AgBank plans US$16.8b recapitalisation drive alongside China banking regulatory move

Agricultural Bank of China times its move with regulators’ plans to allow banks more ways to replenish their capital

The Agricultural Bank of China, the least capitalised of the country’s five top lenders, announced the biggest replenishment of capital by a Chinese company with its 100 billion yuan (US$15.8 billion) stock sale, the same day the regulator cleared the way for financial institutions to use new methods for raising funds.

AgBank said in a stock exchange filing late on Monday that it plans to sell up to 27.5 billion shares to seven major institutions, including the Finance Ministry, Central Huijin Investment and China National Tobacco Corp, a move that will help shore up its tier 1 capital and boost capital adequacy.

China’s third-largest lender announced the plan soon after the nation’s top five financial regulators posted a joint statement, noting that they will give commercial banks more leeway to replenish capital by way of more tools, channels and markets, investor eligibility and fewer red tape.

The statement was jointly released by the central bank, the top regulators of banking, insurance, securities and foreign exchange on the China Banking Regulatory Commission (CBRC) website on Monday, but backdated to January 18.

The measures are not in isolation, analysts said, as they reflectBeijing’s aim to alleviate capital pressures on commercial banks and defuse financial risks by trimming leverage levels and clearing irregularities, which are driving off-balance sheet assets back onto banks’ books and put pressure on banks’ capital.

“The joint notice comes as part of a policy framework, flagging that more detailed measures on capital strengthening for banks is likely on the way,” said Zhao Yarui, a senior researcher at Bank of Communications in Shanghai. “Banks are under increasing pressure to boost capital as the financial clean-up measures are driving shadow banking back on to their balance sheets.”

Even before Monday’s statement, measures to this effect were already under way.

On February 27, the People’s Bank of China loosened rules for banks to issue bonds for capital replenishment, including issuing perpetual bonds aimed at “helping banks better absorb capital losses and better protect investors’ rights”.

The joint notice comes as part of a policy framework, flagging that more detailed measures on capital strengthening for banks is likely on the way

A perpetual bond is a fixed-income security with no maturity date, a niche product in the bond market.

The PBOC notice said banks were encouraged to issue “innovative loss-absorbing capital replenishment bonds”, though banks should be cautious in formulating plans to issue such bonds.

The central bank also allowed the bond issuer to it write-off or convert them into equity under certain conditions.

The International Monetary Fund said in December that Chinese banks should increase their capital buffers to protect against any sudden economic downturn following a credit boom.

UBS analysts estimated in January that Chinese banks had already raised 861 billion yuan in new capital between 2014 and 2017 – mostly via private placements by unlisted banks.

“You have to see them as part of the bigger picture – the deleverage and de-risk drive,” said Yang Yue, a banking analyst from China Zheshang Bank. “The measures are closely related as they translate into improving capital strength of banks and backing up their banking activities to support the real economy.”

Analysts with Fitch Ratings also agreed that the recent flurry of moves adopted by regulators were meant to offset the capital pressures brought by China’s deleveraging campaign.

“Strict supervision of shadow banking and interbank operations are pushing loan back on to the banks’ balance sheet, not only consuming banks’ capital, but also dragging down profits. In the next few years, the scale of asset transfer by some banks may be very large, which restricts their ability to lend. The latest measures seem to be intended to provide partial solutions to this problem,” the report said.

