What next for Chinese yuan after Brexit? ‘Yes’ to devaluation. ‘No’ to capital outflows

Although China will have to devalue the yuan in line with other Asian and emerging market currencies in the wake of Brexit, authorities are determined to control the pace of the depreciation and still see curbing capital outflows as the No 1 priority for now, analysts said.

In a sign of the challenges ahead, Shan Liew, owner of the 88 Estate Agency in London, said she has sold apartments to three Chinese buyers since last Friday when Britons voted to leave the European Union, a shock move that saw the British pound plunge to a 30-year low.

“Chinese investors, including those from Hong Kong and the mainland, are becoming even more interested in London properties after the Brexit as the more favourable exchange rates make buying cheaper. Many people who were sitting on the fence in the last few months are about to jump in now,” Liew said.

However, for those who didn’t have the foresight to move enough money outside China before Beijing tightened checks on cross-border fund flows starting late last year, purchasing a property on the overseas market is a tougher job.

“An alternative is to apply for a mortgage from local banks, while repaying it by using the rent or utilising a Chinese citizen’s annual quota of US$50,000 for offshore investment,” Liew said, noting that she had secured a mortgage for a buyer from Beijing.

But this approach doesn’t work for high-end properties which require bigger payments.

On Tuesday, the foreign exchange authority in Shanghai held an emergency meeting with banks and urged them to strengthen due diligence checks on overseas direct investment by companies to stem illegal capital outflows, three banking sources told the South China Morning Post.

Under existing regulations, an individual can only convert yuan up to a limit of US$50,000 per year. For corporates, the quota for foreign currency swaps is more flexible.

More economists tend to believe that, given the stricter management of cross-border fund flows by the People’s Bank of China (PBOC), the yuan will gradually depreciate against the strengthening US dollar as investors de-risk in the aftermath of Brexit. But Chinese authorities will do what they can to avoid any abrupt fall in the currency after they learned lessons in August and January.

Fearing yuan devaluation, capital outflows started to grow from late 2014 and intensified following the abrupt yuan depreciation in August 2015 and again this February. By the end of this February, the outflows drained China’s foreign reserves pool, the world’s largest, by US$791 billion, almost one fifth down from its peak level.

“To maintain stability in money creation, the central bank had to allow a faster domestic expansion. It was not until February or March this year that the central bank regained control of liquidity conditions with the help of foreign exchange controls and stability in the dollar exchange rate,” BofA Merrill Lynch economists led by Helen Qiao wrote in a note issued Sunday.

Consequently, diminishing capital outflows finally gave way to a rebound in property and infrastructure investments. However, it goes against the agenda of the central government to transform the domestic economy by reducing reliance on investment, deleveraging and cutting overcapacity, according to BofA Merrill Lynch.

“The PBOC is doing a tough balancing every day,” said Pang from Natixis.

The depreciation seen in yuan is less than what has been experienced by other Asian and emerging market currencies after Brexit. Pang said if yuan stays relatively stronger than other currencies, it would erode China’s export competitiveness. A stronger currency may keep the domestic interest rates comparatively high, which would have a negative impact on deleveraging.

“If it devalues quickly it will surely cause capital outflows, the current biggest concern of the central government,” she added.

An easier way to keep the balancewould be to tighten checks on outflow channels. However, underground channels that allow people to send money overseas are still extensive.

In June China “gave up” the chance to join the globally tracked MSCI emerging markets index by declining a suggestion to scrap a rule limiting foreign investors from repatriating more than 20 per cent of their funds each month, a source close to the regulator said.

“Put money into an underground bank in Shenzhen and you will get Hong Kong dollars out in Hong Kong – this is the most common way to move money outside [the country] without supervision,” said a source close to an underground bank with branches in both Shenzhen and Hong Kong.

If it devalues quickly it will surely cause capital outflows, the current biggest concern of the central government

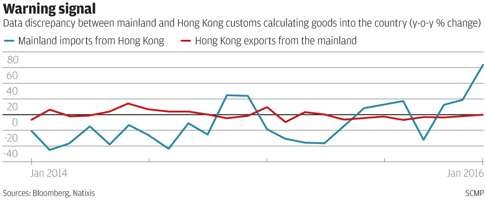

“And the scale of fake mainland investments to Hong Kong and fake imports from Hong Kong is phenomenal…just see the gap between numbers released by mainland and Hong Kong authorities regarding imports from Hong Kong to the mainland,” the source said.

Although Beijing has been calling for measures to stem illegal capital flight, these underground platforms would not likely be stamped out because they serve the interests of local officials and VIPs, he added.

In fact, Chinese buyers anxious to diversify their wealth have become the biggest buyers, snapping up properties in London, the US, Australia and Canada over the past few years. And at this time, with the British pound having fallen to historic lows, UK homes look even more attractive to investors anxious to diversify their wealth.

On Thursday, Reuters quoted an unnamed policy source as saying China was willing to see the yuan depreciate to 6.8 against the US dollar in 2016 “as long as depreciation expectations are under control”.

Heng Koon How, Credit Suisse’s senior investment strategist for Asia Pacific private banking, said Brexit would raise the pressure on yuan and cause it weaken further in the months ahead.

“The European Union is China’s largest trade partner and Brexit has resulted in a heavy sell-off in [pounds and euro]. This negatively affects China’s trade with the EU…onshore yuan needs to weaken alongside the weaker [pound and euro].