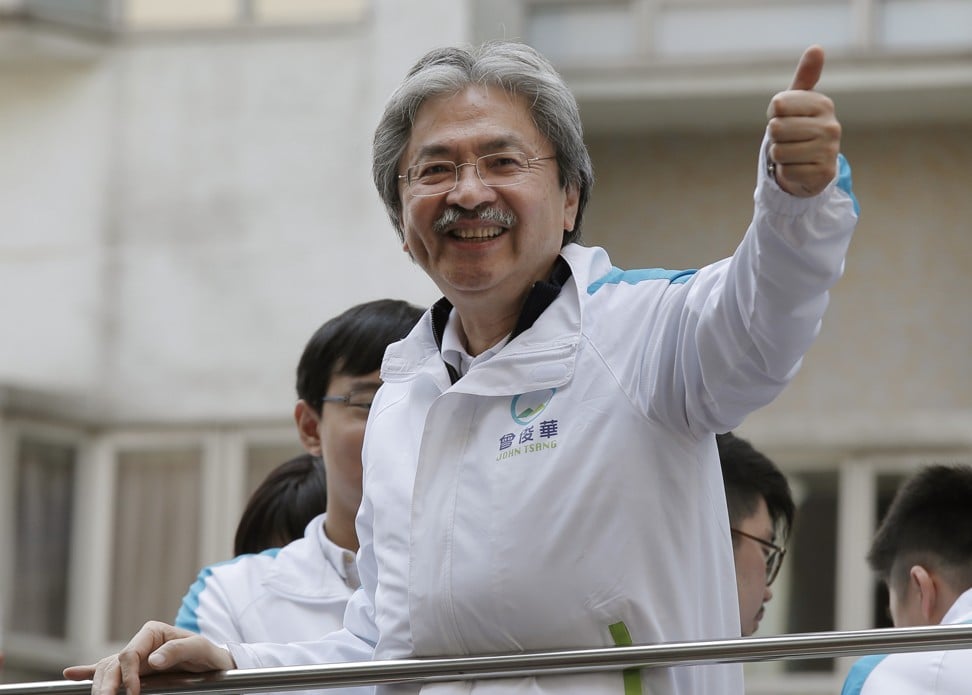

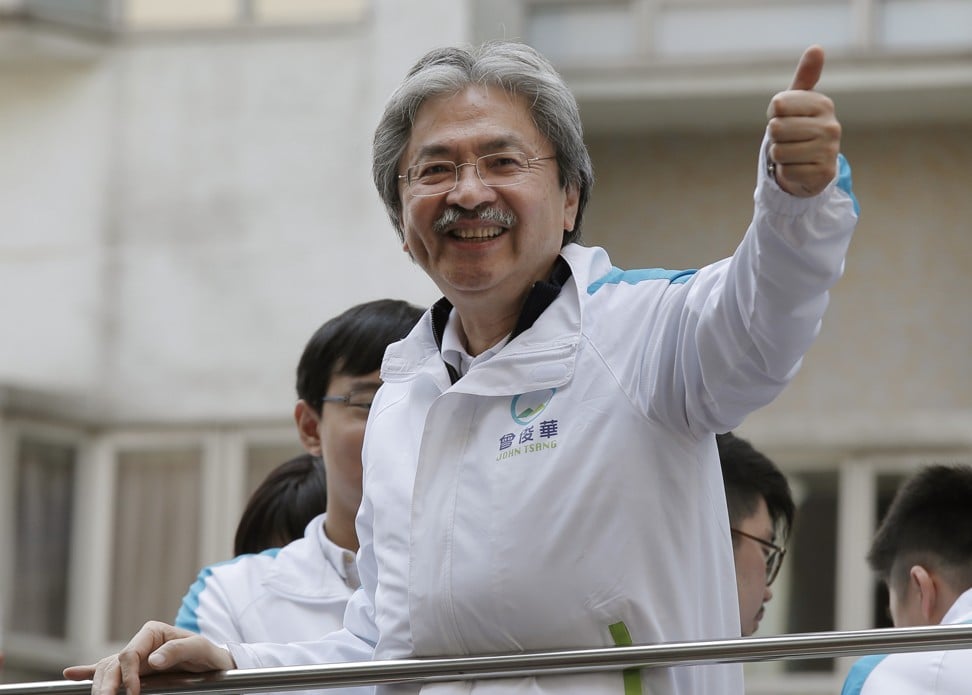

In second bet on fintech, former Hong Kong financial secretary John Tsang backs identification project

Technology that uses telecommunications data ‘safer and better than current methods’

John Tsang Chun-wah, former Hong Kong financial secretary and chief executive aspirant in 2017, has embarked on a new chapter, one that he has promoted since his time in office – fintech investment.

He was last week named vice-chairman of Ion Pacific, a fintech focused merchant and investment bank, and is now poised to be appointed as chairman at BVL, a fintech company that has developed technology that lets merchants verify the identities of customers using the latter’s smartphone telecommunication data.

Tsang, who is also an investor in the company, believes the technology will help to promote e-commerce. “The BVL technology will be safer and better than current methods such as passwords, biometrics and facial recognition,” he said, adding that banks, merchants and telecommunications companies had shown interest in the technology.

While he did not disclose his investment, Tsang said the company was yet to generate revenue as it was still in the process of setting up. But BVL has completed the technology development stage and Tsang was in the process of approaching banks and merchants with the service.

Hong Kong-born and raised, Tsang is the city’s longest serving financial secretary. He held office for a decade until 2017 and guided the city through the 2008 global financial crisis. He resigned in late 2016 and ran for the post of Hong Kong chief executive in early 2017, eventually losing out to Carrie Lam Cheng Yuet-ngor.

When asked if he would run for chief executive again, Tsang said: “I will not look back, as I have already moved on to a new chapter – and fintech will be my new focus.”

Interestingly, it was during Tsang’s tenure as financial secretary that Alibaba Group Holding’s listing was lost to New York. Tsang said he does not regret not giving special preference to the e-commerce giant, as companies with dual-class shareholding structures where banned in Hong Kong at the time.

Alibaba, which owns the South China Morning Post, went public in 2014. Hong Kong as only just started allowing such companies to list here, after the city introduced its biggest listing reform in 25 years in April.

“What we have in Hong Kong is the rule of law, and a legal system that can’t be changed because of one company. We can’t move the goalposts,” said Tsang. “Someone said Hong Kong was conservative. Yes. Conservative is OK!”

He said money was not a reason for him to get involved in banking and fintech. “Hong Kong has always been a good integrator. For instance, Ion Pacific focuses on Israel and fintech projects that will bring technology, talent and projects to the city,” he said.

“Israel has a lot of technology projects, such as desalination. It will be good for Hong Kong to build links with Israel. China and the US have a lot of trade tension and it would be good if Hong Kong can build relations with more markets,” said Tsang.