Tencent outspent Baidu, Alibaba in tech mergers and acquisitions

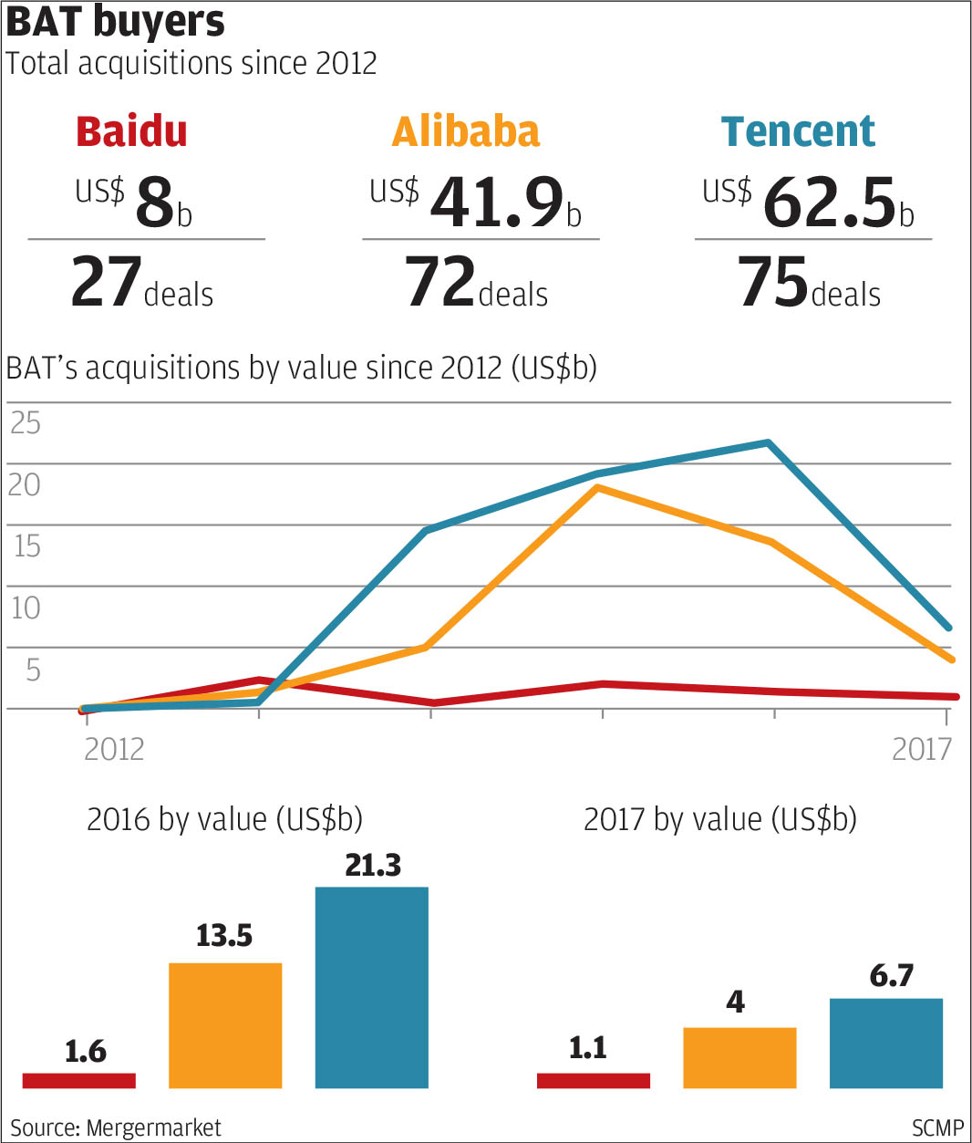

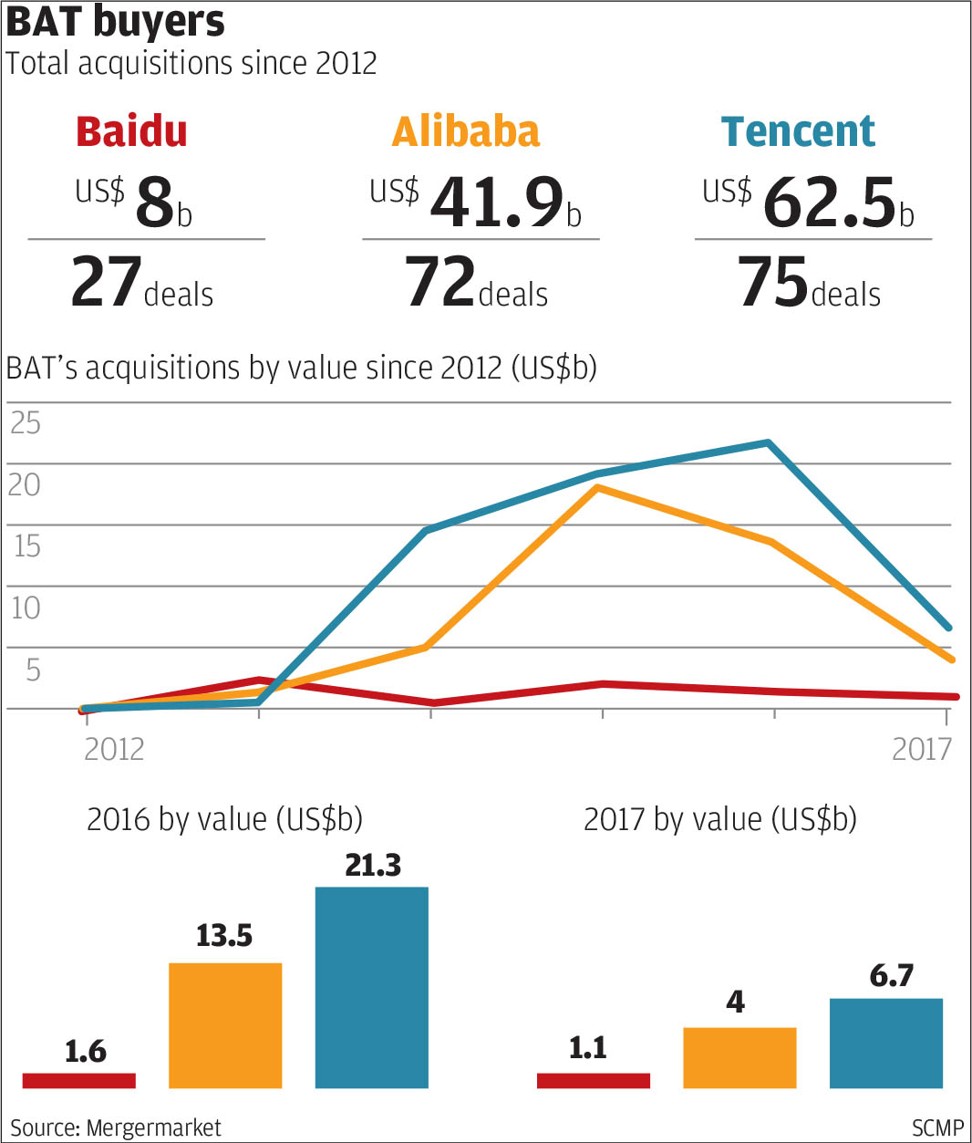

China’s biggest operator of mobile games and social network has spent US$62.5 billion since 2012 in acquisitions, outspending Baidu and Alibaba.

Chinese internet giant Tencent Holdings has surged ahead of rivals Baidu and Alibaba Group Holding in terms of acquisitions, with total spending of US$6.7 billion at the end of May, as the company seeks to cement its position as a leader in the global gaming industry.

Shenzhen-based Tencent is also the biggest spender among the mainland’s three biggest technology companies – often referred to collectively as BAT – over the past five years, splashing out US$62.5 billion since 2012, according to data from market intelligence firm Mergermarket.

Its largest deal within the last year was the purchase of an 84.3 per cent stake in Finnish mobile game company Supercell Oy, valued at US$8.6 billion.

Baidu lagged behind, with just US$8 billion in mergers and acquisitions since 2012, eight times less than Tencent. This year, it has spent only about US$1.1 billion on deals.

Most of Baidu’s investments fit within its current business portfolio, according to Mergermarket, whereas Alibaba and Tencent tend to seek opportunities in new areas.

Baidu, the mainland's dominant internet search service, recorded its largest investment in 2013 when it paid US$1.85 billion for the mobile app store 91 Wireless, one of the largest app distribution platforms in China, and previously owned by Hong Kong-listed NetDragon Websoft.

There is no sign that Tencent will slow down its steps in overseas gaming acquisitions

“Baidu’s acquisition of 91 Wireless shows its determination in moving from being a dominant PC platform towards becoming a mobile platform,” said Kitty Fok, managing director at market research firm IDC China.

E-commerce juggernaut Alibaba has spent US$41.9 billion since 2012, with its investments being the most varied of the three dominant online players.

