Qingdao metals probe may help LME, Hong Kong commodities trading plan

Weakness in mainland metals and financing system could benefit London Metal Exchange and Hong Kong's commodities trading hopes

The Qingdao port warehouse scandal has exposed the weakness of the mainland metals and related financing system, which may eventually benefit the London Metal Exchange and Hong Kong's plan to develop commodities trading later this year.

The mainland authorities are conducting a probe at the Shandong provincial port, where a company using the port's warehouses is suspected of using a single cargo of metal multiple times to obtain financing.

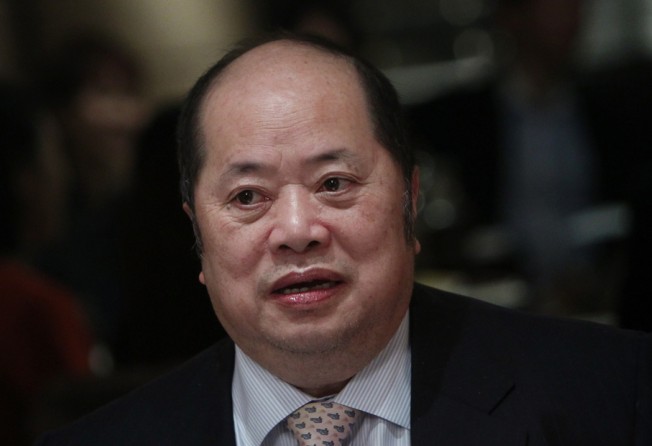

"The Qingdao incident has showed that the regulation of the mainland commodity warehousing system is far from perfect. In contrast, the LME has over 100 years of history and is a well-established exchange. Its approved warehouse system could be more reliable," said Christopher Cheung Wah-fung, a legislator for the financial services sector.

LME is wholly owned by Hong Kong Exchanges and Clearing, which bought the world's largest metal exchange in 2012 in a bid to expand into commodities trading. HKEx plans to introduce a commodities platform later this year to trade yuan-denominated copper, aluminium, zinc and thermal coal contracts in US dollars.

"The Qingdao scandal has led to volatility in prices of copper and some other metals. This may help Hong Kong when we introduce our own commodities platform for companies and investors to hedge risks against volatility," Cheung said.

Citic Resources Holdings last week said its alumina and copper stored at bonded warehouses at Qingdao Port might be affected by the investigation.

"Until the status of the investigation is clarified, the company is not able to accurately assess its impact on the group's alumina and copper stored at Qingdao Port or on the group itself," Citic Resources said in an announcement on the stock exchange website last week, adding that it had obtained orders from the Qingdao court to secure its interests.

Cheung said the Qingdao case might lead some end-users to move their metal stocks from mainland warehouses to nearby approved warehouses of LME in South Korea, Malaysia or Taiwan.

There have been unconfirmed media reports of some companies already starting to move their stockpiles to LME warehouses.

LME, which has 700 warehouses worldwide, does not have any on the mainland.

"Although LME's warehouses are criticised for the long queues, their problems are nothing compared to the alleged fraud in Qingdao. LME may benefit from these movements," Cheung said.

Joseph Tong Tang, an executive director of Sun Hung Kai Financial, said the Qingdao incident had led commodities investors to closely monitor metal prices.

Barclays said the probe might weigh on the price of copper, already the worst performer on the LME this year.

According to LME stock movement data, there was no big increase in warehousing activity in South Korea, Taiwan or Malaysia as of Friday.

An industry source familiar with LME operations said it could take a least a week to ship metal from China to any of these other destinations.