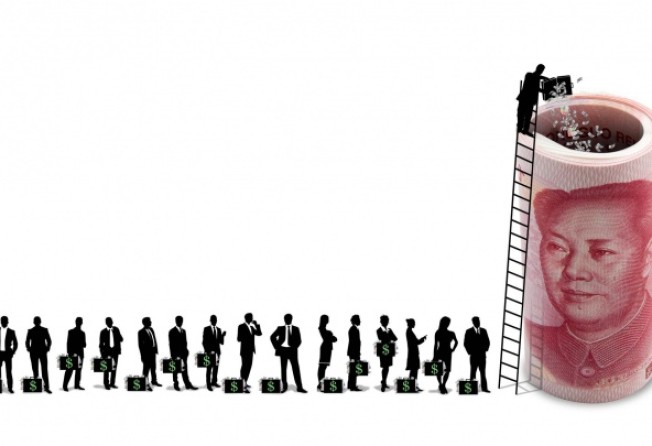

Growing power of the yuan

The mainland currency has risen steadily to a record high against the US dollar, its stability and positive yield catching investors' attention

The yuan has continued its strong run, rising to the highest-ever level against the US dollar on Friday, ahead of talks between President Xi Jinping and President Barack Obama.

The central bank set the midpoint for the central parity rate at 6.162 per US dollar. The onshore spot rate failed to track the midpoint, and was 0.04 per cent firmer in late afternoon trade.

The string of recent records in the yuan have fuelled speculation the currency could be on track to breach a key psychological threshold of 6 to the dollar as mainland officials loosen their grip on the currency.

China has been accused of undervaluing its currency, a barb that was raised last week when eight senators reintroduced a bill to allow the United States to apply punishing tariffs on imports from China if the yuan is deemed artificially manipulated.

The spot yuan has risen about 1.6 per cent this year and is up nearly 35 per cent against the dollar since its revaluation in 2005 - rates of return that are beginning to catch the eye of investors.

Chan Tze-ching, a senior adviser at Bank of East Asia, says investors hurt by the sudden decline of the South African rand and the commodities-backed Australian dollar, are now giving the stable yuan a closer look.

"People are now seeing the advantage [of the yuan] with low volatility but with steady return potential," Chan says.

The yuan is stable partly by design. It is tightly controlled by the PBOC, which allows daily fluctuation of up to 1 per cent on either side of the central parity rate.

In reality, the yuan rarely, if ever, is allowed to fluctuate to the full extent of its trading band, which reflects the central bank's inclination towards a more gradualist approach in its currency management.

Some analysts say stability now ranks more highly among investors who have grown tired of higher-yielding currencies which are more volatile.

The case for piling into the Australian or New Zealand currencies, in a effort to take advantage of higher yields offered on savings deposits, no longer makes as much sense, they say.

"Traditionally, Hong Kong investors used to hold the New Zealand and Australian dollars for their high interest rates, but now those rates are lower than 3 per cent," says Andrew Fung Hau-chung, Hang Seng Bank's executive director and head of global banking and markets.

The yuan is also a stand-out when considering inflation and the ability of the currency to maintain its buying power.

"It's actually a very stable currency," Chan says. "The [yuan] historically has the lowest volatility among all currencies.

"It is the only major currency that has positive yield [government bond yield is positive after subtracting inflation rate].

"You can't say the same for the US dollar or euro or yen bonds."

Yuan bond funds are yielding a high 3 per cent for a duration of 2-1/2 years, a rate of return that compares favourably against bonds denominated in other currencies, according to BlackRock's director and Asian fixed income portfolio manager Tan Suanjin.

"If you look at typical terms, the duration [of yuan bonds] is quite low. Most of the bonds issued are three to five years, so on average it's lower than other asset classes," Tan says.

Meanwhile, other analysts say investing in yuan products should be seen as the kind of investment that lets you sleep easy at night.

"The Chinese government does not want the currency to undergo a lot of sharp volatility like the Australian dollar and so forth, but given the expected strong growth in China and the general price level of goods merchandise and assets in China, they will still embark on the same policy of gradual but stable appreciation over the next few years," says King Au, the chief executive of asset management at Bank of China (Hong Kong).

Once considered an idea that was too unconventional, yuan-denominated bonds are now finding appeal among pension funds and other big institutional investors.

"We have sophisticated institutional investors all over the world looking at [yuan bonds] as a new asset class to diversify their bond investment," Chan says.

In April, the Australian government said it would invest 5 per cent of its A$38.2 billion (HK$281.3 billion) foreign reserve stockpile into Chinese government bonds, the first time it has invested in an Asian country other than Japan.

Other institutional investors with sizeable stakes in Chinese bonds include Japan and Nigeria.

"To put it in a nutshell, the yuan is fast becoming a reserve currency and is seen as a tool for wealth storage," Chan says. "The fact that you see central banks making these types of strategic investment is making a very strong statement."