Bad fung shui in private equity loophole

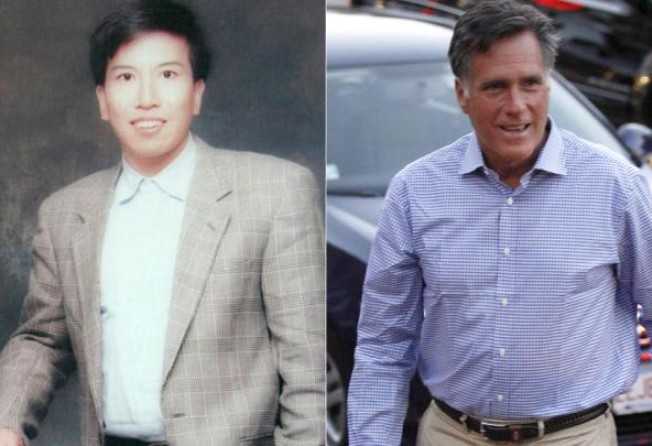

What do fung shui master Tony Chan Chun-chuen and US Republican presidential candidate Mitt Romney have in common? Well, if it's about taxes, they have a lot to share. Both have exploited the peculiarities of tax systems to avoid paying heavy taxes. And in their bid for empire, they have both exposed their industries to the unwanted attention of taxmen.

For years, fung shui consultants in Hong Kong received red packets from clients for their trouble. They didn't consider this method of compensation income, and few ever declared it. But our elite fung shui masters routinely receive tens of thousands or even millions of dollars from our billionaires for their other-worldly insights. In Chan's case, we are talking about billions that he received from the late Nina Wang Kung Yu-sum.

Not satisfied, Chan launched a probate to claim Wang's entire estate, including the control of Chinachem, the city's largest private developer. He lost.

Disclosure in court about the astronomical sums he received from Wang led lawmakers to demand a decision from the inland revenue commissioner to declare whether fung shui payments were income. The top taxman was clear on this point and Chan was slapped with a HK$330 million profits tax bill. In July, Chan lost a Court of Appeal application to take his case to the highest court.

Thanks to Chan, every fung shui man or woman now has to declare consultancy payments.

Now, what of Romney? He said he paid at least 13 per cent in taxes each year during the past decade. And you think Hong Kong has low taxes!

How did he manage it? As a private equity guy, he was able to exploit what is known as "carried interest", which remarkably allows such moneymen in the US to claim the fees they charge as capital gains (taxed roughly at 15 per cent) rather than as ordinary income (taxed at about 35 per cent).

Some of his colleagues at Bain Capital and other US private equity firms went further. They defer getting paid, and instead invest their fees in vehicles designated by their companies. They don't have to pay a cent in tax until the investments are sold and even then, only as capital gains.

Thanks to Romney's ambition to be president, everyone knows of this nifty trick, which may become a prime target of US tax reform.