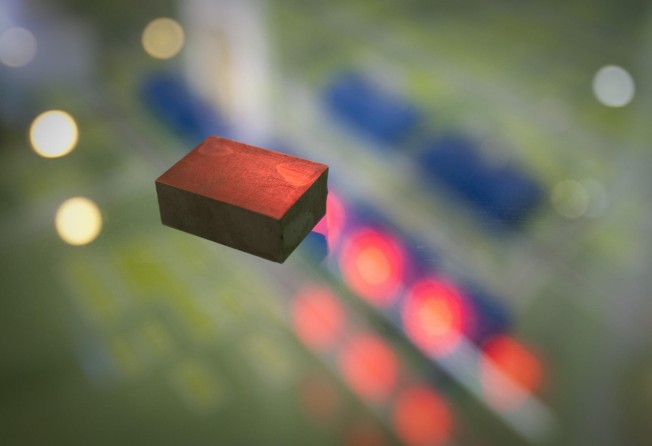

The measures will add to pressures loosening China's stranglehold on the production of rare earths, 17 chemically similar elements used in products from Apple's iPods to Toyota's hybrid-electric cars and cruise missiles made by Raytheon.

"Higher prices may spur the development of overseas rare earths' mining projects," said Chen Huan, a rare earth analyst with Beijing Antaike Information Development, a research unit of the state-backed China Nonferrous Metals Industry Association, who forecast prices might rise more than 20 per cent because of the flagged new rules.

The proposed changes come after the World Trade Organisation ruled in March that China already had violated global trade rules by imposing export restrictions such as quotas and duties on rare earths. Global stocks of rare earths were depleted after China, which consumes about 70 per cent of global supplies, cut exports from 2010.

"They're clamping down on illegal production, have environmental concerns and there are countries which require rare earths which don't particularly want to be beholden to China," said Kevin Schultz, the deputy chairman of Northern Minerals, developing the Browns Range project in Australia. "There's an opportunity."

The new measures include a value tax on producers, according to a May 21 article in China Daily.

Environmental compliance certificates might be required for exports, the report said.

Customers were returning to the market as stockpiles became depleted, meaning prices would advance, said Toronto-based analyst Luisa Moreno at broker Euro Pacific Canada.

At least 18 companies are seeking to begin production outside China by the end of the decade with combined development costs of about US$12 billion.

Shutting down unregulated mines was a major aim of China's campaign that began four years ago to constrain rare earth production. It can create waste gas, including deadly fluorine, and wastewater laced with cancer-causing heavy metals such as cadmium. The industry's problems are part of a larger green crusade in China, which in April saw the passing of the biggest changes to its environmental protection laws in 25 years.