Singapore is falling behind Hong Kong, just do the math

‘People in Hong Kong on average have US$29,000 each a year to spend on themselves while Singaporeans have only US$19,000, and the margin is growing rapidly in Hong Kong’s favour’

Yet, despite benefiting from the world’s biggest market in terms of population size as its hinterland, the gap between Hong Kong’s GDP per capita and that of Singapore has widened, and is predicted to be about US$30,000 this year. -- Letters to the editor, June 22

Why stop at US$30,000? I can easily make Singapore richer than Hong Kong by US$44,000 a year in gross domestic product per capita.

It’s simple. You divide the Singapore GDP figure by 3.4 million official Singapore citizens, ignoring the other 2.4 million inhabitants who are not thus deified, leave alone the uncounted labourers who come across the causeway from Johor every day and are not even counted as inhabitants.

You can also make Hong Kong richer by selective counting, but only fractionally.

These figures tell you that Singapore relies heavily on foreign labour. But there is more to the picture. What people don’t jump to tell you down there is that Singapore is also heavily owned by foreigners.

For every dollar of direct investment that Singaporeans have amassed abroad, foreigners have two dollars of direct investment in Singapore.

The figures for Hong Kong, although not exactly comparable and massively clouded by money laundering, roughly indicate the same ratio, but in Hong Kong’s favour.

The results of all the foreign ownership are clearly apparent from the Singapore GDP figures. Net exports are in surplus by the equivalent of 26 per cent of GDP and have run at such high figures for many years.

This is unusual. It can happen for a few years at a time but, in normal circumstances, people sooner or later take these winnings to spend on themselves or invest them in other sectors of the economy.

This is how it has happened in Singapore too, except that it’s the foreigners who have taken the winnings, taken them back home, leaving the Singapore cow to stay in constant surplus and be milked of yet more income tomorrow from their Singapore investments.

And if one component of GDP is skewed way out of line one way then another must be skewed way out of line another way. In Singapore’s case it is personal consumption expenditure, the money that ordinary Singaporeans have in their wallets and bank accounts to spend on themselves.

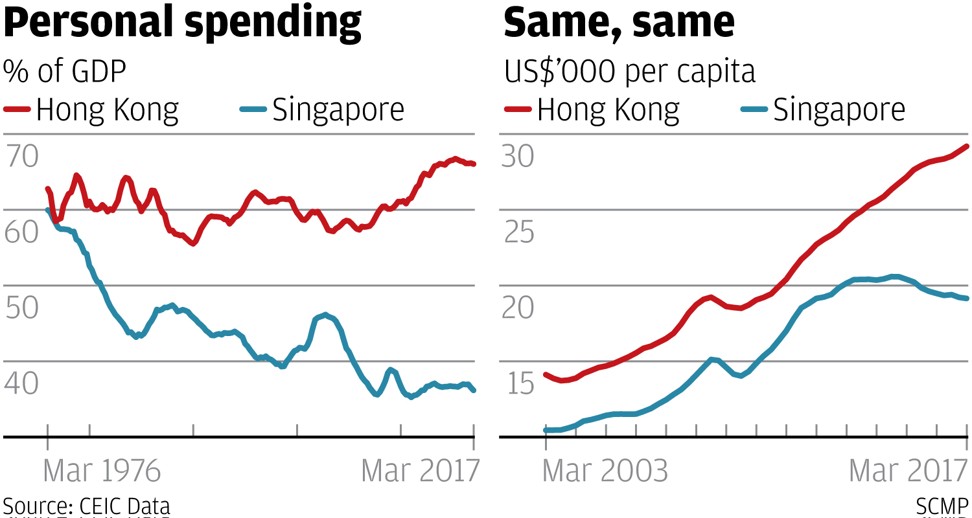

As the chart shows, 40 years ago, before Singapore sold so much of itself to foreigners, personal consumption expenditure was about the same in both Hong Kong and Singapore as a percentage of GDP.

Since then, the figure has edged up for Hong Kong to 66 per cent of GDP while in Singapore it has collapsed to only 36 per cent of GDP.

So now to the clincher. Take these figures for real wealth, the spendable-money- in-your-hands kind of wealth rather than the someone-has-milked-us-and-run-off-with-it kind of wealth, divide them by total population in each place and you get the second chart.

People in Hong Kong on average have US$29,000 each a year to spend on themselves while Singaporeans have only US$19,000, and the margin is growing rapidly in Hong Kong’s favour.

No, they may not have typhoons in Singapore, but they certainly whirl up a lot of hot air about themselves.