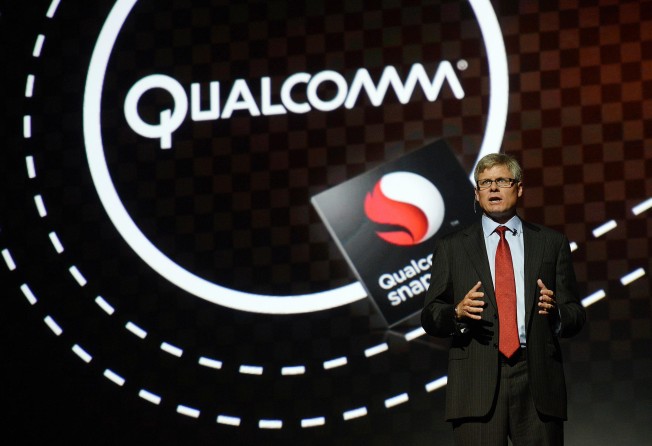

Qualcomm's Steve Mollenkopf out to break into China Mobile network

Qualcomm's incoming chief faces a big challenge in the mainland market in persuading carriers and handset makers to use its technology

Qualcomm's Steve Mollenkopf helped get the company's chips into the world's top-selling phones. His challenge now is making deeper inroads in the world's biggest market.

Qualcomm, whose chips and technology are key parts of Apple's iPhone and Samsung Electronics' Galaxy family, is largely absent from devices on China Mobile's network because the state-owned carrier deployed a related system it said was developed locally.

As mainland carriers upgrade to a higher-speed network called long-term evolution (LTE), Qualcomm needs to gain a wider foothold in the market, particularly with China Mobile, which has twice as many subscribers as the United States has people.

Mollenkopf, a 20-year company veteran, also is grappling with an antitrust probe by a Chinese government agency, which has not revealed why it is investigating Qualcomm.

Underscoring the challenges that other US companies have with China Mobile, it took Apple six years to come to an agreement with the carrier before announcing a deal last month.

Qualcomm, based in San Diego, gets the majority of its profit from royalty fees paid by carriers and handset manufacturers to use its technology. In the 2013 financial year, while 67 per cent of sales came from chips - processors and basebands that connect handsets to cellular networks - more than two-thirds of its pre-tax profit came from licensing.

We spend a lot of time talking to people about what they get from Qualcomm

On China Mobile's current 3G network, mainland handset makers do not pay Qualcomm royalties because the government claims it is using a different homegrown standard. In the move to LTE, Qualcomm is telling Beijing that embracing the company's technology would give domestic manufacturers such as Xiaomi and ZTE a better shot at competing with Apple and Samsung overseas.

The South Korean government took that approach in the upgrade to 3G starting in the 1990s, helping Samsung and LG Electronics expand globally with Qualcomm's assistance, which outweighed the licensing fees.

"We spend a lot of time talking to people about what they get from Qualcomm," Mollenkopf said.

"It is an opportunity for us both on the chip side and on the licensing side," said Qualcomm executive vice-president Derek Aberle, who heads the company's technology licensing arm.

Rainie Lei, a Hong Kong-based spokeswoman for China Mobile, declined to comment on the carrier's relationship with Qualcomm or whether it would pay any licensing fees for LTE technology.

Mainland companies should view Qualcomm's patents as an asset instead of a cost because of the legal protection they provided to exporters, Aberle said.

"Many have aspirations to go outside China," he said. "They worry about the intellectual property. They have to play by the rules internationally."

To help its efforts in China, Qualcomm has produced a new lower-cost version of its Snapdragon chipset with integrated connections to LTE and compatible with all networks across the world. The company also held regular meetings with carriers, phone makers and government officials to educate them about the benefits of its technology, Aberle said.

Whether that would be enough to help Qualcomm succeed in claiming royalties on its LTE patents on the mainland was still an open question, said Piper Jaffray analyst Gus Richard.

In November, Qualcomm's struggle on the mainland became even more acute, with the company disclosing that the National Development and Reform Commission had begun an investigation related to an anti-monopoly law. The regulator said details of the probe were confidential, according to Qualcomm, which said it knew of no charge by the agency that it violated the law.

"Is it - we're not going to pay you, what are you going to do about it?" said Richard. "I don't see why they pay Qualcomm."

Beijing's quest to foster a domestic chip industry that competes with outside suppliers might encourage the government to stand in the way of Qualcomm's expansion, he said.

But Mark McKechnie, an analyst at Evercore Partners, said that if leaders were considering what was best for its handset industry, then they would go along with Qualcomm.

"If you want to do a global launch of a 4G handset that goes from no units to tens of millions of units in the first quarter, no one can do it like Qualcomm," said McKechnie.