Privacy law hinders direct sales

New regulations banning cold calls unless customers allow them have hurt some insurers, but others are finding ways to adjust

Amendments to Hong Kong's privacy law may have made it harder for insurers to sell products by cold calling potential customers, and has cut down sales in the second quarter. But it has not entirely shut the door on such a sales channel.

Total new premiums on life and general insurance policies in the second quarter stood at HK$31.08 billion, down about 3 per cent from HK$31.99 billion in the first quarter.

The amended privacy law came into effect on April 1 and could have been a factor in slowing sales of life policies, industry observers said.

Many insurance companies use direct marketing methods to attract new customers - which include using telephone calls or e-mails to sell products. There are no official statistics on such sales methods, but insurers say they may represent about 10 per cent of life insurance sales, or an estimated contribution of HK$7.5 billion last year.

The amendment to the Personal Data (Privacy) Ordinance forces companies to determine in advance whether their customers object to the use of their personal data for direct marketing purposes.

The ordinance now also prohibits any companies with a lot of customer data from selling that data, or allowing it to be used by insurers or any other third parties without first getting their clients' consent.

An insurance company head, who did not want to be named, said a major impact of the new ordinance was that insurers could no longer freely cold call potential customers.

"Previously, many insurers linked up with banks and used the banks' data to cold call their customers," the insurer said. "This practice is now banned under the amended privacy law."

Under the new provisions of the ordinance, companies must send an e-mail or letter to customers giving them the opportunity to choose whether they are willing to accept cold-call sales.

Customers who respond by saying they do not agree may not be called. Those who respond by saying they do not object to being called - or those who fail to respond - may be called.

Chan Kin-por, the legislator for the insurance sector, said 30 to 40 per cent of customers approached by insurers chose to opt out of being called.

"This has restricted the number of potential clients for insurers to call," Chan said.

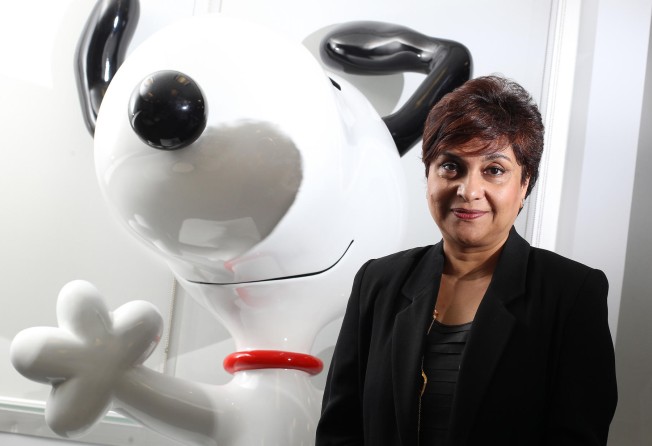

US insurance giant MetLife, better known to locals as the "Snoopy insurer" because it uses the cartoon character to promote its brand, says it will not retreat from direct marketing.

MetLife does not have agency teams and sells through banks, brokers, the internet and by direct marketing methods.

"The new privacy law has benefited our business. We have actually seen a higher success rate from direct marketing since the new privacy ordinance has been implemented," said Nirmala Menon, the company's senior vice-president and head of designated markets and health for Asia. "This is because now we are contacting potential customers who are willing to be sold to."

Menon said the success rate of its directing marketing had increased by more than 20 per cent in the past six months.

The company now planned to expand its direct marketing by telephone and internet, she said.

She said she believed sales made through these channels could increase to about 30 per cent of total sales by 2016, up from about 10 per cent now.

MetLife would also invest in the development of a more comprehensive internet platform that would allow policyholders to buy products online from early next year.

The firm sells 70 per cent of its products through its banking partners, and the rest through direct marketing and brokers. Menon said she would like more balance, with banks and brokers contributing 70 per cent of total sales and 30 per cent initiated by telephone or internet contacts.

Prudential Hong Kong chief executive Derek Yung said the new ordinance provisions had made selling for his firm's agents more difficult.

"Before the law change, our agents could freely cold call any potential customers," Yung said. "But now they can only call a smaller pool of customers. In addition, the agents also need to complete a lot of documentation to prove that the clients agreed to be contacted."

Despite the new challenges, Yung said he had no plans to ban agents from cold calling new customers.

"Telephone marketing is an important method for our agents to sell products," he said. "We will not abandon it.

"We can just do more to make sure our agents are doing it properly."

Zurich Insurance (Hong Kong) will dismiss 700 life insurance agents by the end of this year. It announced on its website that it would stop using agents to sell life insurance products from December 31, and rely on brokers and independent financial advisers to sell products.

Choy Chung-foo, the chief executive of BOC Group Life, said there had been no big impact on sales or the company's business operations from the new ordinance provisions.

"Our company has always been serious about customers' data privacy," Choy said. "We have only introduced some minor changes, so as to remove any possible doubts with the new guidelines."