Gross merchandise volume is not Alibaba’s top business metric, says senior executive

E-commerce juggernaut Alibaba Group will report on its gross merchandise volume on a yearly basis instead of every quarter, following a US regulatory investigation into the company’s accounting practises last month.

Gross merchandise volume (GMV) is a standard often used by e-commerce companies such as Alibaba to measure sales growth. The metric tallies the value of third-party sellers’ transactions processed on the company’s marketplaces.

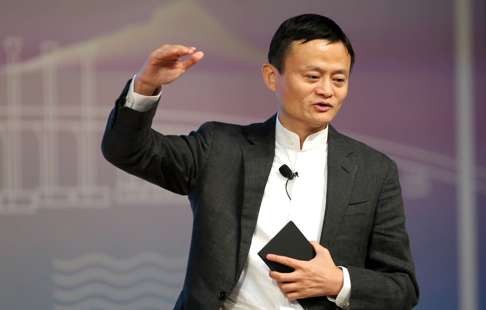

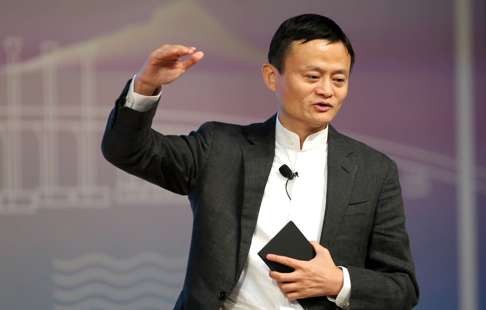

At Alibaba’s investor day on Tuesday, founder Jack Ma Yun said the company used GMV to tally sales numbers because it was following in the footsteps of US online marketplace Ebay, which had used it as a metric.

“In our heart, we know this isn’t really the only index,” said Ma at Alibaba’s headquarters in Hangzhou, China.

Maggie Wu, Alibaba’s chief financial officer, said GMV was not the top key performance indicator for the company. Wu added that Alibaba’s e-commerce marketplace Taobao had already removed GMV as a metric to measure performance.

“We don’t manage this business by … monthly or quarterly GMV,” said Wu. However, Alibaba will retain its GMV target of six trillion yuan by 2020 after it hit a milestone of three trillion yuan in its 2016 financial year.

In May, the Securities and Exchange Commission launched an investigation into Alibaba’s reporting practices on its operating data for Singles’ Day, Alibaba’s annual sales festival. During Singles’ Day last year, Alibaba generated US$14.3 billion in GMV.

Alibaba was also requested to provide information about its consolidation policies and accounting practices for logistics firm Cainiao Network, in which Alibaba has a 47 per cent stake, amid speculation by some investors that the e-commerce giant was downplaying Cainiao’s losses to inflate profits on Alibaba’s balance sheet.

“We will be very co-operative and … provide all this information. We want to be as transparent as we can be,” she said.

In Alibaba’s financial guidance, Wu said the company expected revenue to grow more than 48 per cent from a year earlier. Excluding revenue from its newer investments, including Alibaba’s Youku Tudou acquisition, as well as its US$1 billion investment in Southeast Asian e-commerce portal Lazada, revenue is still expected to rise at 36 per cent, compared to 33 per cent at the same time last year.

Wu cautioned that the revenue growth contributions from Youku Tudou and Lazada would reduce the margins of Alibaba’s core businesses because these companies were still at a “developing stage”.

At the event, Ma also spoke on Alibaba’s anti-counterfeiting efforts, acknowledging that it was becoming harder to fight piracy as the quality of fakes continued to rise despite the company’s efforts.

“The problem is that the fake products today, they make better quality, better prices than the real products, the real names,” he said.

Ma added that while brand companies used original equipment manufacturers to produce luxury products and were able to control the business model using brand quality and channel control in the past, this was no longer the case with the rise of e-commerce.

“[Today], internet becomes the brand. OEMs realise that [they] can make their own products and sell online,” he said.

However, he defended the company’s efforts in fighting piracy, saying Alibaba was “more confident than ever” in identifying counterfeits using its technology.

“We can solve the problem better than any government, any organisation … in the world,” said Ma.

In May, the International AntiCounterfeiting Coalition suspended Alibaba’s membership after one month following complaints from other members and concerns that fake goods sold on the company’s platform presented a conflict of interest.

Alibaba is the owner of the South China Morning Post.