Mainland appetite fuels ninefold growth in Hong Kong’s insurance sector in 20 years

Acquisitive mainland firms see Hong Kong-based insurance companies as a short cut to entering the city’s financial services sector

The insurance sector in Hong Kong has expanded ninefold over the past two decades, when measured by value of premiums, thanks to a mainland buying spree targeting life insurance products and the companies selling them.

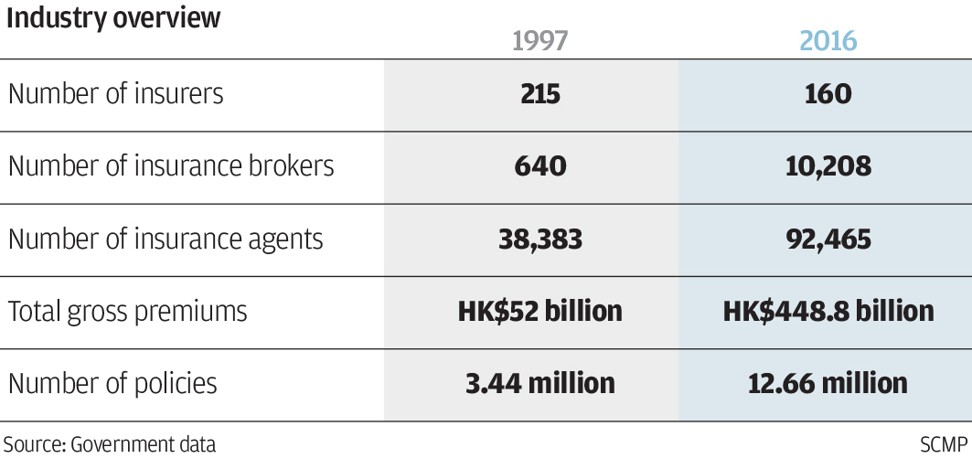

The gross value of insurance policy premiums in 2016 stood at HK$448.8 billion (US$57.55 billion), up 763 per cent from HK$52 billion in 1997, according to government statistics.

The number of policies had more than tripled in the same period, to 12.66 million last year from 3.4 million 20 years ago. And the number of sales agents in Hong Kong had also grown, by 141 per cent to 92,465 last year from 38,383 in 1997, when the territory was handed back to China by the British government.

“The growth of the insurance industry in the past 20 years has been because of economic development and the fact people are more concerned about insurance protection for themselves and for their families. It is also due to mainlanders who like to buy insurance products here because there is a greater choice of products and they tend to offer more attractive returns,” said Peter Tam, chief executive of the Hong Kong Federation of Insurers.

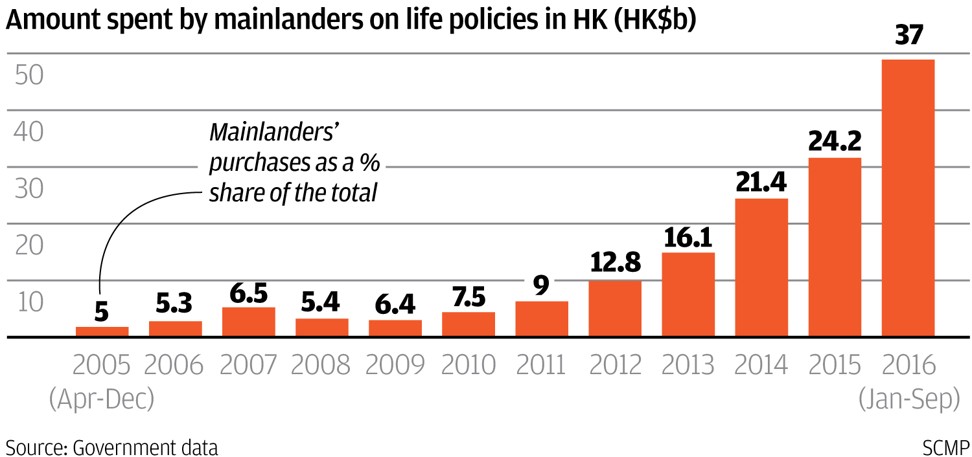

Mainlanders spent HK$48.9 billion buying policies in Hong Kong during the first nine months of last year, the latest available data from the government, representing 37 per cent of all life policies sold. That’s 26 times higher than the HK$1.8 billion they purchased in the nine months from April to December 2005, when the data was first published.

“Mainlanders also like to buy policies here as the insurance products offer a wider investment choice globally, and tend to offer better returns than the mainland insurance products, which are more restricted,” Chan said.

The growth of the industry has made Hong Kong-based insurers look attractive and that has led to a wave of mainland investors buying into the city’s insurance firms in recent years. Of the 21 proposed takeovers of Hong Kong insurers worth at least US$4 billion in the past three years, nine have been led by mainland companies, according to data from Thomson Reuters.

“Hong Kong has a broad range of financial firms, from life insurance and general insurance providers to securities brokers and banks. By taking over Hong Kong insurance companies, banks and broking firms, mainland companies find it easier to obtain the licences they need to conduct a wider range of financial services,” she said.

Koo said this trend is likely to continue, as Chinese companies increasingly look to expand their businesses into overseas markets.

“When Chinese firms want to go abroad, companies in Hong Kong are a natural choice because the city is close to the mainland, and the management team can understand the Chinese language and culture. This makes it easier to integrate the businesses after a merger,” Koo said.

“The returns on the Hong Kong insurance market are reasonable and growth has been strong recently, largely driven by mainland-related business coming to Hong Kong,” Pogson said.

The city is also outside the capital controls that apply to mainland China. Insurers can enjoy the freedom of creating an investment portfolio that consists of a diverse range of global assets and different currencies, which Pogson said would ensure mainland investors keep buying into Hong Kong insurers.