Shanghai-HK meeting on through train deadlocked

Meeting with Shanghai officials ends with key scheme issues unresolved

Two hours of meetings between officials from the Shanghai Stock Exchange and Hong Kong brokers ended without any significant breakthrough yesterday, according to people who took part in the closed-door discussions.

Crucial issues of trade settlement and tax rules that must be worked out before an anticipated launch in October of a scheme to link trading on the two exchanges remain outstanding, Hong Kong brokers told the South China Morning Post.

"There was no new breakthrough in [yesterday's] meeting. We expressed some key concerns and discussed the work that needs to be done in future," said Yim Fung, chairman of Guotai Junan International Holdings, one of the biggest Chinese brokers based in Hong Kong, after the meeting. Yim refused to elaborate.

The Shanghai stock exchange authorities pledged at the meeting to solve the tax issues before the stock connect scheme begins, said Jeanne Lee, chairman of the Hong Kong Securities Professionals Association. The mainland is yet to announce rules specifying how much overseas investors' capital gains would be taxed.

Peter Yip Mow-lum, chairman of Bright Smart Securities & Commodities Group, said Hong Kong brokers need clarification on what to do with their holdings if mainland stocks halt trading when they rise by more than 10 per cent to hit the permissible ceiling. Hong Kong does not have such rules.

The scheme, subject to a quota, was announced in April. Mainland media reports have said it is scheduled to start on either October 13 or October 20, but no date has been confirmed.

The officials declined to answer questions from the South China Morning Post as they entered the meeting at a Hong Kong hotel yesterday. After the meting, they left by a side entrance to avoid taking media questions.

Brokers told the Post before the meeting that they wanted to resolve several outstanding issues, including quota caps, which they say are too tight; the regulatory regime in the event of disputes; and the protocols for trade settlement and market holidays; where there are big differences between the two cities.

The planned cross-border trading scheme caps Hong Kong investors' total trades at 13 billion yuan (HK$16.4 billion) a day and 300 billion yuan in total for mainland stocks. For mainlanders, investment in Hong Kong stocks is capped at 10.5 billion yuan per day and 250 billion yuan in total. Once the quota is reached, investors can only sell stocks.

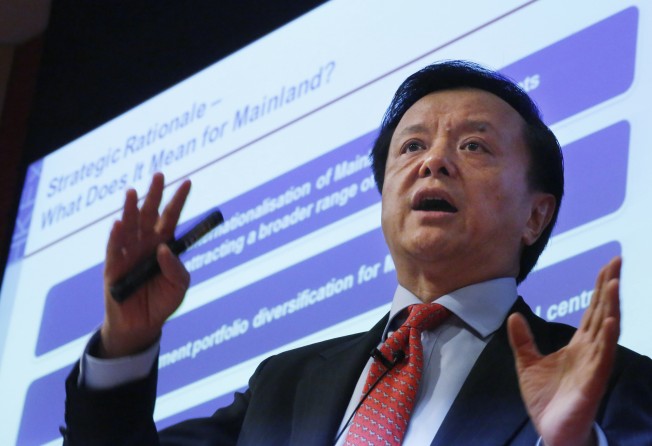

HKEx chief executive Charles Li Xiaojia said in a statement on Sunday it would take time for the mainland market to be aligned with Hong Kong's. "We have to figure out a way to connect the markets while respecting the differences between the current regulatory regimes," Li said.

A through train scheme announced in 2007 - without quotas - was suspended because of Beijing's fears it was losing control over the programme.