Beijing’s curbs on M&A deals will prevent ‘wrong deals’ but that’s good for the long term, says EY

Beijing’s tough measures to curb capital outflows have slowed down approvals of deals to acquire overseas assets but this will be positive for Chinese companies’ outbound M&A in the long run, according to EY China chairman Albert Ng Kong-ping.

“Proper controls are necessary to prevent some mainland firms from making the wrong deals or taking a risk that is too high,” Ng told the South China Morning Post in an exclusive interview in Dalian during the World Economic Forum on Wednesday.

“Before the control measures were in place, it was very easy for mainland companies to get approval to take money out for their overseas acquisitions. Some small firms were buying overseas companies that were too big for them to manage. Some are buying into businesses that are nothing to do with their core business. These deals were too aggressive and may bring a risk too high to these companies,” Ng said.

The days of easy deals are now over with all overseas acquisitions now facing tougher scrutiny. The crackdown came after China’s currency regulator in November imposed stricter scrutiny of overseas payments exceeding US$5 million, and banned deals of more than US$1 billion that were deemed to be “outside the investor’s core business”, according to regulatory documents.

The imposition of such controls was partly in response to capital outflows last year. The yuan’s 7 per cent depreciation against the US dollar last year spurred many mainland companies to go on an overseas shopping spree so they could park their currency offshore as a hedge.

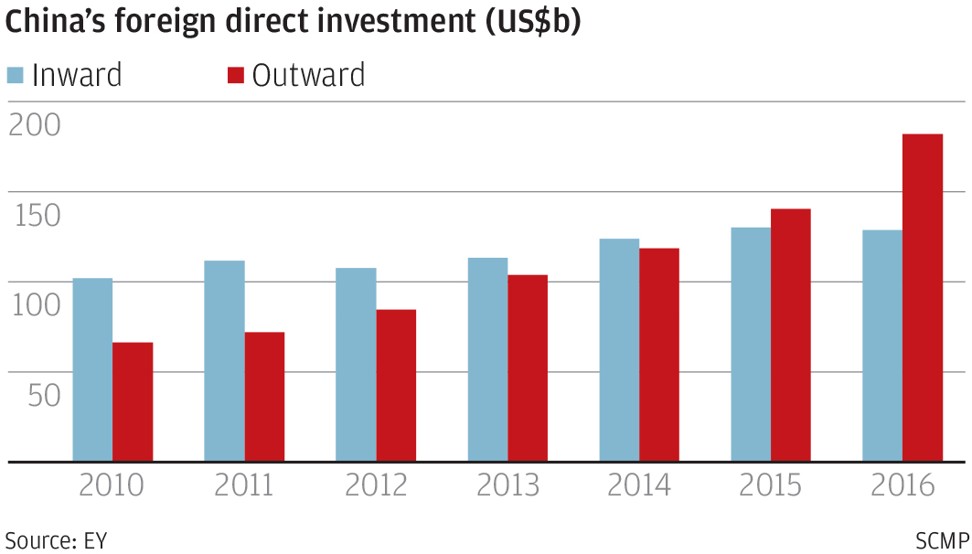

In 2016, Chinese enterprises announced 622 overseas M&As, totalling US$221.7 billion, up 147 per cent year on year. The amount is six times more than 10 years ago, according to EY data.

Ng said the number of deals may slow down this year as a result of the extra scrutiny to stop some excessively aggressive deals.

“It is true that mainland companies wanting to buy overseas companies now need a longer period of time and more documentation in order to seek approval to transfer funds outside of the country to pay for their acquisitions,” Ng said.

“The delay however is not unreasonably long. I’m talking about weeks and not months for them to get approval. The longer approval time was mainly due to the need for companies to hand in more documentation and to answer more questions about the nature of their deals. For those companies able to prove their deals are for their expansion and not an excuse to take money out of the country, they could get approval,” he said.

“Now, we are talking about state and private firms going global,” said Ng. “Their shopping list is so long that it includes fintech, finance, entertainment, tourism, education, medical and others. The trend is going to continue as Chinese companies have the financial ability to buy while they also want to expand their business by acquisition,” he said.

The challenge, Ng added, was not in making a deal but the management issues after the acquisition.

“There are many mainland firms that do not have the experience and talent to manage these newly acquired overseas businesses. Hong Kong financial and accounting professionals may be in a good position to help with this cross border management,” he said.

EY is a strategic partner for the three-day World Economic Forum which kicked off in Dalian on Tuesday. The event has attracted more than 2,000 participants from around the world to discuss technology trends and the economic outlook for the mainland and other markets.