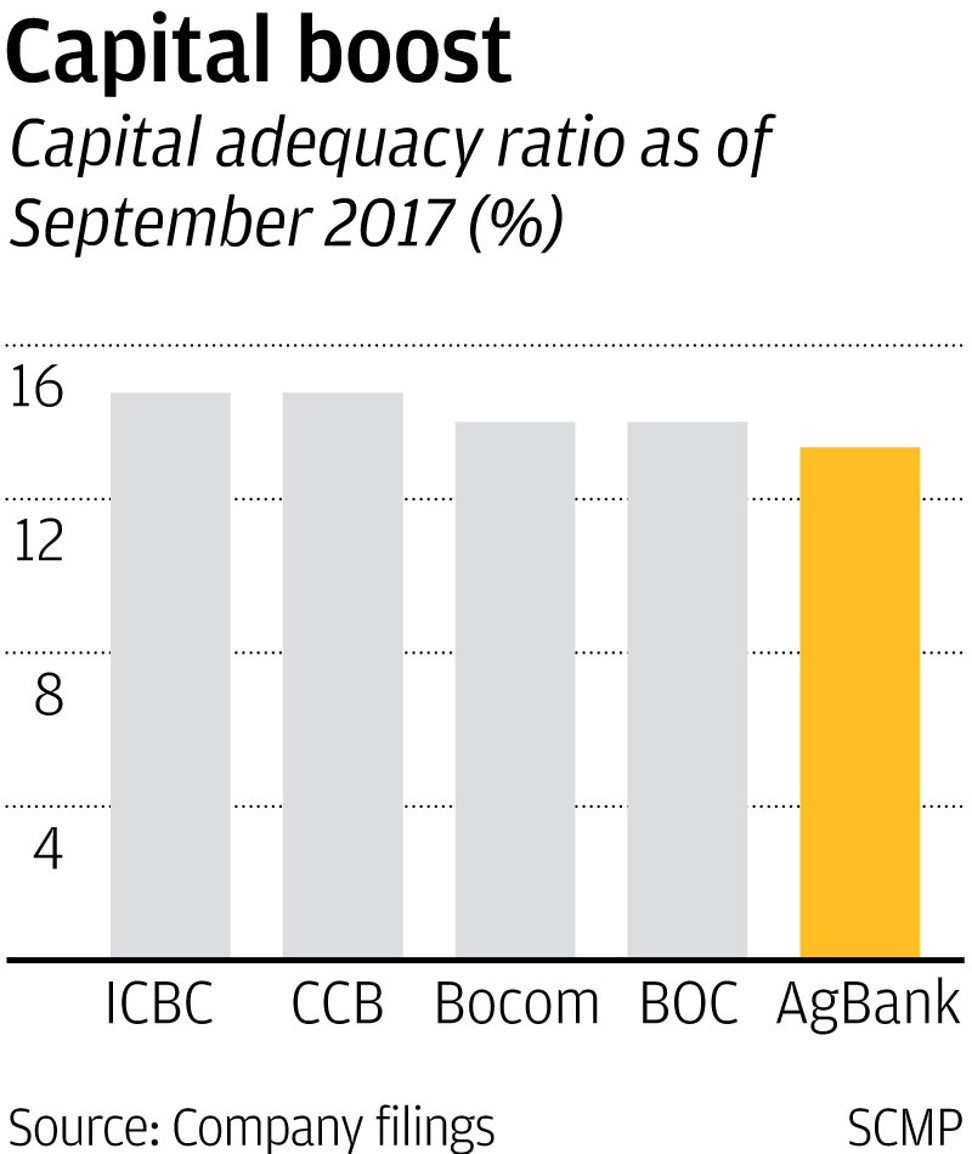

The regulator requires “systematically important” banks, including the big-four lenders, to meet a minimum capital adequacy ratio of 11.5 per cent, while smaller banks must have a ratio of 10.5 per cent this year.

In China, the industry average sat at 13.65 per cent at the end of 2017, still comfortable for now.

The measures act more like precautions, granting banks more space to cope with possible increases in capital pressure, analysts said.

CBRC chairman Guo Shuqing said on Friday that curbing leverage levels held the key to tackling financial risk, one of President Xi Jinping’s top three priorities for the next three years.

The regulator will also continue to tackle risks created in the shadow banking sector – including banks’ wealth management products, interbank activities and off-balance sheet business – and ramp up its scrutiny of trust companies and internet financing, Guo said.

For AgBank, the private placement came as a shot in the arm for its shares on Tuesday, rising 5.4 per cent to HK$4.71 in Hong Kong and 2.5 per cent in Shanghai to 4.13 yuan.

The other big four state-owned banks are unlikely to follow suit, analysts said.

The private placement is an example of “bolstering areas of weakness” supported by large shareholders but not the start of a new wave of common equity raising, said Shujin Chen, an analyst with Huatai Financials, adding that other major H-share listed banks have already announced or completed their common equity raising plan in the past year.