Volatile yuan tires Hong Kong exporters out

PBOC's move to widen the currency's trading band adds to uncertainty in foreign trade

Danny Lau Tat-pong and fellow Hong Kong exporters in the Pearl River Delta say they are exhausted from handling gyrations in the yuan exchange rate recently.

The honorary chairman of the Hong Kong Small and Medium Enterprises Association, one of the city's biggest trade bodies with about 1,000 members, is hoping for a stable, or ideally weaker, yuan to survive summer trade.

However, the People's Bank of China said on March 15 that it would allow the yuan to trade up to 2 per cent above or below a reference rate that it set each day.

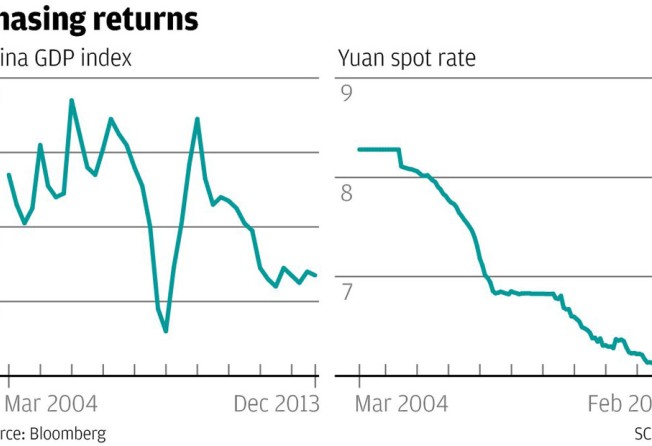

The yuan closed 1.2 per cent lower last week in the first week since its trading band was doubled, the biggest drop in prices on the China Foreign Exchange Trade System going back to 2007. The central bank lowered the daily fixing by 0.21 per cent last week to 6.1475 per US dollar on Friday, the weakest since November 6 last year.

The PBOC's decision to widen the trading band means a more volatile yuan and greater uncertainty in foreign trade, which in turn aggravates mainland policymakers' already difficult task in meeting this year's economic growth target of 7.5 per cent.

"Of course we want the yuan to depreciate," said Lau, also a Dongguan-based manufacturer of curtain wall for skyscrapers. "The currency has become very unstable recently, which is a big headache."

Stable trade, particularly a recovery in exports, was among several key factors that would help the mainland meet its growth target, economists said, with some also pointing to other factors such as growth in domestic consumption and investment.

Beijing has been facing growing pressure to unleash stimulus measures since revealing weaker-than-expected macroeconomic data this month.

Growth in industrial production and retail sales, fixed-asset investments and electricity consumption in the first two months of this year was disappointing, pointing to slower gross domestic product growth of about 7.5 per cent in the first quarter from 7.7 per cent in the fourth quarter of last year, according to HSBC global research.

HSBC blamed the poor data on a cocktail of factors - slowing home sales, the legacy of curbs on official extravagant spending and previous tightening of monetary policy.

Still, Premier Li Keqiang proclaimed his confidence in meeting the 7.5 per cent growth target this year without the aid of any short-term stimulus measures.

At the annual meeting of the National People's Congress in Beijing this month, Li said that if the mainland managed to achieve its target last year without resorting to short-term stimulus policy, "why can't we make it again this year?"

However, some economists say fresh stimulus is needed.

"The government's growth target may be tested," China International Capital Corp chief economist Peng Wensheng said. "With economic growth at risk of slipping below the government's target, policymakers face important challenges in how to strike a balance between supporting growth and adjusting economic structure."

UBS economist Wang Tao said ways to defend the 7.5 per cent growth target included higher fiscal spending, lowering the tax burden for service providers and small businesses and further weeding out red tape to spur private investment.

Allowing the yuan to depreciate modestly would make exporters' lives easier while relaxing credit policy or unwinding property tightening measures would give an immediate boost to the lacklustre economy, she added.

From the perspective of exporters such as Lau, a weaker yuan would throw them an immediate lifeline.

Lau said the PBOC's decision to widen the daily trading band of the yuan left the currency prone to greater volatility.

"We just changed our strategy last month by looking for more domestic customers so that we can have more yuan income," Lau said. "Now the yuan has abruptly come down, which does us no good. We are exhausted from chasing after yuan movements within such a short time."

Lau said feedback from some members of the association suggested that demand in the United States and Europe varied across industries, even though economists said the US and Europe were leading a recovery in the appetite for consumer goods.