The US bond market bull is at a major inflection point

‘Potentially bloated by irrational exuberance and speculative overindulgence, the bond market stands in grave danger of a major correction’

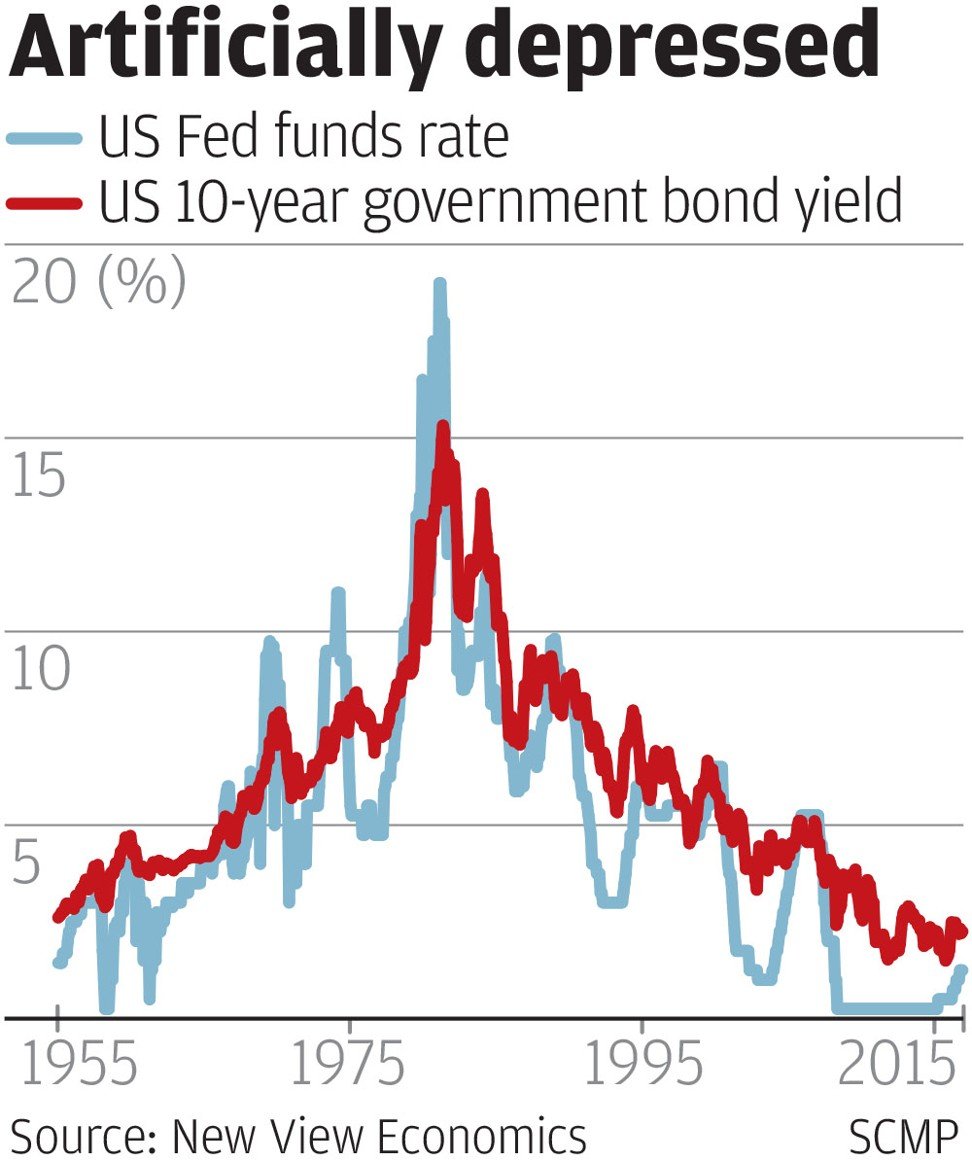

Everything in life has its consequence and the world of business is no exception. Over the last decade, the world’s central banks have applied brute force to push global interest rates down towards zero, so they should hardly be surprised that rates and yields look set to surge now the process is going into reverse. The great global monetary bonanza is over and there will be a cost to pay.

We already know zero interest rate policy and quantitative easing (QE) – the process by which central banks buy government debt and then print money – is almost over. The only issue markets remain unsure about is timing and magnitude. In the last week, the US Federal Reserve has thrown some more light on the process of tighter money in coming months, but markets are still in the dark about what it means for the cost of money in the economy and its impact on short and long term market yields.

The Fed was extremely gung-ho leaping headlong into explosive balance sheet expansion after the 2008 financial crash, but its past devil-may-care attitude is now much more guarded, leaving markets stumped about what happens next. The Fed is under pressure to divest its US$4.3 trillion hoard of QE assets, a massive headache for the US Treasury market’s most dominant player, but an even bigger nightmare for global investors and traders.

With the best will in the world, there must be consequences in the shape of market interest rates and yields bouncing higher over the future. The Fed might like to think it can walk on water and unwind a near decade’s worth of bond purchases without a whimper, but market dynamics tell a different story.

The transition from quantitative easing to balance sheet normalisation means a reversal of past bond market fundamentals. Where demand for bonds outstripped supply under QE, future treasury supply could easily swamp market demand. Weaker prices and rising yields will take the strain, although the Fed hopes to dampen the effect by carefully rationing the net future flow of treasuries returning to market.

Starting next month, the Fed intends to begin gradually unwinding its bond portfolio, limited to around US$10 billion a month in the first instance, with the aim of cutting US$1 trillion or more off holdings in the next few years. The Fed hopes a slow-drip feed of returning bonds should do little to undermine market sentiment.

In a perfect world this might be possible, but the Fed is dealing with a much more imperfect market, riddled with a confusing array of conflicting factors. Worries about slower US growth, the failure of President Trump’s stimulus package to lift off, underlying deflation niggles and latent fears of a stock market stumble could add up to a more bond-positive picture ahead.

But as the Fed switches from net buyer to net seller, there must be a definite downward tilt in bond market psychology. Potentially bloated by irrational exuberance and speculative overindulgence, the bond market stands in grave danger of a major correction. It all rests on how hard the Fed pushes. If the Fed pushes too hard, the upward drift on rates could turn into a horror show.

The speed of transition from ultra-easy to neutral policy holds the key. Judging by the Fed’s own interest rate assumptions, steady seems the watchword. The Fed’s interest rate outlook assumes one more quarter-point rate rise to 1.50 per cent by year-end. Three further quarter point rises are envisioned next year, two increases pencilled in for 2019 and one further implied in 2020, taking the Fed funds target to 3 per cent. It seems a gentle ascent, nothing untoward.

Maintaining future economic stability remains the overriding concern, especially since the Fed has downgraded its estimate for the long term neutral interest rate from 3.0 per cent to 2.75 per cent reflecting reservations about future economic vitality. Clearly, the Fed is also paying some lip service to US inflation pressures failing to surface so far.

Critically, it boils down to a major balancing act for the Fed in the months ahead, maintaining US economic needs on one side, while normalising policy from very dystopian monetary conditions on the other.

If the Fed gets it wrong and fails to get the proper inflation fighting message across, the bond market could bolt. As a result, 10-year US bond yields could quickly resurge to pre-crisis levels above 5.0 per cent leaving the market in tumult.

David Brown is the chief executive of New View Economics