VPower promotes ‘super-connector’ role on power projects along the new Silk Road routes

Company already in talks to form a partnership with China’s oldest and largest conglomerate Citic Ltd to scout for projects in Southeast Asia

VPower Group International, already in talks to form a partnership with China’s oldest and largest conglomerate Citic Ltd to scout for power projects in Southeast Asia, is keen to offer its experience in helping connect other Chinese firms with opportunities in nations covered under Beijing’s “Belt and Road Initiative”.

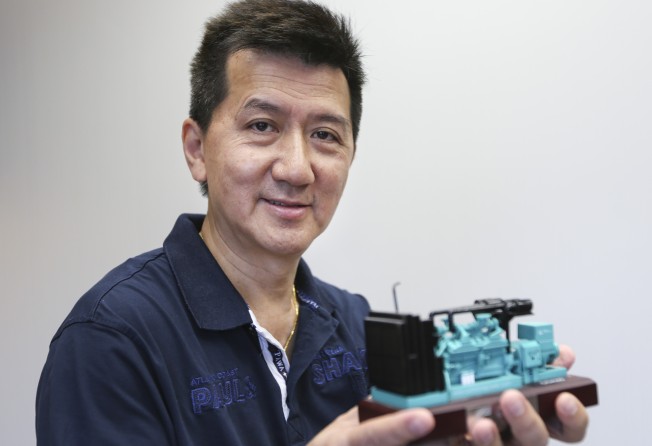

According to Rorce Au-yeung Tai-hong, VPower’s co-chief executive, Hong Kong’s advantage lies in its pool of technical and financial professionals who can provide project planning and risk assessment services.

The company already has five years’ experience building small power stations in Southeast Asia to meet demand not fulfilled by larger plants, that can often take several years to build.

“Hong Kong can play the role of ‘super-connector’ for mainland Chinese firms in terms of pre-project risk analysis, presentation and appreciation,” Au-yeung said in an interview with the South China Morning Post.

“There are plenty of technical and financial consultants that can quickly be called upon to define the scope of a project and assess the investment risks.

“In mainland China, although many state-backed firms in the industry have more resources than Hong Kong firms, they have to go through cumbersome project initiation and pre-approval procedures before they can draw resources to do risk assessments.”

The term “super-connector” was first coined by former Hong Kong chief executive Leung Chun-ying to describe how he saw the city’s role in the Belt and Road.

VPower is among many Hong Kong companies that could potentially benefit from Chinese President Xi Jinping’s push for mainland firms to finance and build infrastructure in more than 60 nations along the old land and maritime “Silk Road” trading routes.

According to a Credit Suisse research report, China could invest anything between US$313 billion and US$502 billion in the nations over the next five years.

VPower grew from being a seller of backup generators to factories on the mainland two decades ago into one of the largest natural gas-fired, engine-based power station owners in Southeast Asia.

Last year it inked a five-year deal with business partner CRRC, under which the state-backed train maker will help VPower procure engines for power projects at a cheaper price and at better payment terms than direct purchases by VPower.

In the past five years, VPower has build 507 mega-watts of small-scale diesel and natural gas-fired power plants in Indonesia, Bangladesh and Myanmar, where power generation has been unable to keep up with the energy demands of the fast-growing economies.

Although many state-backed firms in the industry have more resources than Hong Kong firms, they have to go through cumbersome project initiation and pre-approval procedures before they can draw resources to do risk assessments

Au-yeung said VPower aims to invest in 400-500 MW of new projects this year, of which at least 200 MW will be greenfield projects, and the rest potential acquisitions.

VPower earlier this month said it had extended a three-year, US$30 million loan to the developer of an 80 MW oil-fired power plant in Peru, which it can convert into shares equivalent to at least a 51 per cent stake in the project.

It late March, it also revealed a preliminary agreement with Citic Pacific, a unit of Citic Ltd, to jointly explore potential acquisition deals in clean and renewable power projects, co-develop natural gas-fired power stations in Southeast Asia, and form a joint venture to invest in power projects in nations covered by the Belt and Road.

Citic is in talks to invest and build a major port-cum-industrial park project in Myanmar.

“We are looking at execution in a matter of months, not years, with concrete results within the year,” said Au-yeung, asked when a formal deal with Citic may be signed.

VPower shares have surged 46 per cent since it unveiled the preliminary agreement with Citic, closing last Friday at HK$4.99. It debuted in the Hong Kong bourse at HK$2.88 last November.

BOCI, one of VPower’s two listing joint sponsors, said in a report that news of the potential cooperation with Citic, which owns 8 per cent of VPower, would help stabilise the latter’s share price after the May 24 expiry of a six-month shares sale moratorium on controlling shareholders that own 70.6 per cent of VPower.