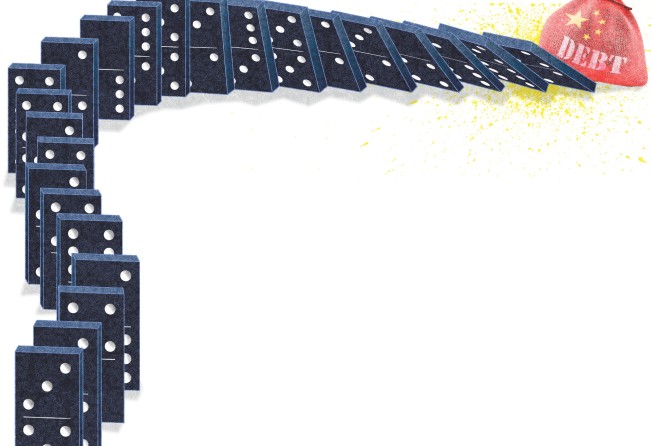

China’s debt dominoes could fall fast

Mainland debt points to crisis as profligacy of local governments sees public borrowing hit US$3 trillion

The game of dominoes was invented in mainland China in the 13th century and was brought by Italian merchants to Europe, where it became a great hit.

And that is precisely what happens when debt goes wrong.

We know from public, private and anecdotal sources that public debt levels on the mainland are very high. The big debts lie with local governments - there is a combined public debt of US$3 trillion, according to official data released at the start of this year.

Local governments borrowed heavily to build large public-sector infrastructure projects, only some of which were useful.

But in a roughly US$9.4 trillion economy, the question is whether debt at that level really poses a problem.

Only confidence in growth to service the debt will generate a recovery

Those that say there is no problem with debt in China are correctly of the opinion that if there is a debt crisis in China, Beijing will provide the bailout.

The great strength that the central government has in a command economy is the ability to manufacture confidence by quickly covering problems and creating liquidity.

However, the optimists also tend to point - wrongly - to China's US$4 trillion of foreign reserves as being available for a bailout.

Reserves do not equate to the domestic wealth of the country that is available for transfer. Real wealth is built from billions of profitable transactions between individuals and the consequent tax receipts, but that takes a good economy a long time to develop.

Sheer size leads to big numbers, but the mainland's modern economy is very young, and in parts it is still poor, verging on destitute.

Those that say there is a serious problem with debt in China point to the enormity of the numbers in the world's second-largest economy.

Analysts estimate total private and public debt on the mainland is close to 230 per cent of gross domestic product. The Greek economy collapsed in 2010 with debt at about 140 per cent of GDP.

The worriers believe that misreporting of debt to the Chinese financial regulators obscures the true levels and that banks only appear to be strong because they have hidden their most toxic debt in off-balance -sheet vehicles - a tool much loved by pre-crisis US banks.

Add in the rising amounts of unproductive capital invested in industries such as steel and coal, which have huge overcapacity, are run inefficiently, and are still being paid for by interest on debt fixed by the government and the problem looks worse.

A large shadow-banking sector has developed outside the regulatory system to trade money at market rates and now lends as much as the regulated sector.

To attract deposits, unrealistically high-yielding wealth management products have been sold in their billions to individuals. Is not such activity - outside of the highly regulated banking system - that which precipitated the Western global financial crisis?

There is no doubt that the government can support the country's current level of debt. There are few unruly international lenders on the mainland, and domestic state-owned banks will be instructed not to rush for the door - but the write-offs will be at great cost to the nation's balance sheet.

How fast will the central government act to assist profligate, bankrupt provincial governments that have been run into the ground by high-living local potentates?

Clearly the temptation will be to let them sweat. After all, the wealth of the nation belongs to the Chinese people; it is their inheritance, their legacy, and not to be frittered away covering corrupt officials.

If we do see anything less than seamless reporting of debt support, we will see nasty headlines, which will hurt the economy.

Imagine the scenario of a liquidity crunch in a big private property company leading to payment issues for a local government to a regional bank, which then defaults on wealth management products sold illegally to retail clients.

Bad news comes progressively - just like a fall of dominoes.

The gamble is whether economic growth will be fast enough to paper over the cracks. That is no different than it would be in Europe or the United States.

Only confidence in growth to service the debt will generate a recovery.

But when we are no longer relying on economics but on confidence itself - is that not as fragile as a line of dominoes?

Richard Harris has built investment businesses across Asia and is the founder of Port Shelter Investment Management in Hong Kong