Will Lufax’s stock sale in April help Hong Kong in its race for the IPO crown?

At US$60 billion, Lufax is set to become China’s second most valuable fintech company, only after Alibaba affiliate Ant Financial, which was previously estimated to be worth US$75 billion

Hong Kong is set for its second heavyweight fintech flotation in less than seven months, as China’s largest online wealth management platform lines up a listing in the city in April, which experts now hope will do wonders to act as a magnet for other blockbuster tech and internet firms to choose to list here in 2018.

Set up by Ping An Insurance Group in 2011, Shanghai-based Lufax – its full name is Shanghai Lujiazui International Financial Asset Exchange – plans to file an application with the Hong Kong exchange at the end of this month and is looking for a valuation of around US$60 billion, according to sources close to the company. That’s a threefold increase from US$18.5 billion after its last funding round in 2016.

At US$60 billion, Lufax is set to become China’s second-most valuable fintech company, only after Alibaba’s affiliate Ant Financial. Ant Financial was valued at US$75 billion by CLSA in 2016.

While Lufax’s bankers and advisers are still discussing how many shares to sell, initial expectations are for around 10 to 15 per cent of its valuation, one of the sources said.

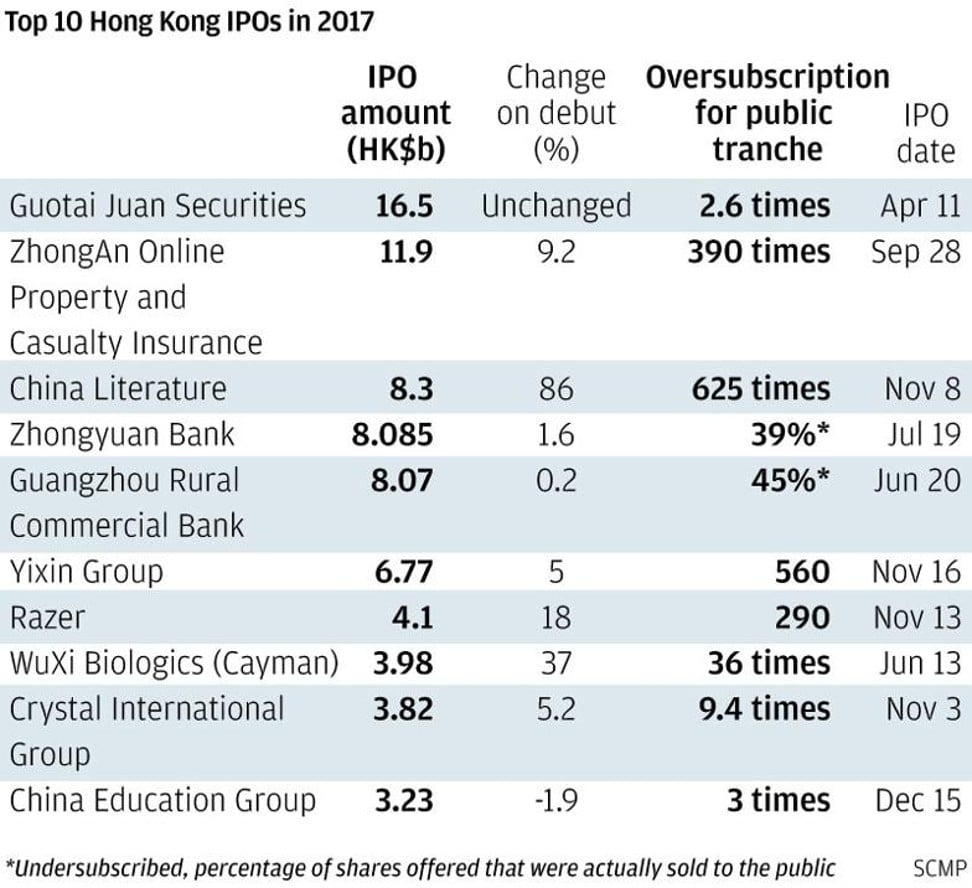

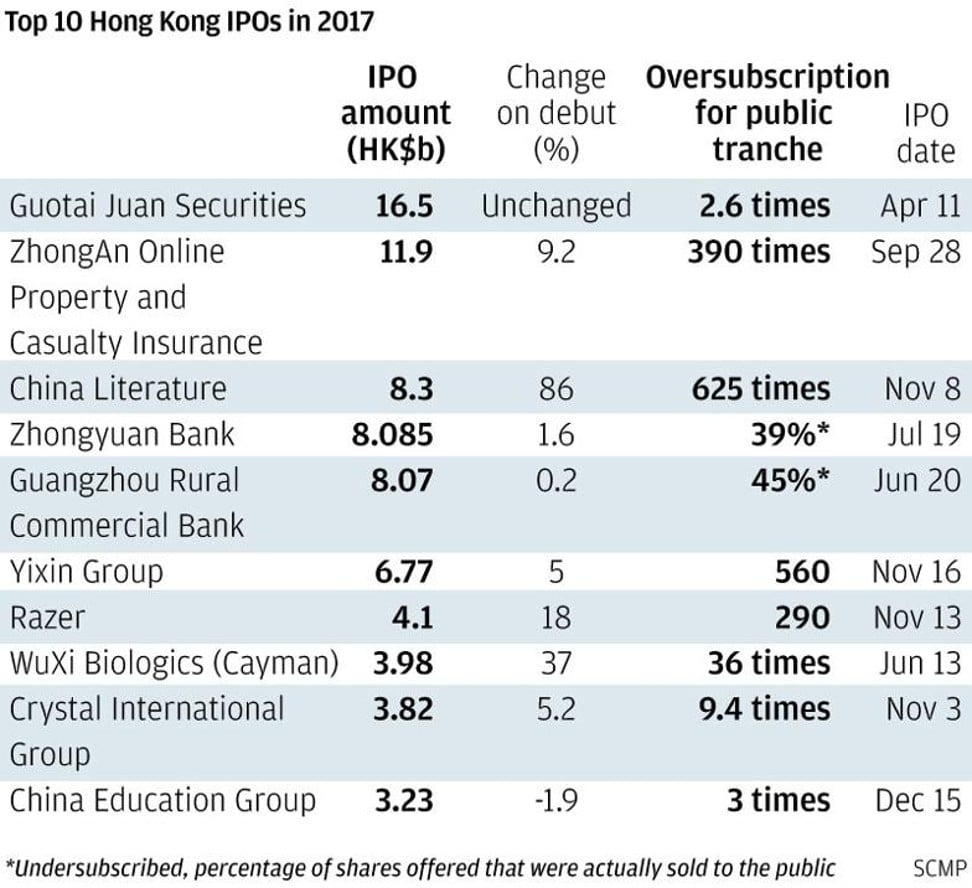

That would make it Hong Kong’s first major fintech listing since ZhongAn Online Property & Casualty Insurance raised US$1.5 billion in its Hong Kong debut back in September, which valued the insurtech firm at US$13 billion – considered back then by many in the market as a huge fish to land.

ZhongAn’s co-founders include Alibaba’s Jack Ma Yun, Tencent’s Pony Ma Huateng, and Ping An’s Peter Ma Mingzhe.

Officials at Hong Kong Exchanges & Clearing (HKEX) have made no secret of the fact that they see technology companies of all sizes as their main target for new listings this year.

And so with the mouth-watering amounts expected to be raised by the likes of Xiaomi, Tencent Music and Baidu’s video streaming site iQiyi through IPO later in the year, HKEX is expected to be pulling out all the stops to attract them to Hong Kong – most likely putting it head-to-head with New York.

