Big players bullish after Shanghai hits 8-month high

Market shows signs of rebound from three-year slump, but retail investors are not convinced

The mainland stock market, which closed at its highest level in eight months yesterday, has turned bullish after three years of lacklustre performance, analysts said.

However, retail investors, who tend to lag behind institutions in sniffing out investment opportunities, are still in a wait-and-see mode, hesitant to increase equity holdings amid fears of an imminent correction.

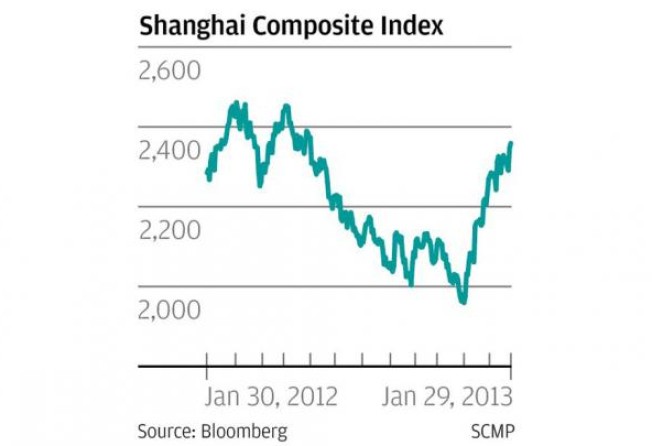

The Shanghai Composite Index rose 0.53 per cent to 2,358.98 points, the highest since June 1. The gain followed a 2.4 per cent rally on Monday. Since December 3, when it closed at 1,959.77, a four-year low, the index has risen 20.4 per cent.

Institutional investors are becoming upbeat on this year's market outlook amid an economic recovery and better corporate earnings.

UBS Securities forecast the index could break the 2,700-point level this year, up 20 per cent from last year's close. The gauge was among the world's worst performers in the past three years, although the mainland remained the fastest-growing among major economies.

Retail investors, fearing a flood of initial public offerings, are not convinced that a bull run is shaping up. "In the past three years, our bets on the market direction all proved wrong," Tang Huahai said. "We had better take a cautious stance."

Last year, retail investors found themselves stuck with blue-chip stocks after China Securities Regulatory Commission chairman Guo Shuqing in February urged them to buy into the 300 largest listed firms, which, he said, would provide an 8 per cent annualised return.

The CSRC halted new public offerings in October to stem the fresh supply of equities and bolster the weak market. More than 900 companies have sought to list on the market. Retail investors are worried existing stocks will fall when the ban is lifted.

However, brokerages are predicting huge capital flows into the market this year, which will help digest new share offerings.

The widely-publicised failure of a wealth management product sold at a branch of Huaxia Bank last month may lead to a flight of funds from banks to the stock market. "That was good news for the stock market, as those investors who had flocked to the wealth products earlier would return to equities this year," UBS strategist Chen Li said.

A government report on Monday showed industrial companies' profits climbed 17.3 per cent last month, the latest sign firms' performances are improving.

"All signs are showing the upward momentum will continue," said Shenyin Wanguo Securities analyst Li Xiaoxuan.