New York-listed Alibaba has investments ranging from finance, sport and health to entertainment and commercial retail. Last year, it even made its biggest foray into the newspaper industry when it bought the South China Morning Post.

“Alibaba’s M&A landscape is incomparably broad among the three. [It has] quickly built up footprints in almost all the rising sectors in China, mainly through M&A,” said Wang.

As of May this year, Alibaba has splashed out US$4 billion in deals, Mergermarket said.

Its largest deal to date was its US$4.6 billion investment in Chinese electronics retailer Suning as part of its effort to integrate online and brick-and-mortar shopping.

While Chinese technology companies may have gained a reputation for replicating each others’ technology instead of investing in or acquiring start-ups in the past, Fok said that this trend was changing.

The BAT companies need to acquire companies that have the technologies they are targeting. If they were to develop their own technologies from scratch, they would not be adapting fast enough

Companies such as Alibaba and Tencent find themselves involved in more mergers and acquisitions deals to move faster in adapting to consumers’ rapidly changing habits.

“There are over 410 million digital natives in China today, and the generation born after the 1990s have also entered the Chinese workforce,” IDC's Fok said. “Their ability to spend and the way they make purchases are different from the previous generations.

“For the BAT companies to keep up with them, they need to move fast and the way they can do this is to acquire companies that have the technologies they are targeting. If they were to develop their own technologies from scratch, they would not be adapting fast enough.”

Overseas mergers and acquisition deals have also increased as Alibaba and Tencent, in particular, intensify international business expansion.

Last year, Alibaba invested US$1 billion in Singapore-based e-commerce company Lazada Group, which has operations in Malaysia, Singapore, Indonesia, Philippines, Thailand and Vietnam.