You'd be crazy to ignore the great iBond giveaway

The third round of inflation-linked notes is effectively a gift from the government to you

The third round of iBonds is due to arrive in June. The HK$10 billion inflation-linked bond, issued by the Hong Kong government, is a good deal.

That fact is reflected in the first-day trading performance of the first two rounds of issuance.

The iBond issued in 2011 rose 6.7 per cent in price on day one, and the one sold last year climbed 5 per cent.

This kind of first-day gain for a bond from a triple-A issuer (as is the Hong Kong government) is unheard of. It is irrational. Put another way, it is a giveaway from the government, from it to you.

And if you cannot bring yourself to hold on to something so dull as an inflation-linked bond for three years, you can at least hold the investment for one day, and sell for a likely profit.

The instruments are listed on the Hong Kong exchange and are easily traded.

Clearly, Hongkongers have cottoned on to this idea. In 2011, the first year of the iBond programme, investors put in HK$13 billion of orders. Last year, that amount ballooned to HK$50 billion.

Which leads to the biggest drawback of the scheme: low allocations. For the first iBond, a subscriber could get an allocation of up to HK$440,000. Last year, however, the average allocation was just HK$30,000.

Assuming a subscriber gets a HK$30,000 allocation this time around, and on day one the bond trades up 5 per cent, he or she would get a first day's profit of HK$1,500. That is not nothing, but it is not super exciting either.

However, if you oversubscribe, Cindy Fu, Standard Chartered's iBond specialist, reckons that investors could get allocated up to HK$50,000 per person. If you and your wife both subscribe, and your family is allocated HK$100,000 of iBonds, then you are looking at a day-one trading gain of HK$5,000.

There are a couple of hurdles. A person has to set up a bond account at a local bank, an account into which the bank can distribute coupon payments and the like. This involves answering a short (three-question) risk assessment survey. The process should take about half an hour.

Standard Chartered charges no fee to subscribe to the iBond, or to set up a bond account. Other banks may charge a minimal fee. The bid-offer spread (the difference between the price you pay for the bond, and the price you can sell it for) is also narrow, but you should budget a cost of about 0.1 per cent.

A person also has to set aside money to subscribe to the bond. Fu suggests committing up to HK$100,000 to ensure getting the maximum number of bonds. The process, from order to allocation, takes two to three weeks. So that is money tied up that could be used productively elsewhere.

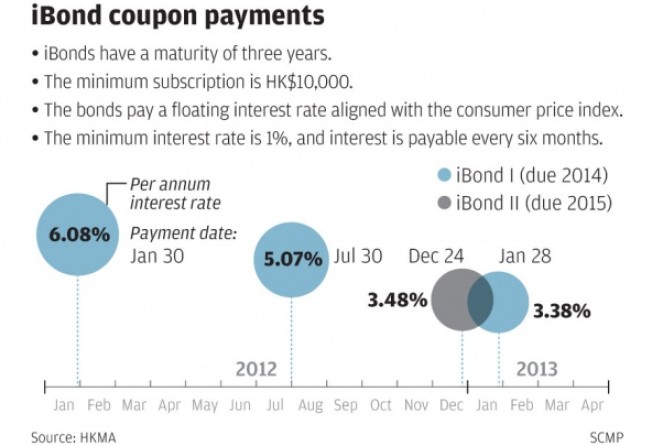

Otherwise, there is little downside to iBonds. Hong Kong's rate of inflation is trending down and that is resulting in lower iBond coupons (see table) but demand for the instrument remains strong. The iBond that was issued last year is trading at about a 6 per cent premium to the issue price.

The worst-case scenario is this: the bond does not trade up on day one, and you sell at par, resulting in no gain for a bit of hassle. The worst-worst case scenario is that the bond actually trades down in value, in which case you would be obliged to hold a triple-A bond with inflation-linked returns - not a bad outcome in an era of high-powered central-bank money printing.

Be aware that iBonds may not be offered next year. Mavis Hui, a spokeswoman for the Financial Services and the Treasury Bureau, says the programme is done to promote public interest in bonds, but she adds: "It is a non-recurrent measure." Translation: get them while they last.