Five firms plan to raise US$613m in Hong Kong as investor sentiment picks up

Companies plan to raise US$613m in total as investor sentiment shows signs of improving

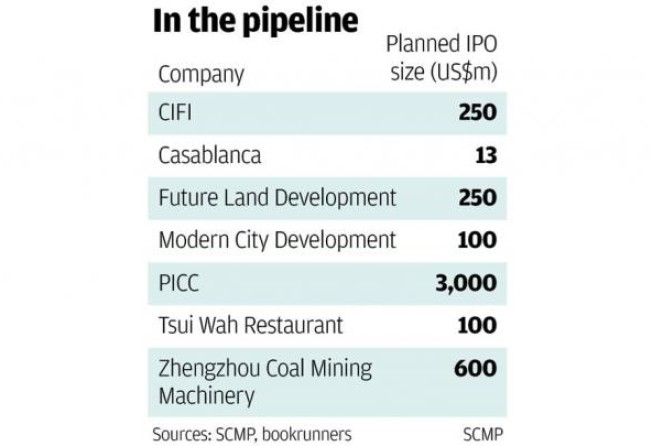

At least five companies are poised to begin initial public offerings to raise more than a combined US$3.6 billion in Hong Kong this month as investor sentiment shows signs of improvement.

Mainland property firms CIFI and Future Land Development, local restaurant chain operator Tsui Wah, and bedding retailer Casablanca yesterday announced they will launch their offerings this month.

Between the four of them, the companies aim to raise a total of US$600 million.

Joining the listings rush, bedding retailer Casablanca announced it will raise about US$13 million. It plans to use the bulk of the net proceeds for expansion on the mainland.

Meanwhile, People's Insurance Company (Group) of China, or PICC, will begin its pre-marketing campaign for its H-share listing on Thursday, planning to raise about US$3 billion through a Hong Kong listing. The planned Shanghai listing has been put on hold pending regulatory approval.

"PICC is likely to list on the Hong Kong stock exchange first, and will get support from state-owned financial intuitions and the sovereign wealth fund," said a market source, who declined to be identified.

If it materialises, the deal could be the largest offering in Hong Kong this year, and the share could begin trading as early as December 7, the person said.

The PICC deal was originally scheduled as a mega-sized dual listing in Hong Kong and Shanghai to raise more than US$6 billion in total, but the China Securities Regulatory Commission put an end to the A-share listing plan of the country's largest non-life insurer.

After the Hong Kong float, 15 per cent of PICC's share capital would be listed in Hong Kong.

New shares of Future Land Development, a Jiangsu-based property firm, are likely to be priced at a distress level, offering a price to net asset value discount of 60 to 70 per cent, according to two people with direct knowledge of the deal.

"The new share offering of Future Land is set to ride on the theme that it offers limited downside to investors while being priced at an attractive level," said one person.

Shanghai property firm CIFI is likely to offer IPO shares at a range of HK$1.33 to HK$1.65 each, representing a discount of up to 69 per cent and a price-earnings ratio of a paltry four times next year's earnings.

Most of the proceeds will be used for land purchases in tier-1 and tier-2 cities, where the firm has existing projects.

Local cha chan tang operator Tsui Wah Restaurant, meanwhile, plans to raise up to US$100 million after the firm delayed the IPO a few times.

Tsui Wah will start taking orders from investors from Monday and begin trading on November 26.

Additional reporting by Bloomberg