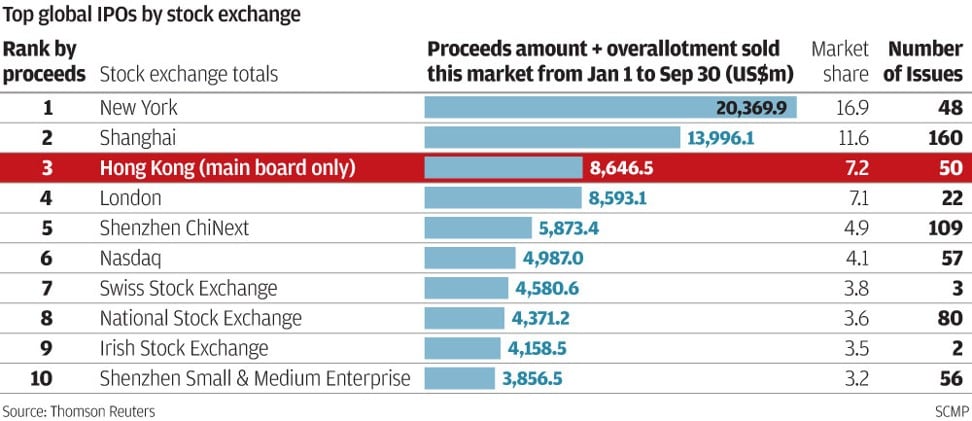

The Lufax listing in April comes just months after Hong Kong lost its much-coveted crown to New York for the first time in three years, as the world’s biggest fundraising hub, and it even slipped behind Shanghai for the first time ever.

Hong Kong’s IPO value for 2017 dropped to the lowest since 2012 to US$16.3 billion, compared with US$49.5 billion in the US and US$31.7 billion in China, according to data from Dealogic.

The fact Lufax is based in Shanghai’s Lujiazui financial district, but still chose to list in Hong Kong has made the win all the sweeter.

Lufax has two main lines of business: wealth management focusing on “the middle class and affluent” clients, and also lending for “the mass market”, according to a document obtained by the South China Morning Post.

Its middle-class investors are defined as those with assets under managements (AUM) of between US$4,500 and US$150,000, while its affluent clients are those with more than US$150,000.

Around two-thirds of Lufax’s total AUM are from investors with more than US$75,000, the document shows.

It has 33 million registered users and manages assets worth nearly 500 billion yuan (US$77.3 billion).

Citic Securities, Citi, JP Morgan, Morgan Stanley, and Goldman Sachs are acting as co-sponsors on the deal.

Lufax says it has built its own “risk management models” to mitigate risk. The models were developed using more than 12 years of data on consumers’ credit, spending and other online behaviour, the document shows.

It has also applied new technologies, such as artificial intelligence and big data, to control risk and improve customer experience, the document claims.

For instance, the firm uses facial recognition, voice registration, and remote video interviews to authenticate identities.

Lufax has promoted itself as a “first mover in providing financial solutions for institutions and governments”, hoping to become the leader in China’s budding “WealthTech” sector, and the largest non-bank consumer lender, according to the document.

Xiaomi, the privately owned Chinese smartphone maker, has been in talks with investment banks for a possible IPO as soon as this year, with some banks saying that a US$100 billion IPO would be reasonable. Morgan Stanley, Goldman Sachs, Credit Suisse Group and Deutsche Bank were among the international banks selected to work on Xiaomi’s IPO, its timing and location to be decided, Bloomberg reported, citing a person with direct knowledge of the matter.

That compares with a valuation of US$46 billion at its most recent funding round in 2014, and media reports suggest Hong Kong and New York are fighting it out to host the listing, which would be a massive win for either.

A float of that size would be the third-largest technology IPO in history, surpassing Snap’s US$24 billion listing last March.

Alibaba Group Holding, which owns the South China Morning Post, and Facebook rank first and second with valuations of US$167 billion and US$104 billion, respectively, when they were listed in 2014 and 2012 in New York. Alibaba raised US$25 billion, but there was some bitterness at the time that it had not chosen Hong Kong.

Separately, Tencent Music, the music streaming unit of Tencent Holdings, has also invited investment banks to handle its planned listing in 2018, which could value the unit at US$10 billion, Bloomberg reported recently, citing unnamed sources.

Other potential fintech IPOs of 2018 could include Lufax’s rival Dianrong.com, backed by Singapore’s GIC, which is considering a Hong Kong listing to raise at least US$500 million, as well as Hong Kong’s online finance lending platform WeLab, with a possible listing size of US$500 million.

Baidu’s iQiyi is aiming for a 2018 IPO in New York, valued at up to US$10 billion, according to reports.

Hong Kong’s2017 fundraising by technology and internet companies was encouraging, with five of its 10 largest IPOs by companies operating in the new economy, compared with none in 2016.

Listings by banks and securities companies – staples of Hong Kong’s capital market – halved to 30 per cent of 2017’s top IPOs, from 60 per cent the previous year, in line with regulators’ goals to draw more new economy companies to float here.

The Hong Kong stock exchange said in December it would propose rule changes to allow dual-class shares on the main board, with a formal public consultation to be launched as early as the first quarter of 2018. The overhaul in listing regulations has been described as the city’s most drastic in three decades.