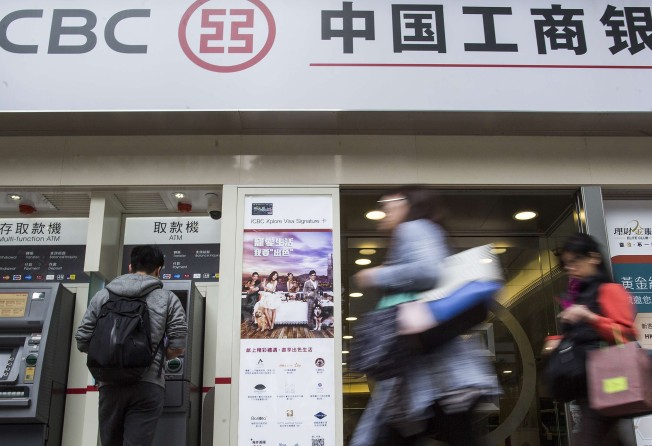

ICBC signs debt-for-equity swaps with seven Chinese companies

State-owned lender scotches rumours on ending of debt-to-equity swaps, says AMC plans on track

China’s state-owned Industrial and Commercial Bank of China has inked debt-to-equity swap agreements worth with seven troubled companies for replacement of debt worth 60 billion yuan (HK$67.5 billion), bank officials said on Thursday.

Debt-to-equity swaps are programmes envisaged to help reduce corporate financial leverage, improve corporate governance and enhance long-term development. It is also a key plank of Chinese President Xi Jinping’s supply-side reforms that seeks to alleviate troubled companies’ repayment problems with the help of State lenders.

However, the debt-to-equity swap has also raised controversy as such swaps might saddle the listed lenders with more bad assets while sustaining zombie firms at heavy cost.

The seven companies that have reached deals with ICBC include Shandong Gold Group, BBMG Corp, Taiyuan Iron &Steel and so on. All of them are state firms in the steel, cement and coal sectors and the deals do not include any non-performing loans.

“Although ‘shedding overcapacity’ is a State policy, we should not bankrupt all firms in the steel and coal sector. Instead, we should support the big companies as long as they have a chance to improve their performance,” said Hu Hao, vice-president of ICBC.

The lender’s move comes amid rumours that the banking regulator is likely to pull the plug on debt-to-equity swaps as some lenders are just turning the debt into “equity” only in name and are instead seeking assured,fixed returns from these firms. Though the reports have been dismissed by state media, it still exposes the grey areas associated with the programme.

Wei Xuekun, head for the credit business at ICBC also dismissed the rumours and said the debt-to-equity programme is going ahead as planned.

However, some bankers feel that there are still some chinks in the programme that need to be ironed out. There are doubts as to whether the swaps are conducted in a market-oriented way and in accordance with the regulations. Some others expressed concerns on the exit mechanism for banks.

Wei said that lenders can exit through initial public offerings, mergers and acquisitions, gradual stake reduction with agreed dividends, share buy-backs or through sale on a possible special public bourse.

He said that the plans to set up an asset management company to handle swap deals has been approved by the board, and the detailed plan is under review by regulators. ICBC had in December 2016 announced plans to invested 12 billion yuan on a fully-owned AMC. Other major state lenders in the past months have also unveiled similar AMC plans, ranging from 10 to 12 billion yuan.

Meanwhile China Construction Bank on Thursday signed debt-for-equity pacts with three Henan-based coal and steel companies for a combined value of 35 billion yuan, three days after it signed deals with three energy companies in Shaanxi for a total 50 billion yuan.