Macau gaming stocks sold off after revenue falls short

Quick judgment passed on 7pc growth in sector revenue, with drops in some casino shares topping 7pc, but analysts cite early holiday's impact

Some Macau gaming stocks tumbled by more than 7 per cent yesterday on the news that gaming revenue grew just 7 per cent year on year last month, the slowest growth in 15 months.

However, analysts said the soft spot was just a hiccup before Lunar New Year spending kicked in.

Shares of Sands China and Galaxy Entertainment took the biggest drops of 7.45 per cent and 7.34 per cent, respectively, while the four other casino operators fell between 2 and 6 per cent.

Despite a strong finish to last year that saw full-year growth beat many analysts' expectations, last month's numbers came in weaker than expected due to a high base for comparison last year and a Lunar New Year holiday that crossed into January instead of landing in February.

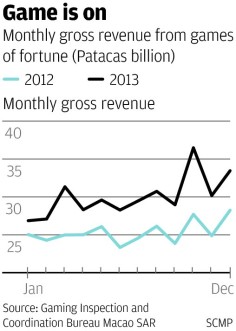

For the first month of the year, revenue was 28.7 billion patacas, down 14 per cent on December. The 7 per cent year-on-year rise was short of analysts' forecasts of year-on-year revenue growth of between 11 and 15 per cent.

"We were disappointed because up until the first 26 days we had about 14 per cent growth. There were some initial numbers out," CLSA head of consumer and gaming research Aaron Fischer said. "The timing of Chinese New Year meant it dropped off a bit faster. There's usually a slowdown in the week before."

Fischer said mainlanders' Lunar New Year travel plans would have had an impact and casinos had probably also experienced "an unlucky hold rate, where the customers won more money than predicted".

Barclays said in a report that because the Lunar New Year started on January 31 this year, compared with February 10 last year, most of the pre-Lunar New Year weakening was captured last month, while there had been no such impact in January last year.

"However, we believe it is too early to read too much into the five days of greater-than-expected pre-Chinese New Year weakening and the impact on full-year growth rates … we expect February growth to resume to at least the high teens," it said.

Standard & Poor's credit analyst Joe Poon said last year was a high base owing to a release of pent-up demand.

There seems to be little doubt about a return to double-digit growth rates. The Macau Government Tourist Office announced that tourist arrivals for the first five days of the Lunar New Year holiday were up 19 per cent to 760,000.

Angela Leong On-kei, managing director of SJM, which owns the Grand Lisboa casino, said yesterday that the visitor flows during the holiday had been ideal.

Fischer said spot checks had shown that holiday business was "very, very strong". "The mass market gaming floors have been super packed," he said.

Poon said insufficient infrastructure was one of the biggest hurdles to gaming growth in the medium term. "Macau is so packed already," he said. "There is a new wave of casino openings [in late 2015]. They need better infrastructure for transportation to improve visitation."