Dairy duo must show that someone is not milking the deal

First came the fund-raising, then the dividend payouts, and now the takeover offer from Mengniu. Yashili's about-turn needs to be explained

China Mengniu Dairy's planned takeover of baby formula milk producer Yashili International is an important case to study. It is not about the consolidation of the country's dairy industry but our regulatory regime.

On Tuesday, Mengniu said it would buy all the shares of Yashili at HK$3.50 each, 9.4 per cent above the latter's last closing price. That priced Yashili at HK$12.4 billion.

The deal shed new light on a surprising and puzzling decision by the Yashili board on May 3 to pay a special dividend of one billion yuan (HK$1.2 billion).

It is surprising because that's only a month after Yashili announced a final dividend of 400 million yuan, equal to 85.4 per cent of its 2012 profit. It is puzzling because that's only two years after Yashili had raised 1.6 billion yuan via a Hong Kong listing and only weeks after it won approval to build a 700 million yuan plant.

Back then, Yashili said the special dividend was paid "in recognition of the continual support of the shareholders as it has excess cash for the group's present and future funding requirements".

If it doesn't appear to make any sense financially to Yashili, it makes every bit of sense for Mengniu as a buyer. The special dividend reduced Yashili's net asset value - four billion yuan at the end of last year - by one billion yuan.

Had this not been done, Mengniu would have had to offer a higher acquisition price with a higher cash element to Yashili's shareholders. This would mean a higher gearing for Mengniu, which is borrowing to pay for acquiring Yashili and another dairy producer, China Modern Dairy. The bill for both deals stands at HK$16 billion.

The big question is, when Yashili paid the special dividend was the board aware of Mengniu's planned offer? This would be price-sensitive information. If it has nothing to do with the acquisition, what changed in Yashili's operations and financing plans in the 40 days after its final dividend announcement that the board found it appropriate to dish out more than a third of its cash while the firm is expanding?

By the way, there is also an interesting coincidence that the company should explain. In announcing the special dividend, it said the special and final dividends would be paid only to shareholders whose names appeared on the registrar on June 13, instead of June 17 as stated in its earlier announcement on the final dividend. Yashili suspended its share trading on June 13 before announcing Mengniu's acquisition.

From this year, regulators have made it mandatory for listed companies to disclose price-sensitive information. This appears to be particularly relevant when one looks at Yashili's price chart.

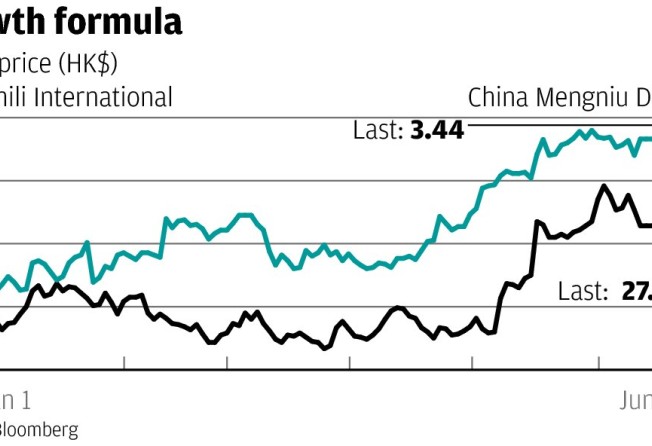

Mengniu's appetite for acquisitions was first made known by a Merrill Lynch research report in mid-December. A month later, Mengniu's chairman Frank Ning confirmed that the company was talking with China Modern. From then, Yashili's price and trading volume began rising in line with China Modern's. Between January and March, Yashili's shares rose 60 per cent and its daily trading volume averaged eight million shares, compared with a few million in 2012. But from April, the performances of Yashili and China Modern began to diverge; Yashili's price headed up while China Modern's went south. The gap continued to widen. This is despite announcements by Mengniu and China Modern on April 24 that they were having informal talks "regarding a possible acquisition of certain assets". Yashili had said nothing.

(It all made sense on May 8 when Mengniu announced a purchase of China Modern Dairy's controlling stake only. No general offer was made.)

Between April 1 and June 13, Yashili gained 40 per cent compared with China Modern's 0.39 per cent rise. During the period, the former's average daily trading volume stood at 12 million shares, compared with the eight million average in the first three months of the year.

Shareholders may well wonder what caused Yashili's share to jump from HK$2.365 to HK$3.33, which is way above the special dividend of 28.25 fen.