New equity issuance in Hong Kong slumps to 11-year low in first half, while outlook remains uncertain

Equity fundraising in Hong Kong fell 77 per cent during the first half on year, hitting its lowest level in 11 years as the volatile market dampened investor appetite, according to Thomson Reuters data.

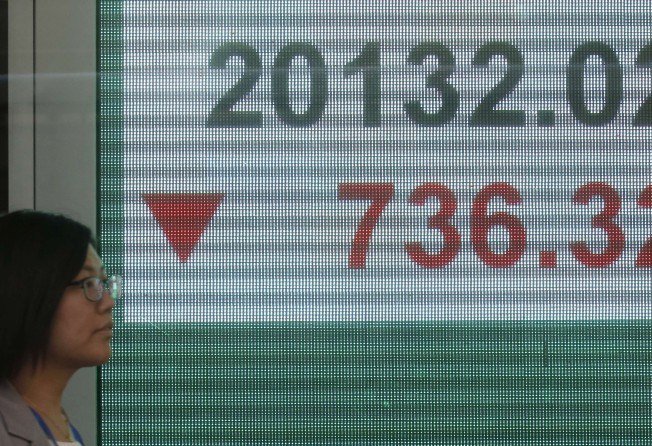

Brokers said volatile market conditions are set to continue, particularly after turmoil in the wake of the pro-Brexit referendum result, which sent shock waves across global markets, including Hong Kong where the Hang Seng Index was down nearly 1,000 points intraday on Friday. In currency markets, the pound sterling dived to its lowest against the US dollar in 31 years.

Still, Hong Kong remains on top of the global league tables in terms of initial public offerings, with 22 listings in the first half, raising a total of US$5.39 billion. Hong Kong outpaced the New York Stock Exchange which raised US$3.76 billion, while OMX Copenhagen trailed in third spot with US$3.53 billion. Shanghai ranked fifth with funds raised via IPOs of US$2.49 billion.

Total funds raised in the city’s stock market via IPOs, share placements, and right issues in the first half year stood at US$12.53 billion, down 77.1 per cent from the same period a year earlier, according to Thomson Reuters data. The result was the worst since 2005, which saw US$11.74 billion raised in the city.

“The weak stock market performance in the first half of this year has discouraged listing hopefuls from applying for IPOs, while listed companies did not seek to issue new shares as they may not be able to raise funds at a good price,” said Joesph Tong, chairman of Morton Securities.

“In addition, regulators have tightened the approval process for new listings in the first half after criticism of the quality of some new listings. This has also led to a downturn in new listings,” he said.

The Securities and Future Commission and Hong Kong Exchanges and Clearing last week issued a consultation paper to reform the listing regime. The proposed changes include setting up new committees to set listing policies and approve complicated listing applications. This follows a number of number of instances where newly-listed companies suffered financial problems shortly after their market debuts, while criticism was also directed towards the Growth Enterprise Market amid speculative trading related to back door listings.

“The regulator may have tightened the approval process too much. Over regulation would hurt the market development,” Tong said.

The Hang Seng Index is down 7.55 per cent year to date, adding to a 7.16 per cent decline last year. Average market turnover has shrunk to about HK$60 billion a day.

Louis Tse Ming-kwong, director of VC Brokerage, said fund raising in the second half would continue to be haunted by the political and economic fallout as the UK begins the process of unwinding its membership in the European Union.

“The Brexit affects global market sentiment and will discourage companies from listing. There are some mainland mega IPOs set to list in the coming months but then this will depend on global investment market sentiment. If international investors take a cautious approach in investing, it will be hard for mega IPOs,” Tse said.

A total of 34 companies successfully completed their IPOs in the first half, raising US$5.49 billion, compared to 50 listing which raised US$17.53 billion in the first half of last year. The result represents the worst IPO performance for the January through June period since 2013, when US$ 5.16 billion was raised.

China Zheshang Bank ranked as the largest IPO in the first half, raising US$1.94 billion, followed by BOC Aviation which raised US$1.13 billion. Among listed companies, PICC Property & Casualty ranked as the biggest in terms of supplemental share sales, successfully raising US$1.25 billion.

Tong hopes the second half of this year will show improvement, noting that equity markets could get a boost from the Hong Kong and Shenzhen Stock Connect, which may be announced as soon as July 1 and come into operation a few months later. Meanwhile, the likelihood of a further tightening in US interest rates appears to be diminished in the wake of recent data pointing to weakness in the US economy.

Issuance of yuan-denominated bonds issued, or dim sum bonds, in Hong Kong during the first half totalled US$7.31 billion, the lowest since the market was launched in 2010 and down 60 per cent from a year earlier. The decline was mainly due to the bumpy ride of the yuan against the US dollar over the past six months, which dampened investor interest in yuan products.

Mainland companies remained the major source of IPOs in Hong Kong, accounting for 67.7 per cent of the funds raised, while 21.1 per cent of companies were from Singapore, and 11.2 per cent from Hong Kong.

Haitong Securities led the first half year in underwriting in Hong Kong, with a 11.4 per cent share of the market, followed by Goldman Sachs at 7.8 per cent and China Construction Bank at 7.5 per cent.